Copper Price Remains Under Pressure As China Fears Continue To Grow, Coal Prices Soar

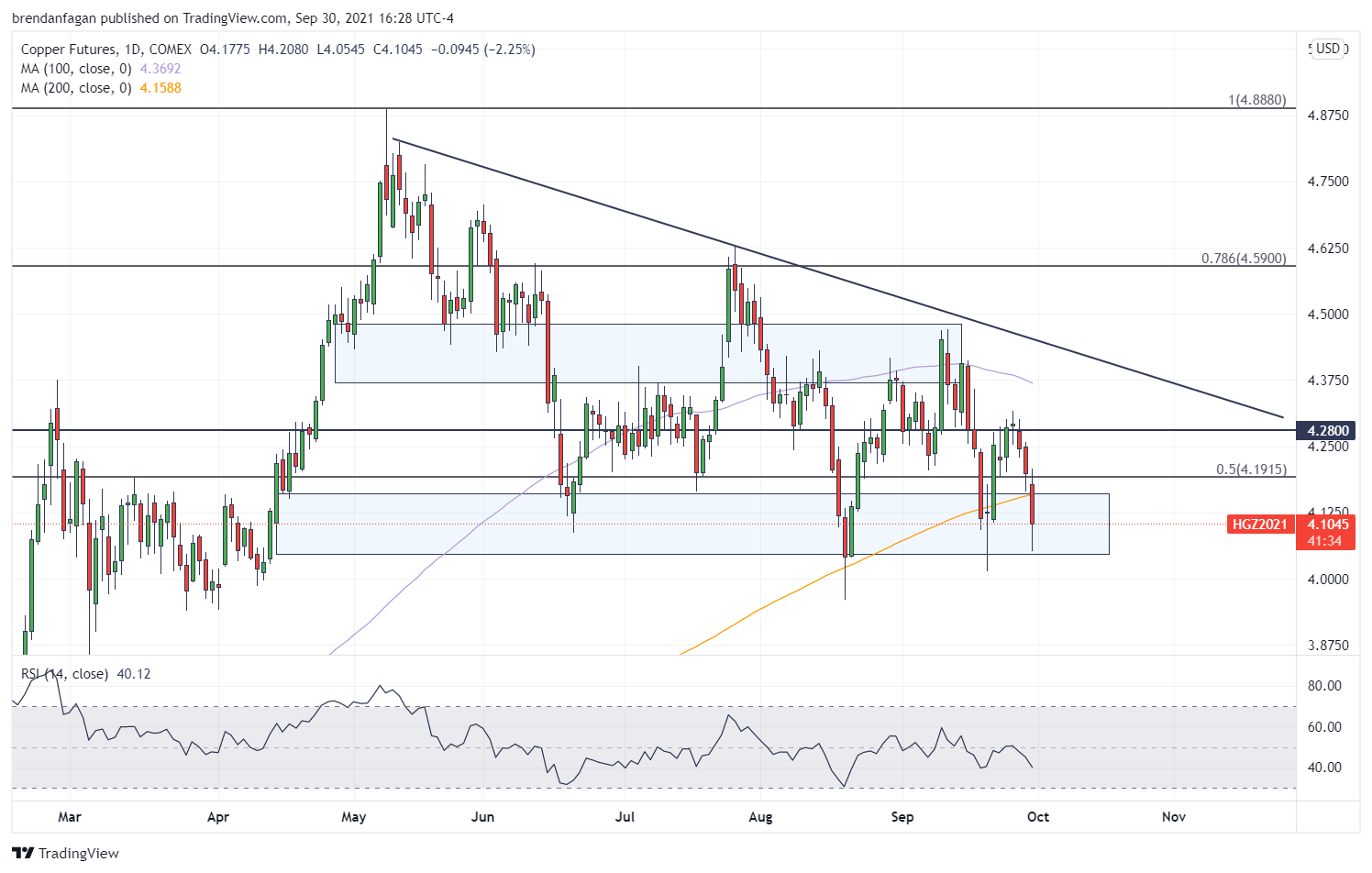

Copper prices continue to buckle under pressure emanating from China, as power restrictions and Evergrande ripple effects continue to weigh heavily on markets. Futures contracts in New York fell by more than 2% to $4.10 per pound, which represents a close below the 200-day moving average. Price has struggled with the recent contraction of the Chinese economy, as robust demand for metals seen throughout 2020 dissipates.

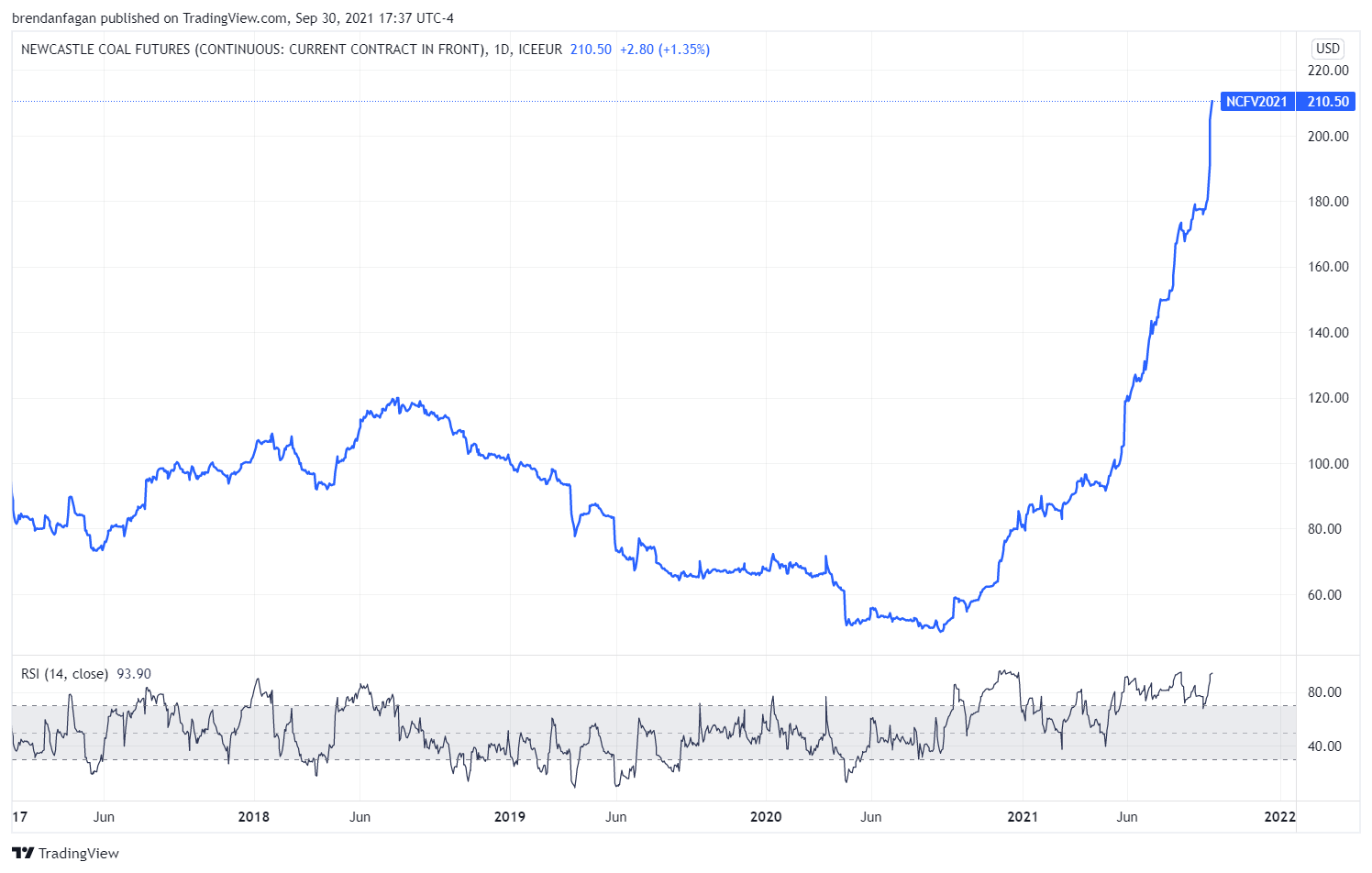

NEWCASTLE COAL FUTURES (CURRENT CONTRACT) LINE CHART

(Click on image to enlarge)

Chart created with TradingView

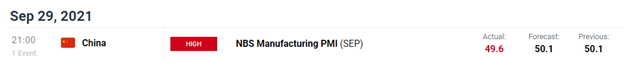

A power crunch sweeping across China has heaped additional pressure on the price of copper, with manufacturers shutting off power and halting their production of goods. With demand for Chinese goods soaring, producers have rushed to fill orders from around the globe. This has placed a noticeable strain on China’s energy infrastructure, with coal supply falling well below required levels. This has pushed global coal prices to record highs, with the Newcastle Coal futures contract once again making fresh all-time highs. As a result, numerous provinces have had to limit power consumption. Weakness in China’s manufacturing sector was reflected in the NBS Manufacturing PMI for September, which recorded its first contraction since the pandemic began.

CHINA ECONOMIC CALENDAR

Courtesy of the DailyFX Economic Calendar

The fundamental outlook for copper prices remains weak, as much also remains unknown about Evergrande. Should Evergrande contagion spill into other sectors and markets, a regional economic downturn could bring about further pain for copper. Additionally, China’s current energy crunch may see a renewed push to mine coal, a significant energy source for major power plants. This may delay the move toward renewable sources of energy, potentially pushing the price of copper lower.

COPPER FUTURES DAILY CHART

(Click on image to enlarge)

Chart created with TradingView

A slowing economy, coupled with the potential catastrophe that could accompany an Evergrande default, may have the potential to plunge China into an economic recession. Much of the near-term price action for copper will rely on sentiment surrounding China’s economy. Should support around $4.00 per pound hold, price may look to revisit resistance in the form of a descending trendline.

Disclaimer: See the full disclosure for DailyFX here.