Copper Price Forecast: Chinese Demand, Weak USD May Lift The Red Metal Into 2021

Copper futures look set to record the first weekly loss since October as the industrial-linked metal’s COMEX futures price drops below $3.50 per pound. The impressive rally since March, when Covid-induced volatility dragged prices near early 2016 lows, appears driven by an ailing US Dollar, strong demand, and an improved long-term economic environment.

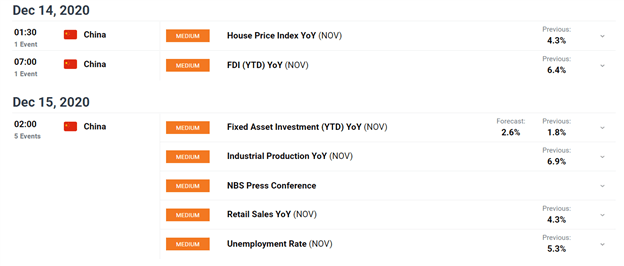

Copper Futures Vs Us Dollar (DXY) Weekly Chart

(Click on image to enlarge)

Chart created with TradingView

The rally has seen a huge boost from the weaker greenback, given that the commodity is widely priced in US Dollars in exchanges across the world. This is as China, the largest importer of copper, has seen a record level of imports this year as the Asian economy moves forward with an investment-driven recovery plan.

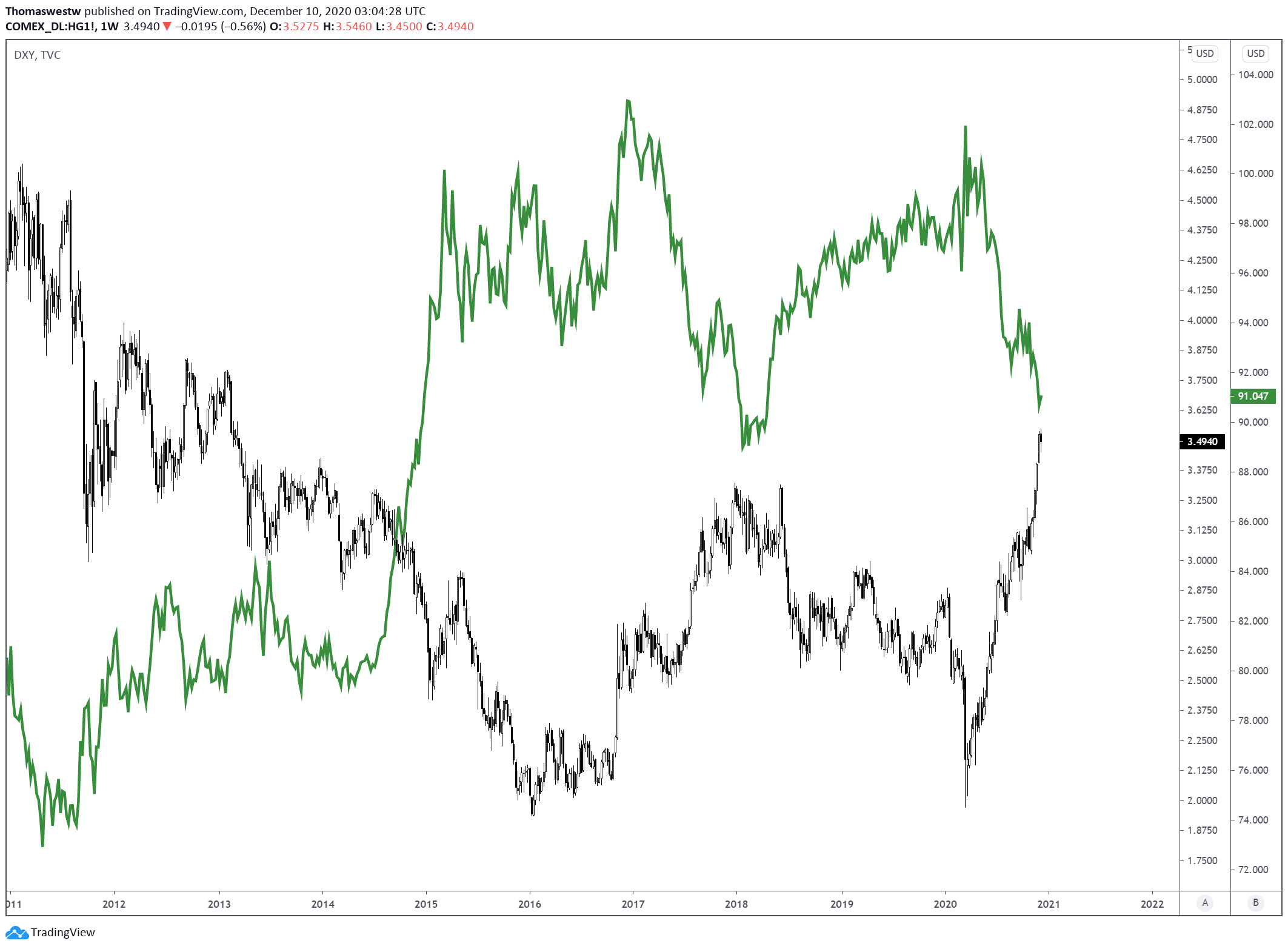

Given China’s outsized demand for the red metal, keeping an eye on Chinese economic data, along with the broader economic recovery, is key for traders. According to the DailyFX Economic Calendar, China will release multiple data points next week that will give further insight into the economic recovery in the copper-hungry country. Industrial production will look to expand for the eighth consecutive week on improving demand conditions.

China – Upcoming Economic Data

Source: DailyFX

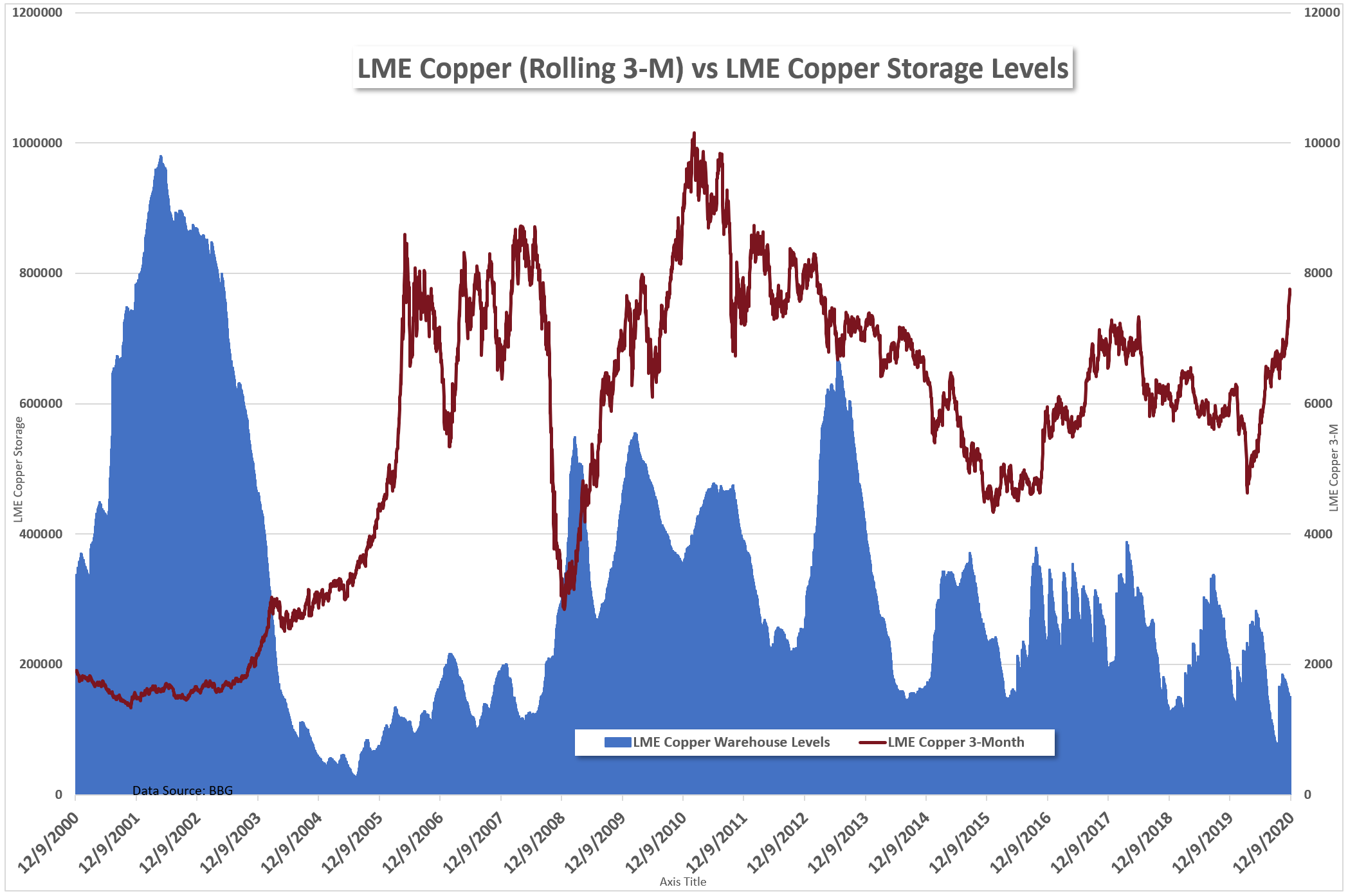

Copper storage levels at the London Metal Exchange remain depressed and have sunk further into December. The drop in warehouse levels may indicate supply-side issues as Covid’s impact on the global supply chain continues to cause disruptions. Chile, the largest single exporter of copper ores, also continues to deal with output issues as companies struggle with labor union strikes.

(Click on image to enlarge)

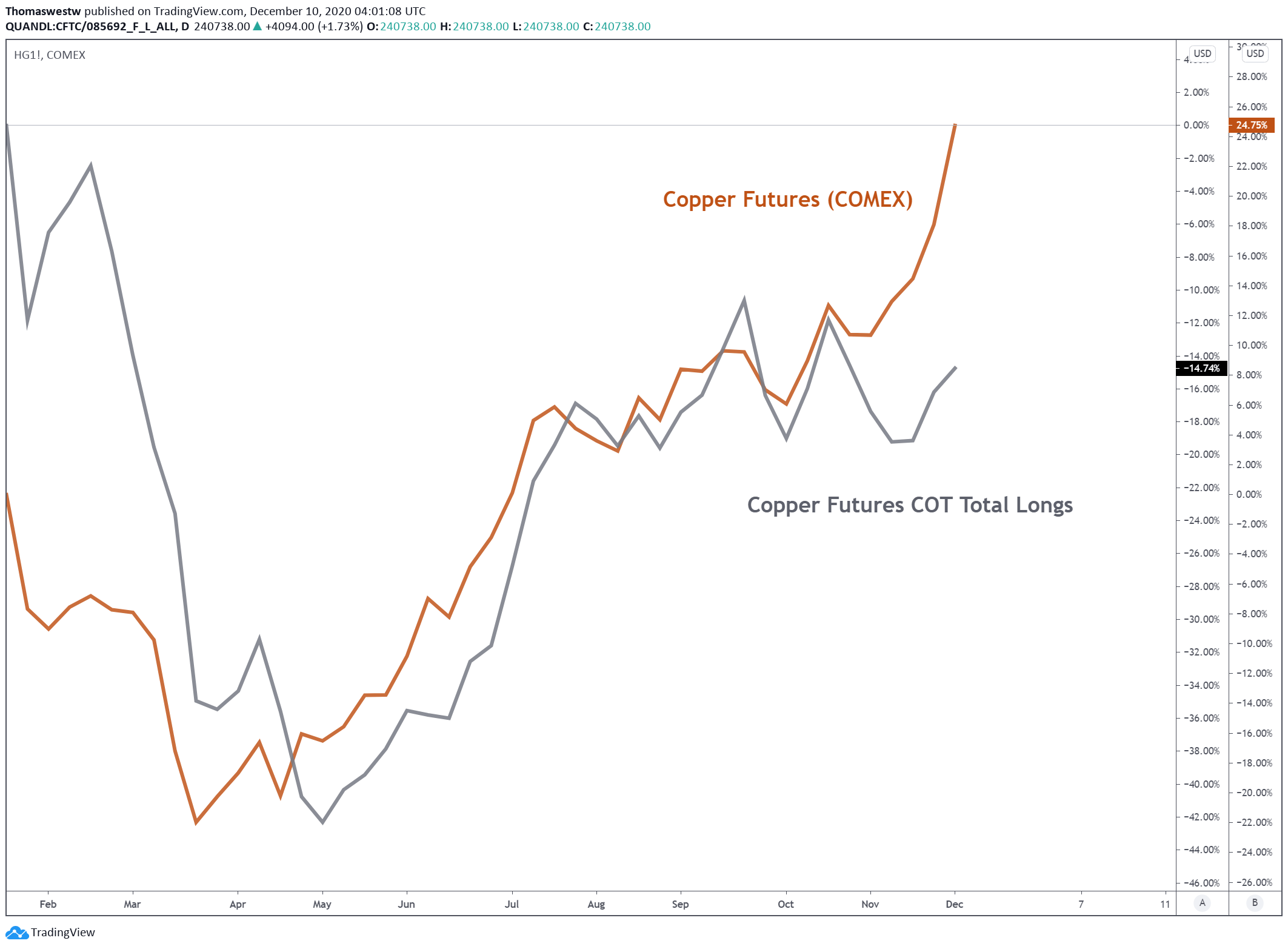

Looking at the latest CFTC Commitments of Traders report (COT) shows total longs in copper futures contracts increased for the week ending December 1. Although total longs have eased from levels seen in September and October, the increase in recent positions is notable considering the adjacent rise in prices for the metal. From a contrarian standpoint however, which the COT report is frequently used to gauge for, this could point to near-term gains. Overall, the positioning among futures traders indicate expectations for copper prices to rise on net, albeit at a seemingly diminishing pace.

Copper Futures (Comex) Vs COT Total Copper Futures Longs

(Click on image to enlarge)

Chart created with TradingView

Disclosure: See the full disclosure for DailyFX here.