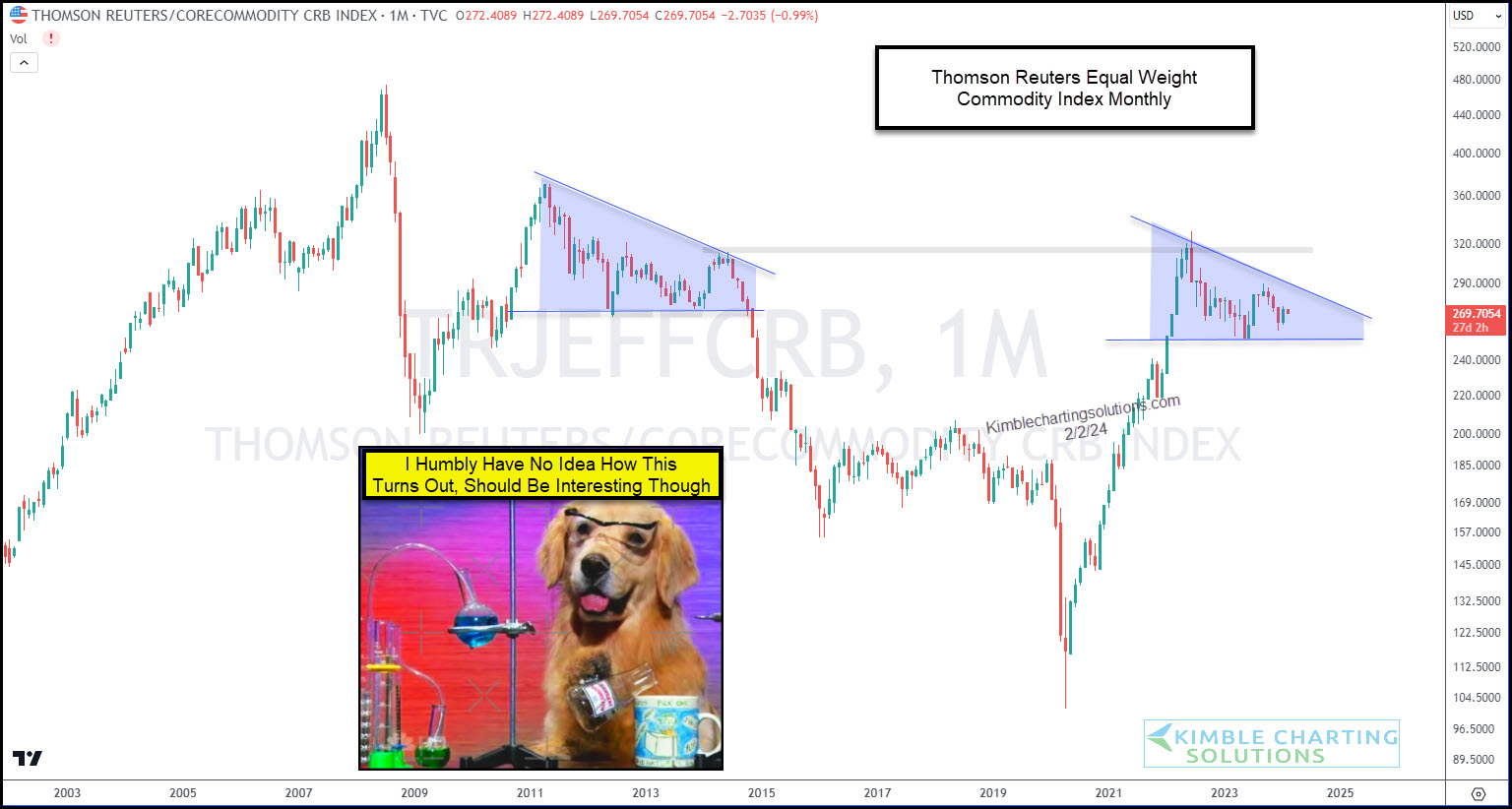

Commodities Wedge Pattern Should Lead To Huge Move

(Click on image to enlarge)

During the COVID pandemic, commodity prices soared. And this led to a bout of inflation that we hadn’t seen in years.

But commodity prices have leveled off and this has helped to keep inflation in check.

This consolidation like pattern can be seen on today’s “monthly” chart of the Thomson Reuters Equal Weight Commodity Index.

The last time we saw a gigantic wedge pattern, it broke to the downside. But I humbly have no idea which way this pattern will break.

But I do think that when it does make a decisive move out of this pattern, it will be a big deal. So it’s worth keeping on your radar. Stay tuned!

More By This Author:

2-Year Treasury Bond Yields Near Important Fibonacci SupportAdvanced Micro Devices Attempting Huge Fibonacci Breakout

Tech Stocks Reach Important Price Resistance Level, Says Joe Friday

Disclosure: Sign up for Chris's Kimble Charting Solutions' email alerts--click here.