Commodities Review

Those that view the message of the market on a daily basis are likely confused by trading noise. While trading noise contributes to the long-term trends, it does not define them. Human behavior tries to explain trading noise as a meaningful trend. This confuses the majority which, in turn, contributes to their role as bagholders of trend transitions.

Commodities - foodstuffs, industrial, metals, and so on, can acquire just as much of a "spiritual" tone as stocks, bonds, and cryptocurrencies. Experienced traders might recognize this as stating the obvious, but understanding or remember the nature of the herd is important. Commodities won't bottom because we will it. They will bottom because price and time cycles get extended and the majority believes the primary trend can only be down. In other words, they give up right as the invisible hand steps in.

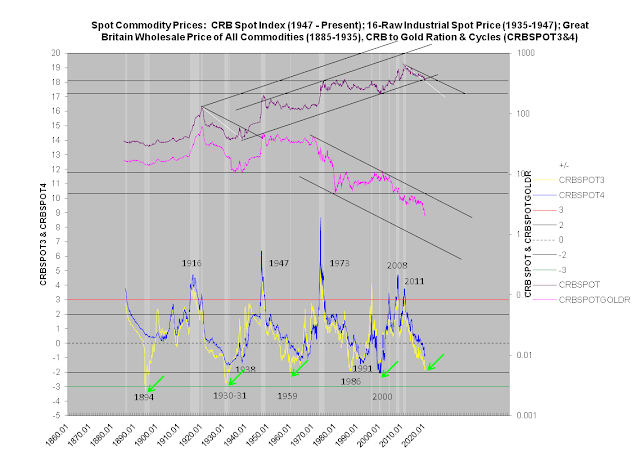

Will commodities bottom in 2020? It's possible. Follow cycle concentration (C1, C2, C3, and C4) and the primary trend described in the Matrix. Assets tend to bottom when cycle concentration fall below -2, especially cycles C3 and C4.

Commodities Intermediate and Long Term Cycles

(Click on image to enlarge)

Every asset follow the Evolution of the Trade. Commodities are no different. Commodities need a bullish energy build, or series of them to flip the primary trend. Corn is a possible candidate.

The bulls must wait for the primary trend to flip. They must wait for commodities LTCO to climb above 0. This process (bottoms are process as much as tops) takes time. Wait for a green box to materialize. Use the Matrix to follow them and stop believe something must happen. Believing leads to bad decision making.

Commodities Primary Trend

(Click on image to enlarge)

I am watching commodities with great interest, but this does not mean I have accumulated aggressive positions yet. The Evolution of the Trade is still very early. I have discussed this for months - warning people to be careful aggressively buying corn a year ago. I have said the same thing about numerous agricultural products - largely because their primary trends have yet to flip.

Disclaimer: Content provided by Eric De Groot is intended as general information and not specific recommendations. Individuals are responsible for their own investment decisions. Past ...

more