China’s Waning Appetite For Copper Might Not Be The Only Reason For Concern

The slowdown of copper consumption in China is concerning for bulls that coincides with the recent price weakness. Speculations about Fed tapering could lead to strong market gyrations and a bumpy road ahead for copper.

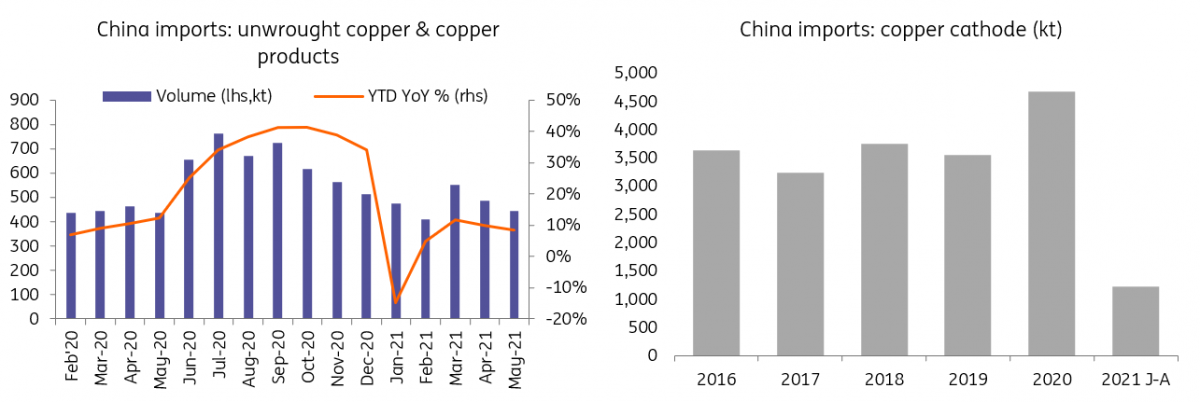

The preliminary trade data released by the China Customs on Monday shows that imports of refined copper and copper products fell by more than 8% month-on-month to 446kt in May for the second consecutive month. This includes both copper cathode and alloys products, but the bulk of it (around 90%) is copper cathode.

Looking at cathode alone, imports fell by 10% MoM in April to just below 320kt. So the preliminary trade data for May could suggest that cathode imports still fell from the April level, as the detailed number will only be available later this month.

But to be clear, China is still the largest copper importer, but exports are slowly creeping up, so as a result net imports have started to dwindle. This is not a surprise given the cross-market arbitrage (Shanghai/London) in spot terms swung in favour of exports by onshore traders instead of imports. However, such export activities are rare, and not every trader has access to do this.

As we noted earlier, the contraction in imports is not something happening out of the blue, and at least a sliding Yangshan premium had heralded longer before the actual trade number came, but the underlying causes are worth paying attention to.

First, the record high copper prices have received rising pushbacks from the world's largest consumer, with some physical buyers on the sidelines and manufacturers are reportedly trimming down operations. The increasing gap between Chinese PPI and CPI partially implies that many manufacturers stuck in the middle are bearing the brunt of rising costs. Secondly, there has been simply waning appetite in stockpiling, whether its state-backed or commercial type.

China copper imports started to fall as exports creep up

Source: China Customs, ING

The market is getting cautious with China's retreating in its copper purchases, but the recent weakness in prices has been seen across the industrial metals complex.

In the case of Aluminium, China's imports have remained strong, signaling that the country has been continuously drawing down the surplus from the offshore market. That may imply there could be a bigger concern in the market rather than just reduced appetite from China in copper's case.

Much of the market gyrations we have seen in recent markets closely track the broader macro market activities. There have been rising speculations on FED tapering, and there seems to be no one-way track in such as the dollar bear trend, so does for copper. The trade-weighted dollar index fell from its recent peak above 93 at the end of March to below 90 at mid-May, during the period copper hit its record. However, since then, the DXY has been broadly caught in a large rangebound and slightly grinding higher from the lows seen in May. The caveat could be that there's a bumpier road ahead for copper for the rest of the year.

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more