China Reaffirms Tight Grip On Gold Market, Ushering In A New Monetary Era

Image Source: Unsplash

Without a doubt, the Chinese central bank (PBoC) is still the leading single entity that is driving up the gold price to record highs, year-to-date by more than 55 percent.

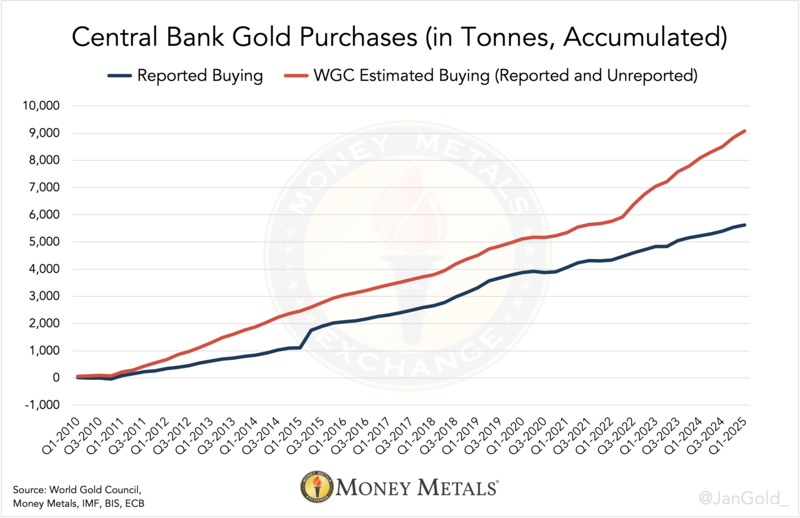

In the third quarter of 2025, the PBoC’s gold purchases (reported and unreported) accounted for 118 tonnes, up 39% MoM and 55% YoY, according to my long-time methodology1 (now copied by Goldman Sachs, Bloomberg, MarketWatch, The Washington Post, TIME magazine, Financial Times, Financiele Dagblad, and El País, to name a few).

Chart 1. Reported central bank gold buying versus estimates by the World Gold Council on central bank gold buying based on field research (reported and unreported buying). The majority of unreported buying must be ascribed to China.

My estimated total for Chinese monetary gold reserves stands at 5,411 tonnes in Q3, versus 2,304 tonnes reported by the central bank of China to the IMF.

Why is China buying so much gold?

It’s because China is the second-largest economy globally, and due to the weaponization of the dollar since the Ukraine war in 2022, the vast, covert buying spree by China and countries like Saudi Arabia should not be viewed as a hedge against the dollar but as a replacement for the dollar.

The mBridge Gold Standard

For the better part of the past 80 years, the U.S. dollar has functioned as the world’s trade and reserve currency. This setup gave the United States the exorbitant privilege of being able to print money to pay for imports, even though America’s manufacturing base has been eroded as a consequence.

China aims to establish an alternative to the U.S. dollar while seeking to avoid the risks associated with issuing its own reserve currency.

On November 19, 2025, the chairman of the Central Bank of the United Arab Emirates completed a landmark digital currency transaction during a meeting with the governor of the People’s Bank of China, formally inaugurating project mBridge.

The platform allows participating countries with established digital currencies to conduct bilateral trade in their own currencies, bypassing the U.S. dollar.

For the “mBridge gold standard” to be fulfilled, any surplus of local currency accumulated through trade must be directly exchangeable in a liquid gold market. Furthermore, it requires a new international gold vaulting and clearinghouse network.

(Click on image to enlarge)

Chart 2. In a historical shift, Eastern countries that before 2022 were price sensitive are now driving gold higher.

China will be the largest, or one of the largest, trading partners of countries participating in mBridge, and so the renminbi will be a dominant trade currency in the arrangement. This is why the Chinese are developing the Shanghai International Gold Exchange (SGEI).

The SGEI was launched in the Shanghai Free Trade Zone (FTZ) in 2014 and recently opened its first offshore vault in Hong Kong. The idea is to open additional vaults abroad.

The international vaulting system will likely be developed in accordance with the extensive network of repositories that constitute the SGEI system within the Chinese domestic market.

In the last SGEI Annual Report, it states that the SGEI adopts a “centralization, netting, and multi-tiered” clearing model with 18 certified margin custodian banks offering 70 certified vaults in 36 cities throughout the mainland.

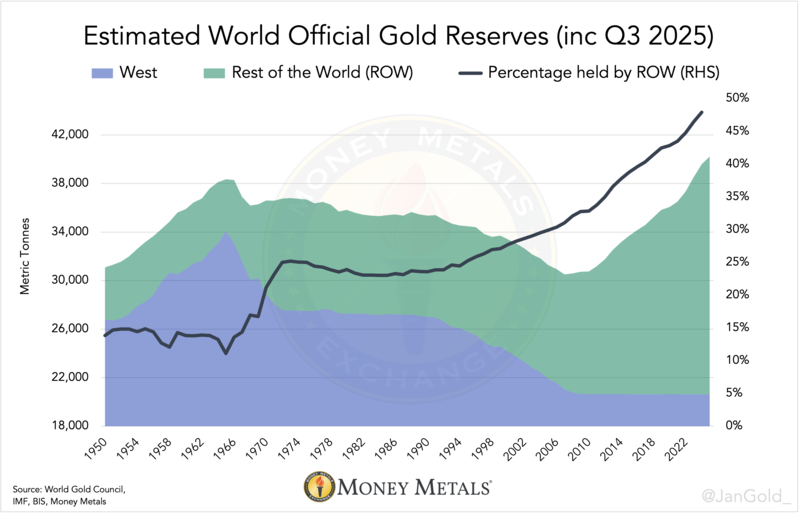

Gold Is Shifting the Distribution of Global Reserves

As central banks aggressively load up on gold and move the price to new all-time highs, global gold reserves are rising to the detriment of the dollar. By Q3, my estimated total of central banks’ monetary gold reserves accounted for 40,225 tonnes, 49 percent of which is owned by countries outside the West. In the 1990s, this percentage was 25 percent.

(Click on image to enlarge)

Chart 3. The West comprises the US, UK, Western Europe, and Australia.

Due to the actions of the PBoC in increasing prices, monetary gold now accounts for almost 28 percent of global international reserves. This is a truly monumental increase from 21 percent in 2024.

(Click on image to enlarge)

Chart 4. Because gold has appreciated against all reserve currencies since Q3, gold’s “live” share of reserves is actually closer to 30 percent.

In my next article, we will zoom in on gold versus the dollar’s share in international reserves.

Notes

- My most important analyses on the covert PBoC’s gold buying are:

- Estimating the True Size of China’s Gold Reserves (February 2023)

- PBoC Gold Conduit Revealed—Chinese Central Bank Did Not Stop Buying Gold in May (July 2024)

- Chinese Central Bank Just Secretly Bought 60 Tonnes of Gold (November 2024)

- China’s Gold Reserves Going Through the Roof (April 2025)

More By This Author:

Secret Gold Purchases By Chinese Central Bank Reach Mainstream Media

Can Gold Reach $16,000?

China’s Gold Reserves Going Through The Roof

If you enjoyed reading this article please consider supporting "The Gold Observer" by subscribing to the ...

more