Central Bankers Disagree About Gold

Image Source: Pexels

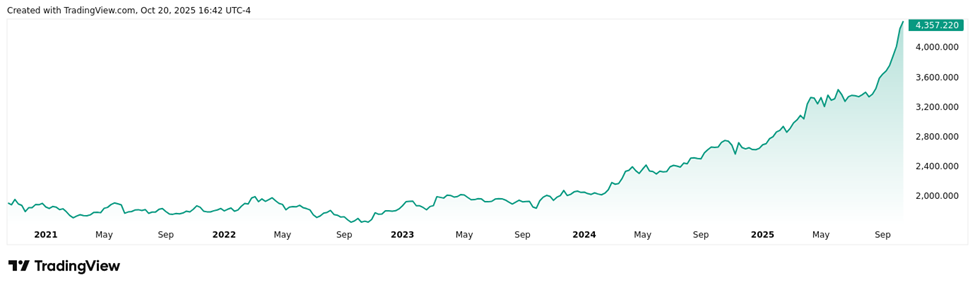

With the fiat US dollar price of gold multiplied 2.6x since October of 2022 (as of October 20, 2025 when this was written) and rising exponentially (Figure 1), some people are deeply worried that something is seriously wrong with the dollar and with the global financial system generally. Is the soaring price of gold a sign of monetary instability? Or is it just a transitory “nothingburger”?

Figure 1: Gold spot price per troy ounce, most recent five years

Source: TradingView

Central bankers are now being asked such awkward questions, and they are giving sharply divergent answers. During a Q&A session at a convention of business economists on October 14, Federal Reserve Board Chairman Jerome Powell responded:

EMILY KOLINSKI MORRIS: You used the term gold standard. And you didn’t mean it in this context that I’m going to pivot here, because there’s a question from the audience that’s getting a lot of upvotes. So, one of your predecessors, Alan Greenspan, used to view the price of gold as an indicator of inflation risk. So, in that context, how do you view the rally that we’ve seen in gold? And if you want to throw in Bitcoin, you can comment on that too.

JEROME POWELL: I’m not going to comment on any particular asset price, including that one. And I think we think of inflation as driven by fundamental supply and demand factors. And it’s not something we look at actively.

Powell is saying that the Federal Open Market Committee (FOMC), which tries to fix the quantity of dollars in existence, allegedly doesn’t care about the price of gold in particular because it views gold’s price as just one price among a vast array of prices that informs their decision-making. According to this view, gold is just another commodity which makes only a small, insignificant contribution to the overall demand for dollars and has no impact on the supply of dollars.

During the October 19 broadcast of CBS’s Face the Nation, European Central Bank President Christine Lagarde gave a startlingly different answer:

MARGARET BRENNAN: So you have also said recently that you think investors have begun to question whether the dollar would still warrant its status as the ultimate safe haven currency. I mean, the American dollar is one of the strongest weapons, frankly, that the administration has to use. Do you think that it is the rise of cryptocurrency that is most threatening to that or why are you worried?

CHRISTINE LAGARDE: I see signs that the attraction of the dollar is slightly eroded, and future will tell whether there is more erosion of that. But when you look at the rise of cryptos, number one, when you look at the price of gold. Gold is typically, in any situation, the ultimate destination for safe haven. Price of gold has increased by more than 50% since the beginning of the year. --

MARGARET BRENNAN: -- So people are worried. --

CHRISTINE LAGARDE: -- That’s a clear sign that the trust in the reserve currency that the dollar has been, is and will continue to be, is eroding a bit. In addition to that, we’ve seen capital flows outside of the U.S. towards other destinations, including Europe. So, you know, for a currency to be really trusted you need a few things. You need geopolitical credibility. You need the rule of law and strong institutions. And you need, I would call it, a military force that is strong enough. I think on at least one and possibly two accounts, the U.S. is still in a very dominant position, but it needs to be very careful because those positions erode over the course of time. We’ve seen it with the Sterling Pound, you know, way back after, after the war. But it happens gently, gently, you don’t notice it and then it happens suddenly. And we are seeing intriguing signs of it, which is why I think that having a strong institution with the Fed, for instance, is important. Having a credible environment within which to trade is important. So volatility, uncertainty, to the extent it is fueled by the administration, is not helpful to the dollar.

While Lagarde seems to agree with Powell that cryptotokens are not that important, gold is profoundly different. For her, gold is the “ultimate destination for safe haven” and the rise of its dollar price is a sign that “trust in the reserve currency” of the world is eroding. According to Lagarde, trust in a currency requires geopolitical credibility, a rule of law, strong institutions, and a strong military. Trust is something that can disappear suddenly and, without it, gold is the haven that the world turns to.

As an empirical matter, gold is still critically important as a part of the official reserves that central banks and governments use to prop up the purchasing power of their fiat currencies when needed. In fact, reported official reserve holdings of gold now exceed those of US Treasury securities, the first time that has happened since 1996. Lagarde seems to be correct (at least to the extent one can believe official Reserve statistics) that trust in the dollar is slipping away in favor of gold, at least among her central banking peers.

More importantly, economic theory and a common sense understanding of economic history favors Lagarde’s views over Powell’s. The fundamentals of monetary supply and demand are well described in chapter 11 of Murray Rothbard’s Man, Economy, and State. While a government can often use its tax codes and regulations to compel domestic use of its own currency, it can’t effectively prevent its citizens from holding other highly-marketable assets (what Rothbard calls a quasi-money) as substitutes for holding cash balances as a reserve for their future purchases, nor can it always compel foreigners to use its currency to settle international transactions (though, as Lagarde noted, superior military strength might sometimes enable it to do so).

The anticipated future purchasing power of money (PPM) is always an issue because the utility of money depends entirely upon subjective anticipations that it can be exchanged for a sufficient quantity of other goods whenever desired. In the case of constantly-depreciating fiat monies like the US dollar, the use of short-term US Treasury securities as a quasi-money reserve asset makes the dollar itself acceptable overseas because Treasuries can be readily exchanged for dollars whenever needed, and because interest payments on Treasuries reduce the costs associated with on-going dollar PPM declines.

Trust in the issuer of a fiat global reserve currency is always a challenge because foreigners have to depend upon the ability and willingness of the issuer to honor its obligations (e.g., US Treasury securities) to pay sufficient interest on those obligations to offset PPM declines sufficiently, and to keep its markets open to imports so that foreigners can earn enough revenues denominated in the reserve currency to purchase and accumulate those obligations.

If the issuer gets in a fiscal jam and can’t or won’t pay enough interest to compensate for PPM declines (which themselves are often closely linked to using fiat money creation to deal with fiscal problems), or gets in the habit of selectively reneging on its obligations to particular foreigners it doesn’t like, or starts closing its markets to foreign exporters or foreign investors, the crutch of using interest-bearing debt as a quasi-money to shield foreign users of the currency against PPM declines no longer works. In that case, foreigners will be obliged to find some other reserve that does work.

What does always work is a quasi-money that isn’t someone else’s liability and isn’t denominated in terms of someone else’s fiat currency or propped up by reserves of someone else’s fiat currency, namely, gold. Gold is a natural substance that doesn’t require trust in other governments or even trust in the behavior of gold miners (who can at most add only a small percentage annually to the total stock of gold in existence). Gold doesn’t lose its real purchasing power over the long run like fiat-denominated assets do; it has lower storage and transaction costs than other highly marketable natural commodities and doesn’t have the technological vulnerabilities and limitations of artificial commodities like cryptotokens.

While it is a matter of entrepreneurial judgment and not economic theory to affirm gold’s superiority as the ultimate “store of value” and potentially even as the preferred replacement for fiat monies (though silver has often been a strong competitor to gold for the latter role), I must agree with Lagarde’s assessment of the empirical facts concerning reserve asset competition, not with Powell’s dismissive attitude about gold—when the chips are down and the world is forced to turn to an unconditionally trustworthy reserve of purchasing power, the world will turn to gold. What soaring gold prices might indicate is that the world is now turning to gold.

More By This Author:

Do Markets Ever Reach Equilibrium?

How To Actually Solve The Affordability Crisis

Does A Decline In “Aggregate Demand” Cause A Recession?

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436.

Note: The views expressed on Mises.org ...

more