Buzzer Beater - WTI & Brent Oil

We are in the final minutes of the game. Not much left on the clock. The game is tied. It looked like the Bears are finally able to turn things around and make some crucial plays to decide the game. But not so fast! The Bulls come back with an amazing offensive game plan and win this week’s game in the oil market with a last-second shot to beat the buzzer! Who would have thought? So, we are closing an extremely exciting week in this market. After a steep price increase over $60.64 for Brent Crude and over $57.95 for WTI, we initially expected that the upward movement of the 5th wave was finished, as the curve smoothly bend around the middle of the week and indicated a slight downward slope. Its clean look gave us enough reason to believe that the curve going to perfectly align with our expectation. However, both crude oils came back at the end of the week and strongly pushed for bullish runs. Our primary expectation was that the bullish offensives of the last weeks should stretch to prices of $60.64 for Brent and $57.95 for WTI at maximum, but when the prices slightly exceeded these marks we were prepared to see higher quotations in the course of alternative development. We adapted the chances of this alternative, increasing its probability to 40% and rightly so, as it turned out. On Friday evening, prices for both crude oils sharply increased.

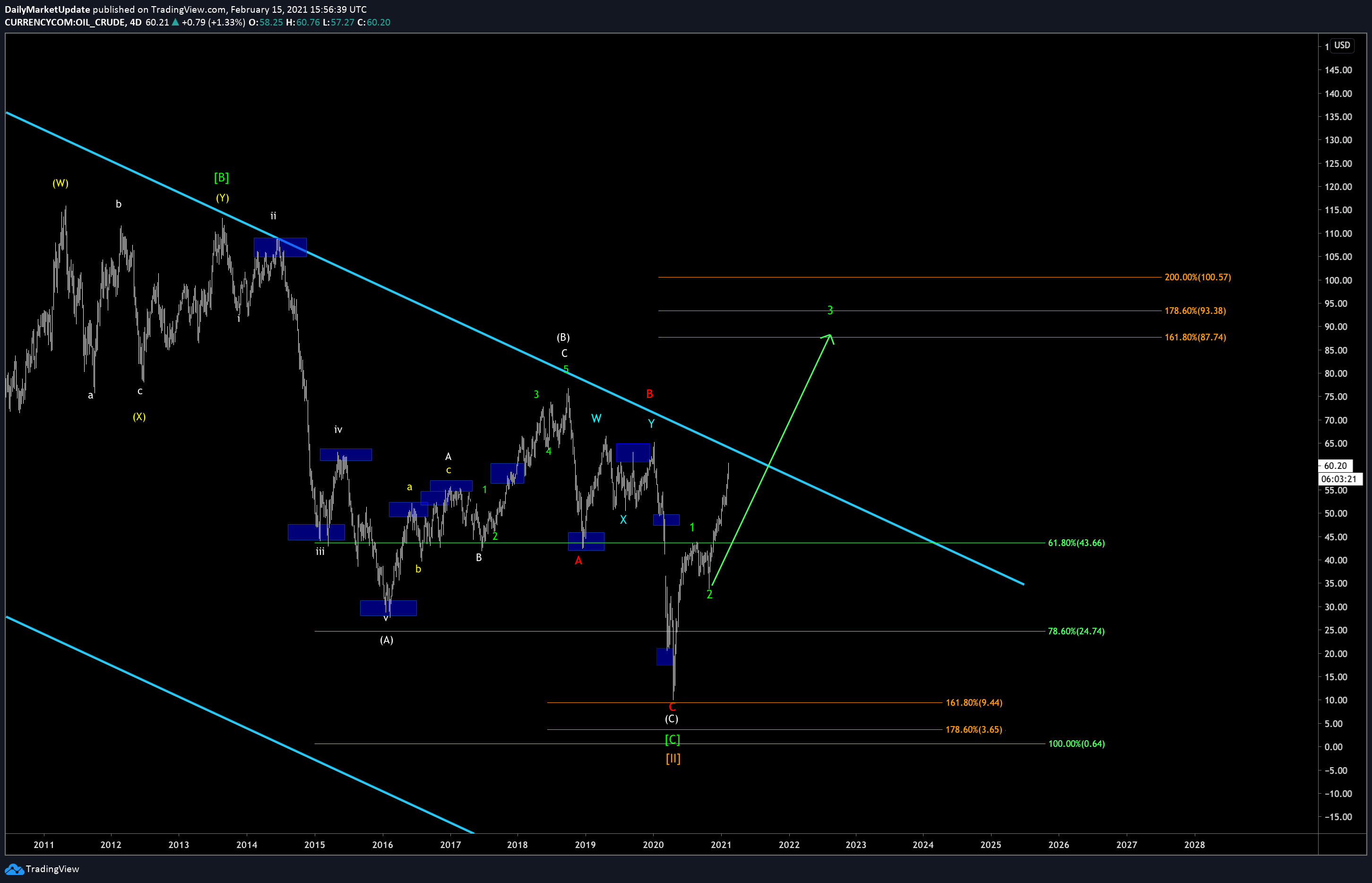

WTI 4 day Chart

(Click on image to enlarge)

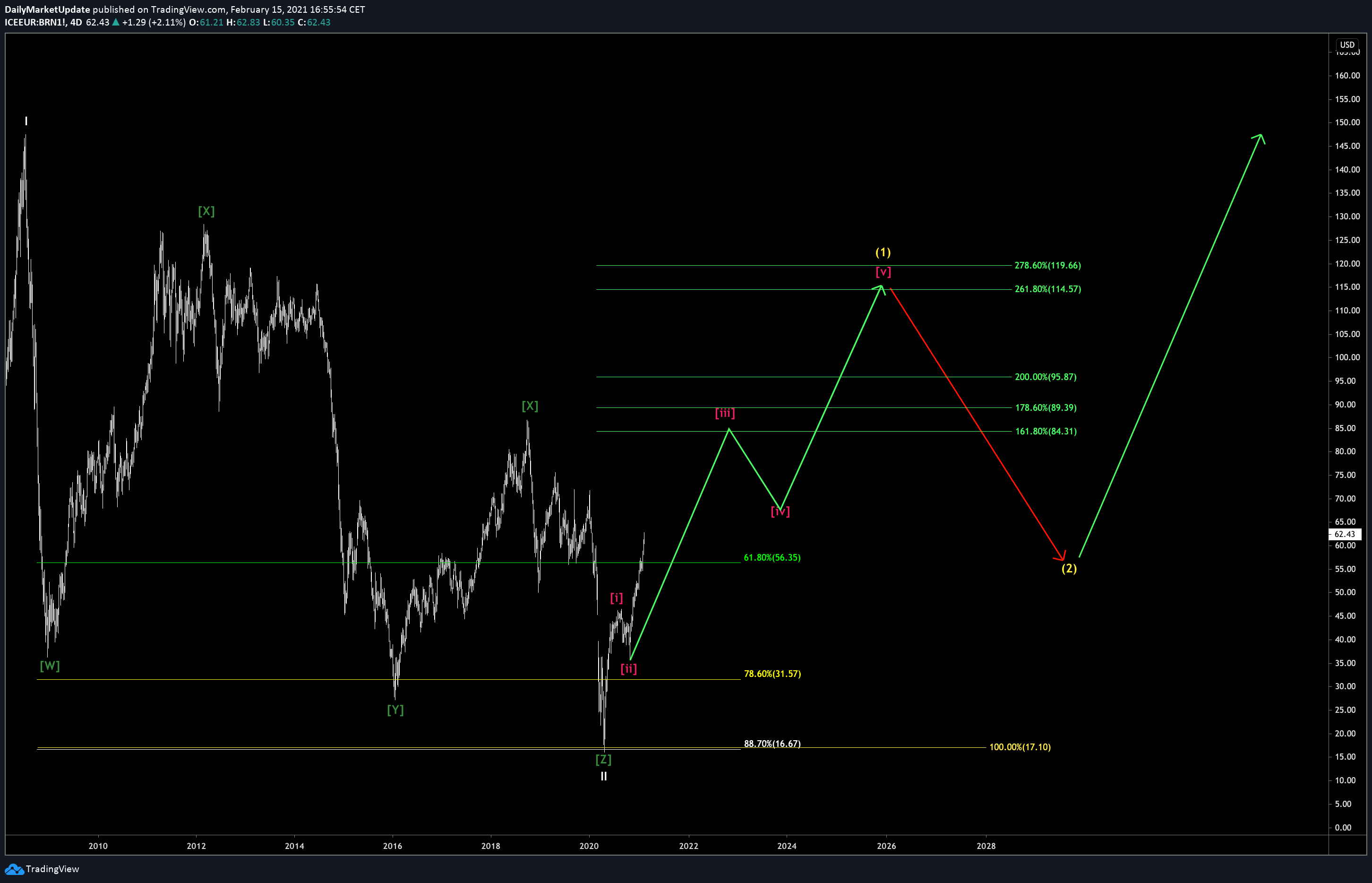

Brent 4 day Chart

(Click on image to enlarge)

Now, what is next? It’s going up, of course! For Brent, we predict the price to further increase until it reaches an area between $64.33 - $66.61. Regarding the price for WTI, we should aim for quotations between $61.62 - $63.89. Certainly, these are great news and spur our excitement for the coming week – and not only for this upcoming week. The next couple of weeks, months, and even years should be something investors in this market should be excited about. As we have been for quite some time now, we continue to have a strongly bullish orientation here and expect our benchmark oils to reach heights of at least $80 – if not considerably higher. With the current situation still evolving, we are already very close to this mark. It is, therefore, highly probable that we will also reach the $100-mark over the next years.

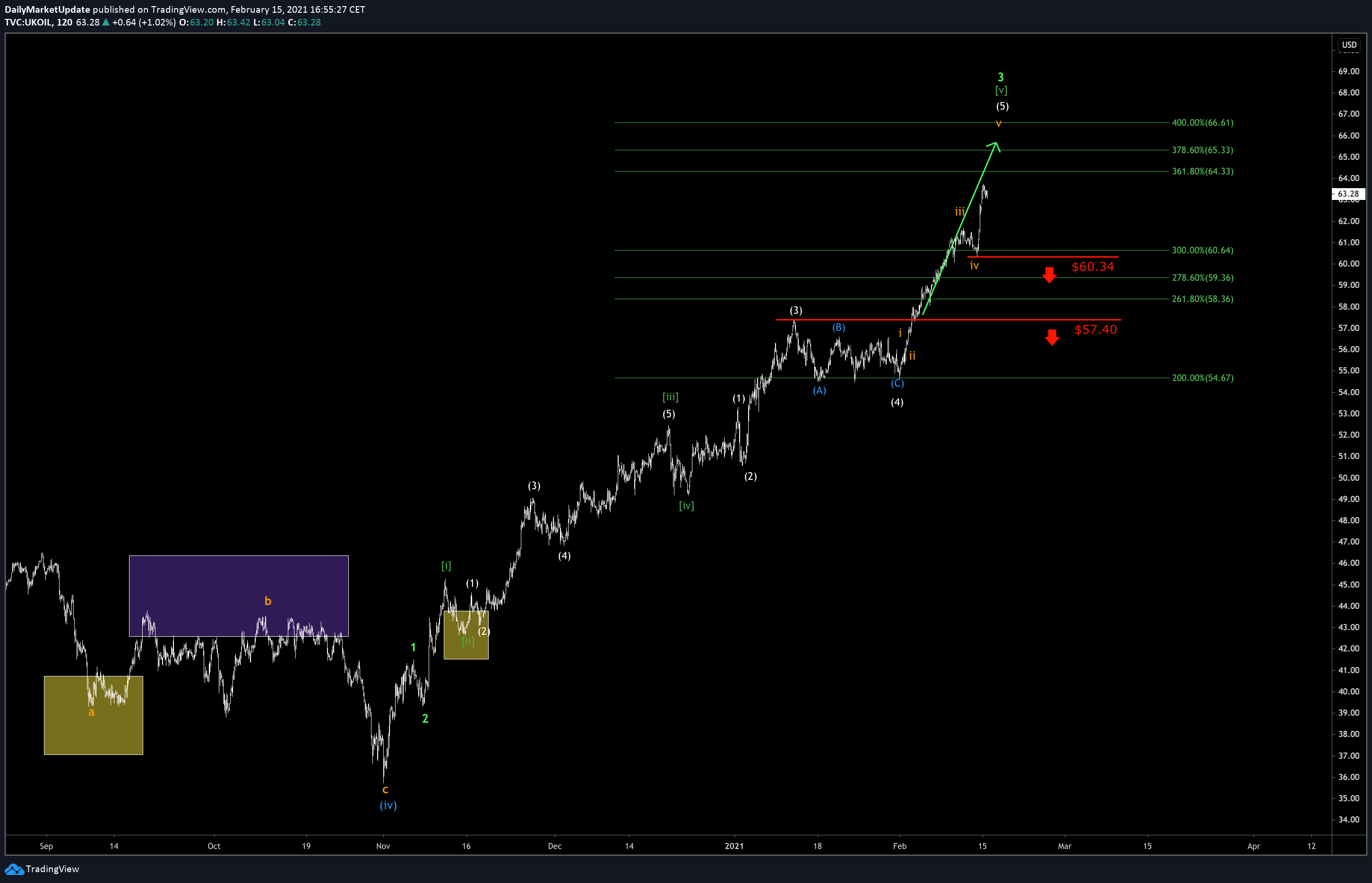

WTI 2h Chart

(Click on image to enlarge)

Brent 2h Chart

(Click on image to enlarge)

Anyways, since Michael Jordan, we are accustomed to stunning late-game performances of the Bulls. In this last week, they did not disappoint. But it is almost time again to enter the court for another battle for the win on the oil market. If you want to be part of this week’s game, you can do so by entering on the long side supporting the bulls and place a stop under $57.27 for Brent and $60.34 for WTI. These marks should not be crossed from now on, in order to upkeep the current upward trend.

Wow!