Buy Gold/Silver And Sell E-Mini S&P Index

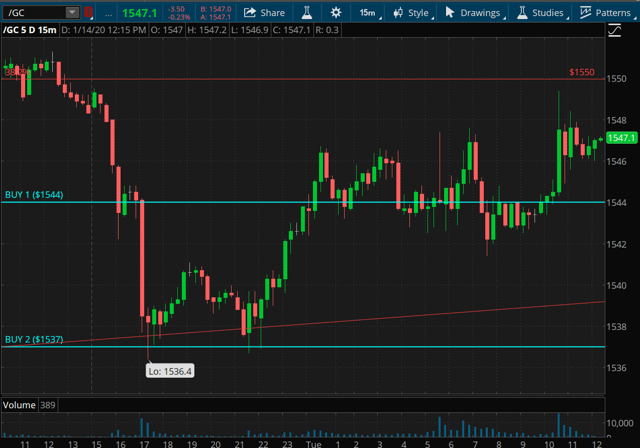

Gold is trading last at $1,545.50. The market came down overnight to the Variable Changing Price Momentum Indicator (VC PMI) Buy 2 level of $1,537 and activated a buy signal at about 5:15 pm PT. The signal had a 95% probability of the target of $1,544 being completed. As you can see, the market went up to about $1,541 and then tested $1,537, activating a buy trigger at 9:45 am. The target was completed at about 12 am with a high of $1,544.40.

(Click on image to enlarge)

The signal now has gone neutral. We are trading now at the $1,544 level, the Buy 1 level. This level has a 90% probability of a reversion to the mean. If the market triggers another buy signal, the next level above will be activated. The signal came in at about 6:15 am by closing at about $1,544.90. If you take the signal, your stop is $1,544 on a closing basis using the 15-minute bar. Your target is $1,544. For less than a dollar risk, you can lock in about $10; a pretty good risk-reward ratio.

Silver

(Click on image to enlarge)

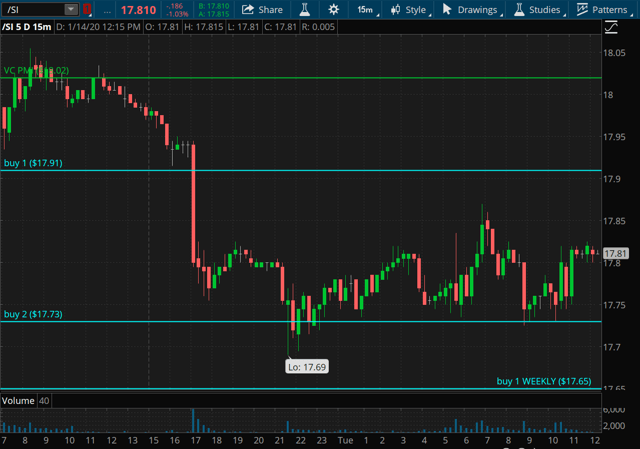

Silver is trading last at $17.84. It has activated a buy signal at about 9:30 pm by the market testing that $17.73 Buy 2 level with a 95% probability of the price reverting back to $17.91. We have activated a buy trigger, and the reversion to the mean into the target of $17.91 is occurring. When you reach $17.91, go neutral and wait for the market to tell you what to do. If it closes above $17.91, it is activating another buy trigger with a target of $18.02. Do not go short on a close below $17.91. Do not so go short in the blue levels or between the Buy levels, since they have a very small probability of success. Do not go short between the Buy 1 or Buy 2 daily or weekly.

E-mini S&P

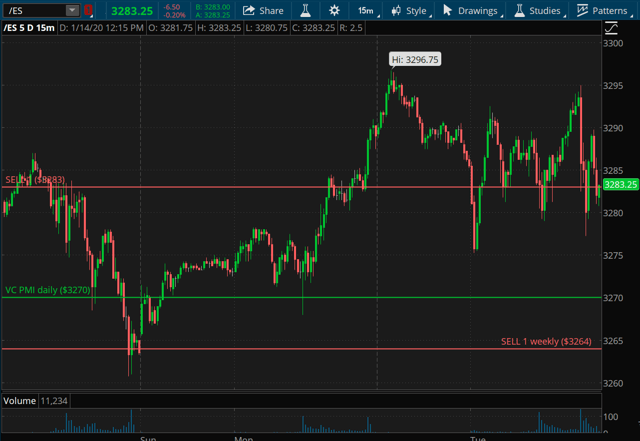

The E-mini S&P has met our targets for a short trade at about 11 pm from 3,282.25. It came right into that target of 3,283. When the price is in red, do not buy into it. The buying has the lowest probability of success. The price may come up, but it is a very small chance. The price can collapse, as it did here.

(Click on image to enlarge)

Gold Summary

After the high of $1,616.30, the market has reverted back down into the area of demand with support from $1,544 to $1,537. The principle of the reversion to the mean and the artificial intelligence of the VC PMI tells us that the area in blue offers the highest chance of a profitable trade. The market activated a buy signal from $1,539, the stop was $1,537, and the target was $1,544, which was completed. It traded around the Buy 1 level, and once again, we are on the long side from $1,544.90. For conservative traders, use a stop on a close below $1,544. It's not a straight stop; it's a close below using the 15-minute bar.

Disclosure: I am/we are long NUGT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose ...

more