Bullion Bears Are Not Going Anywhere

Not to beat around the bush: everything remains bearish. However, let’s take a look at what happened yesterday in the precious metals sector.

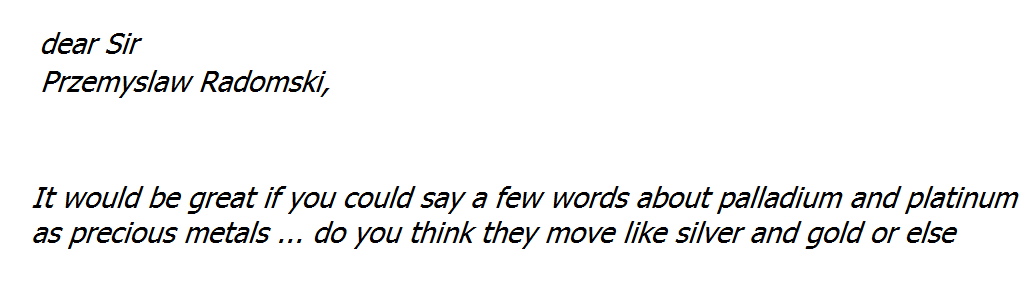

The most notable – and interesting – action took place in the mining stocks.

The GDX ETF rallied on an intraday basis, but erased almost all of its previous gains before the end of the session, closing only 6 cents higher. This tells us two things:

- That was an intraday reversal (it was not accompanied by huge volume, but still)

- Gold miners failed to rally back above their previous lows – they just touched the previous support and verified it as resistance.

Consequently, yesterday’s price action was nothing bullish – it was probably the final part of a corrective upswing.

In mid-September, we saw a tiny verification of the breakdown, and this time, the verification took a form that’s clearly visible even from the medium-term point of view. Does it change anything? Actually, yes, it does. Breakdown’s verification tells us that miners are even more ready to decline to new lows in a powerful manner.

The GDX ETF ended the day above the $30 level, but this level is not the key support/resistance level – the previous lows are. If the $30 level was critical, previous bottoms would have formed at it, and they didn’t.

But miners outperformed gold! Isn’t that a bullish sign?

If this persists, it might indeed become a bullish sign, but for now, it seems to have just been a necessary technical development (verification of the breakdown) that was likely influenced by what’s happening in the general stock market.

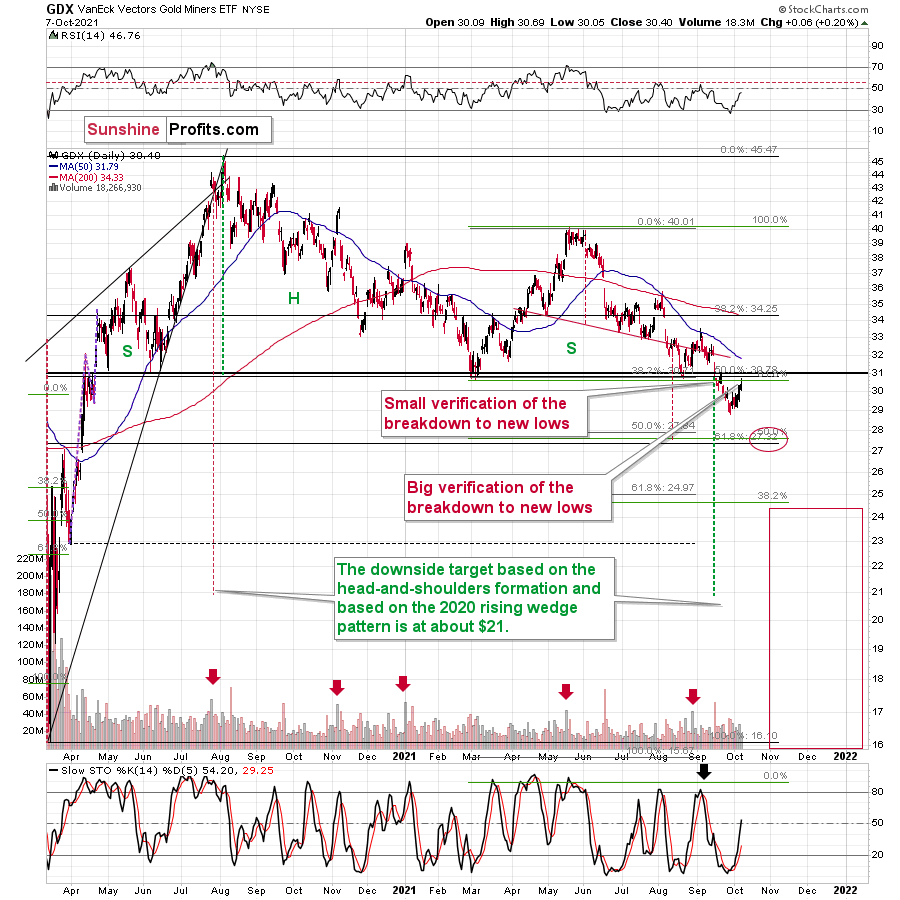

Every now and then miners follow stocks closely, but this link is usually short-lived. And so, as the general stock market rallied (and reversed), so did miners. I don’t think that stocks would be able to trigger a bigger rally in the miners, even if they rallied significantly from here.

And based on stocks’ yesterday’s inability to rally above their declining black resistance line based on previous lows, it seems that they are ready to head south any day or hour now.

Gold and the USDX

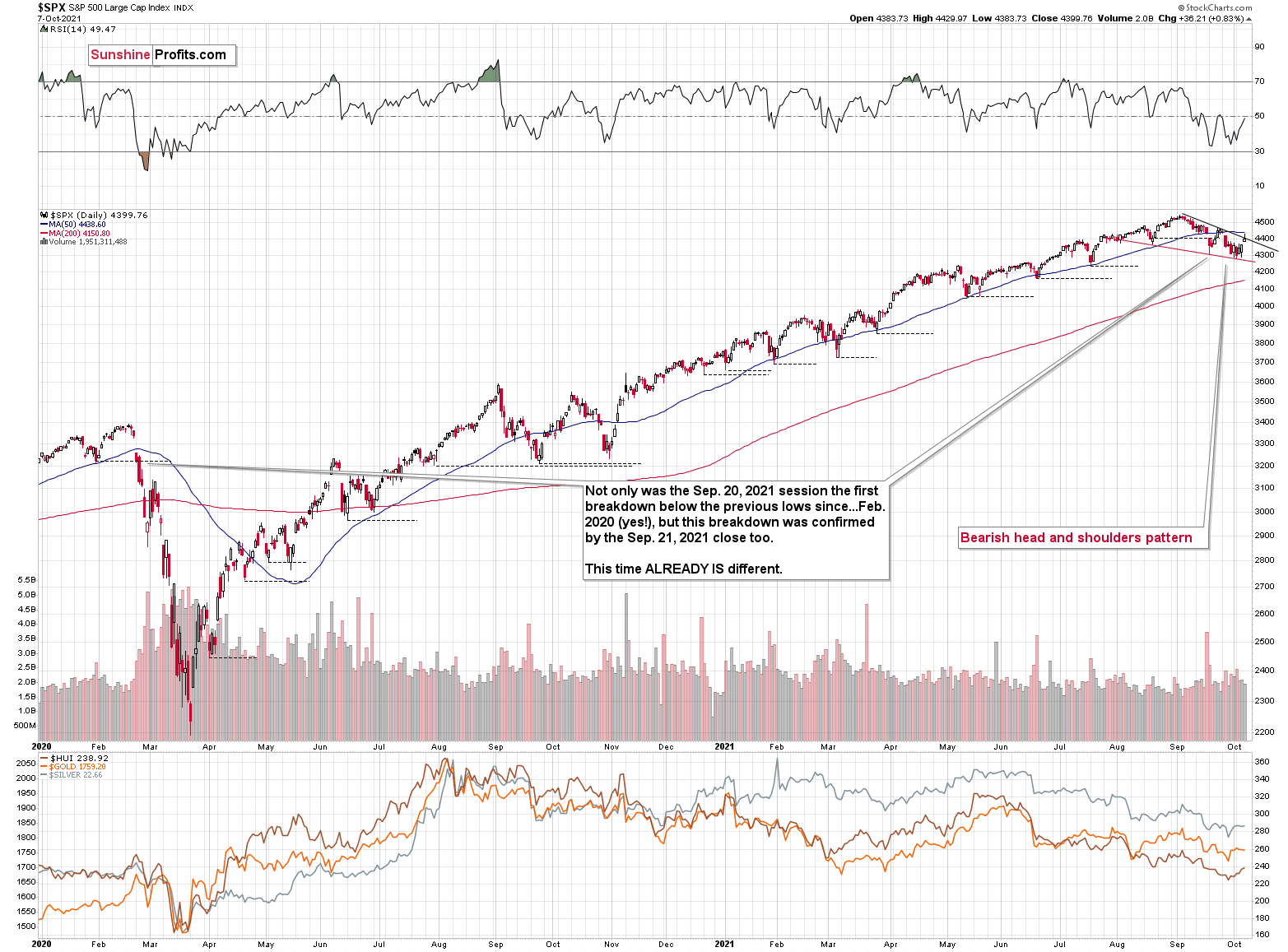

Gold is moving back and forth, and it’s doing so in tune with what happened in early 2013.

The implications of this analogy remain bearish.

Gold moved higher along with the USD Index recently, but that’s likely just a temporary effect of the debt-ceiling discussion, nothing more. Besides, the size of gold’s “strength” is not significant. So, all in all, I don’t view it as a true bullish sign.

And speaking of the USD Index, please note how well it managed to verify the breakout to new highs and above the rising support/resistance line. It’s also above the rising dashed support line, so even the very short-term trend remains up.

Once the USD Index soars once again, PMs are likely to respond with much lower prices, and it seems that we won’t have to wait too long for it.

On a final note, before we move to more fundamental discussions, please note that the politicians might provide some more smoke and mirrors about the debt ceiling so that it looks like they hadn’t decided to keep raising it a long time ago. That’s just pretending to really care about fiscal responsibility and not about the S&P’s returns and votes. It might look like a “real, fierce fight” after which the politicians will be “forced” to raise the debt ceiling for “the good of the people”. The real reason will likely be that nobody wants to be directly responsible for the short-term economic turmoil that would follow otherwise. I don’t mean to be cynical here, and I’m not saying that all politicians are like that, but assuming that politicians and semi-politicians (monetary authorities, etc.) want votes and S&P returns while avoiding the personal blame usually allowed me to make quite accurate forecasts…

photo inside