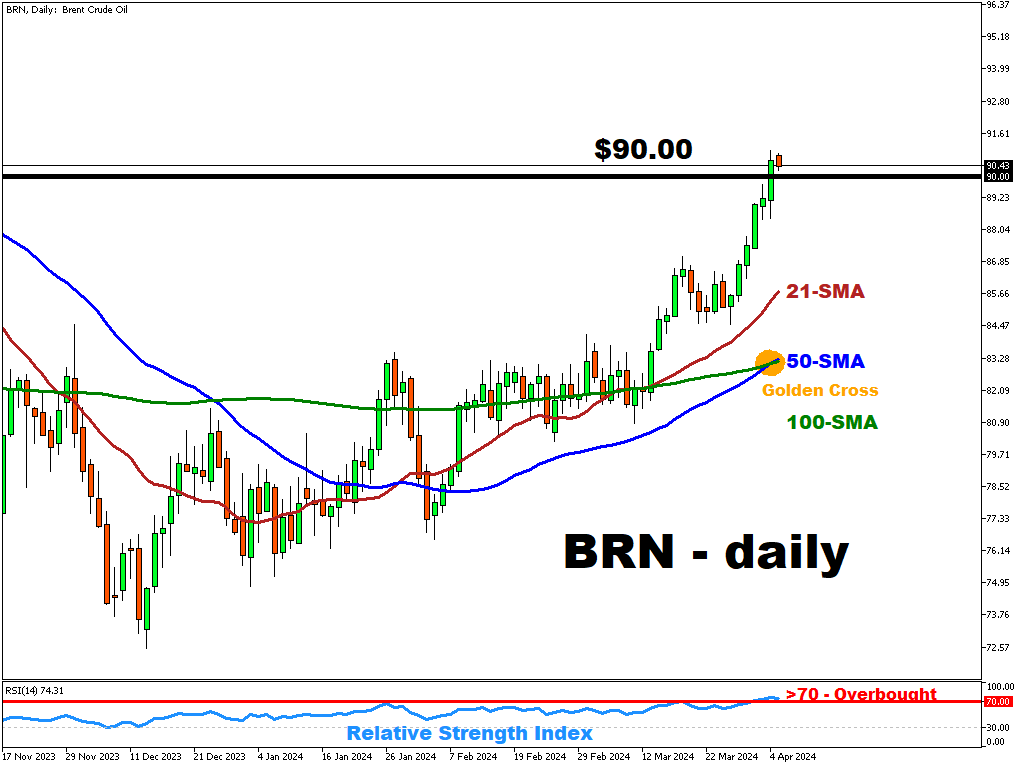

BRN: Further Upside As Golden Cross Forms?

BRN is trading above the psychologically important $90/bbl, the level last seen in October 2023, forming a golden cross formation.

Golden cross is bullish chart pattern that occurs when short term moving average (50-period SMA) moving above long-term moving average (200-period SMA).

Escalating tensions in the Middle East and fears of a potentially wider regional conflict have been the main catalyst for the recent rally.

Since the beginning of this year, Brent has already posted ~17% gains.

On the supply side

OPEC+ has decided to maintain its production cap unchanged while pushing some members of the cartel to be more compliant with its policy.

Some participants have already expressed their willingness to increase their compliance with the established output limits.

As of last month, the OPEC+ voluntary production cuts are set at 2.2 million bbl/day through June 2024.

The continuation of the OPEC+ production cuts through 1H 2024 may tighten the global oil supplies in the near future which could translate into BRN moving higher.

The disruption in the Russian oil refineries as well as disruptions in the Red Sea shipping routes may also result in a tighter oil supply.

The US Energy Information Administration (EIA) is expecting Brent to average at $88/bbl in Q2 2024.

More By This Author:

XAUUSD Sets New Record High, Touching Above $2300

Bitcoin To Recover Above The 21-Period SMA?

AUDUSD Rebounds Following The RBA Minutes Release

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial ...

more