BRN Edges Higher Towards It's 2024 High

BRN edges higher towards its 2024 high ($84.14/bbl)

The market, (with a 75% probability according to FedWatch Tool), expects the Fed to loosen its monetary policy in June.

However, it could be delayed if inflationary risks remain high.

A decrease in interest rates could weaken the U.S. dollar, making oil cheaper for countries with stronger currencies. This may translate into oil prices moving upward.

Beyond the Interest rates, geopolitical tensions in the Middle East, with a focus on disruptions in Red Sea shipping routes, can significantly impact crude prices.

Additionally, OPEC+ production cuts extend a major support to the black gold.

A potential extension of these cuts beyond June 2024 could further push oil prices higher.

On the technical side

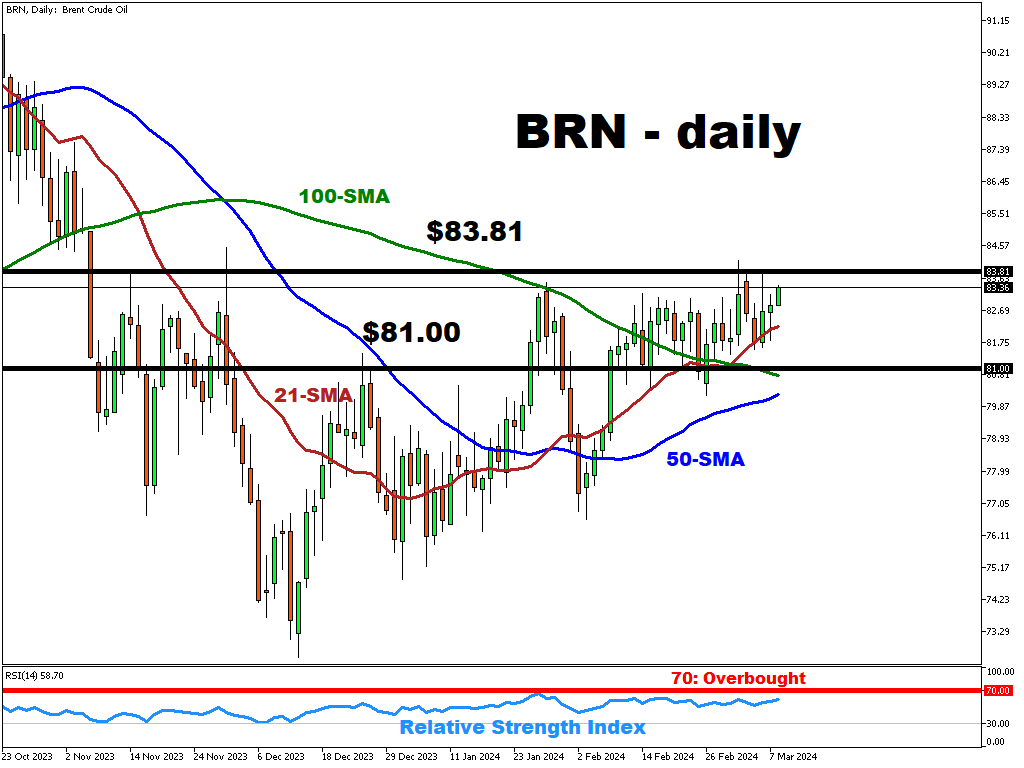

- Brent crude oil is currently trading higher than its major moving averages (21-day, 50-day, and 100-day), signaling a strong upward trend

- The 21-period Simple Moving Average (SMA) is currently positioned to act as immediate support if Brent crude prices experience a decline

- To the upside the $83.81 may prove to be a strong resistance level

- The Relative Strength Index (RSI) currently sits in neutral territory (between 30 and 70), indicating the price could trend upwards or downwards

More By This Author:

JP225 Slides Below Its 40000 MilestoneAUDUSD To Close Above 21-Period SMA?

Bitcoin Near $70,000

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial ...

more