Brent Set For First Yearly Drop In 3 Years

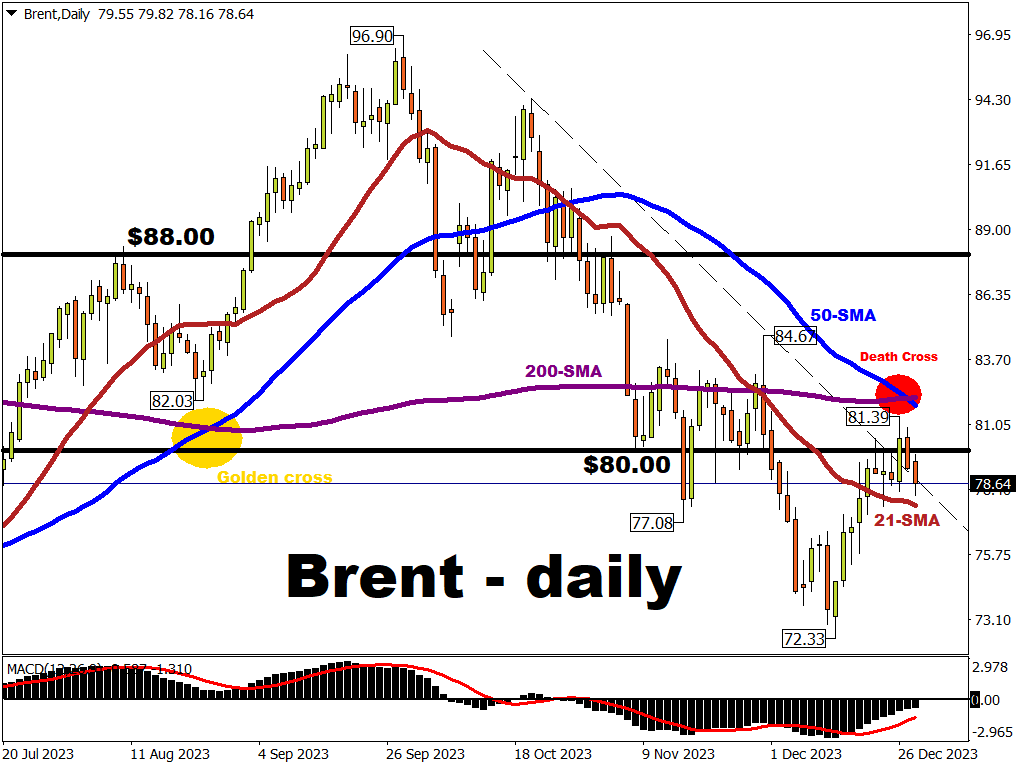

Brent oil has been dragged back below the psychological $80/bbl line on a combination of fundamental and technical factors.

Rising US crude stockpiles have restored fears of sluggish global demand.

Meanwhile, a “death cross” on the daily charts may have added to downward pressures - a bearish signal that we had warned about in last week's article.

The incoming official US government data on crude stockpiles due in a couple of hours may inject further volatility in oil.

Broadly, the lingering threat of a broadening conflict in the Middle East means oil markets have to remain vigilant over supply-side risks, while potentially ensuring a geopolitical risk premium remains baked into prices.

With Brent on course for its first annual drop since 2020, prices may better reflect the market’s assessment of the supply-demand outlook once trading volume picks back up in the new year.

Oil benchmarks may find stronger support as long as the US dollar moderates further, provided that the Fed can indeed follow through with its forecasted rate cuts in 2024.

For the near-term, immediate support may arrive around its 21-day simple moving average (SMA).

More By This Author:

Gold Steadies After Record-High CloseUSDJPY Tests 200-Day SMA Resistance After BoJ Summary Of Opinions

Solana's 2023 Gains Still Above 1000% Despite Pullback

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial ...

more