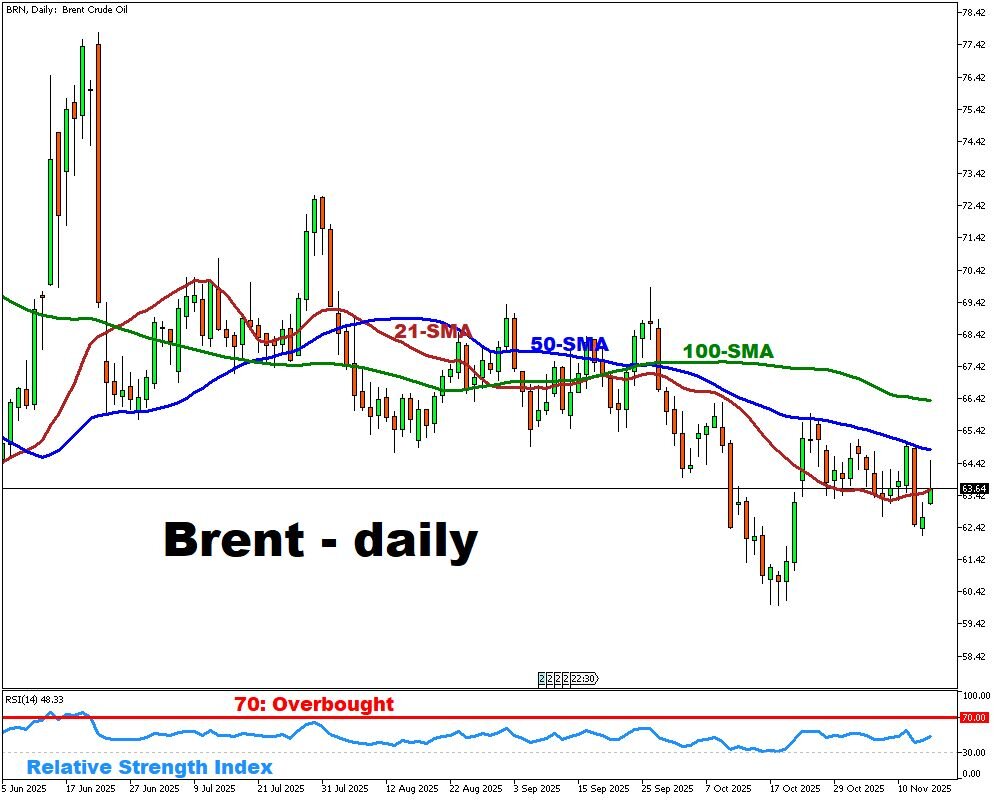

Brent Rebounds As Sanctions Threat Meets Oversupply Doubts

- Brent crude futures climb ~1.5% toward $64/bbl

- Market set to break a two-week losing streak

- Supply risks rise ahead of upcoming U.S. sanctions

- IEA warns of sizable global oil surplus ahead

- U.S. output and inventories continue to trend higher

In the latest trading, Brent crude has found footing as market participants weigh two conflicting forces: material supply-risk upside from impending U.S. sanctions on Russian players, exemplified by early staff cuts at Lukoil PJSC and reports of large volumes of Russian oil stuck at sea, against entrenched concerns of a global oversupply.

The upside case hinges on blocked flows and rerouted cargoes which tighten availability, giving the price a lift. Yet the longer‐term structuring remains weak: the IEA’s forecast of a sizeable supply surplus this year and next, OPEC’s own admission of a Q3 surplus and strong U.S. production all point toward persistent downward pressure.

Thus, the current rebound looks tentative: it may reflect a short-term reaction to geopolitical risk rather than a sustainable tightening of fundamentals.

Unless demand growth accelerates or structural supply cuts materialize, the oversupply narrative is likely to reassert itself, placing Brent at risk of yielding its gains.

Brent dynamics, source: Alpari MT5

More By This Author:

S&P 500 Gains On Shutdown Optimism And Tech StrengthThis Week: GBPUSD, EURUSD & CHINAH Index In Focus

XAUUSD Climbs On Rate-Cut Odds