Brent Lost 11% Over Week

Image Source: Unsplash

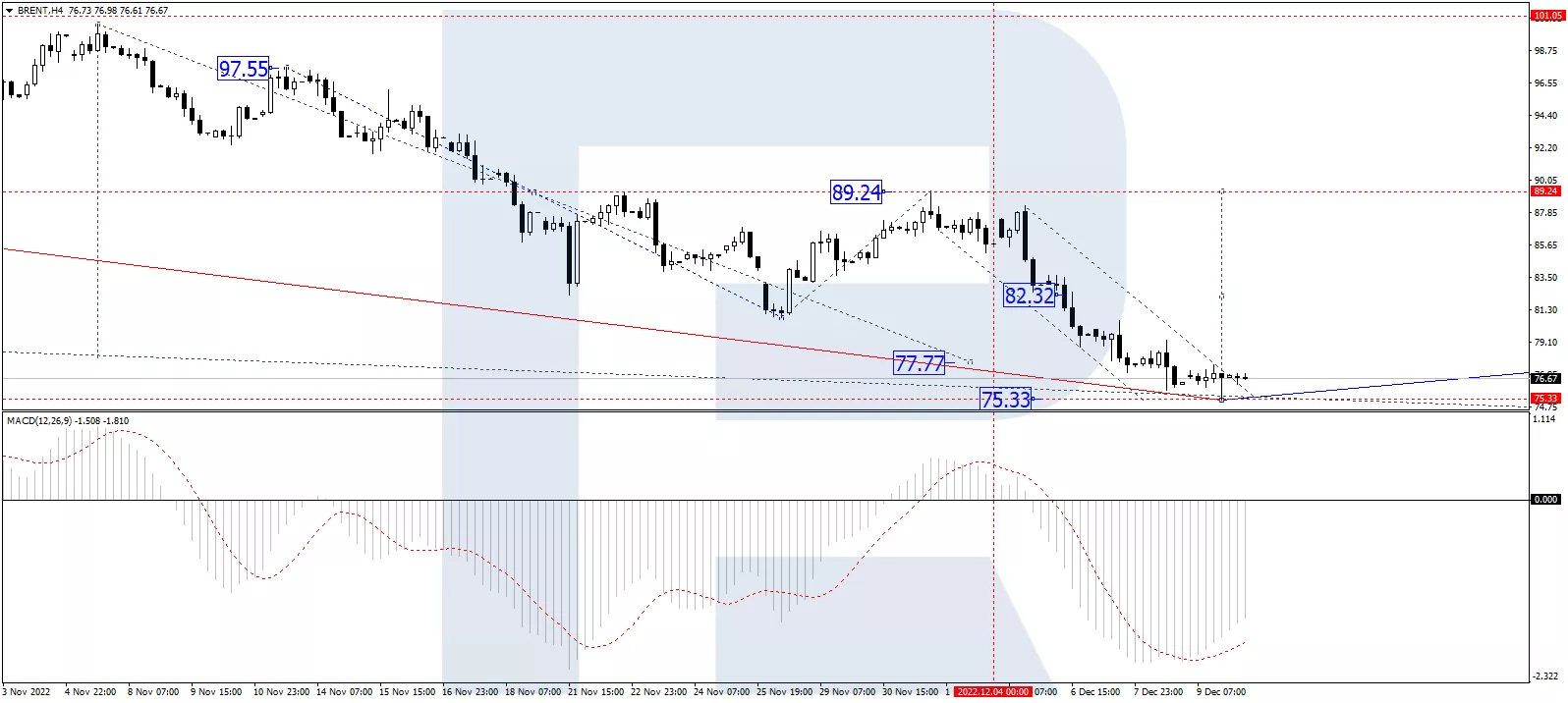

The crude oil market keeps trying to stabilize but fails. Brent barrel started this week with an attempt to reach 76.55 USD.

On the whole, the probability of an equally fast decline looks limited. Nonetheless, investors may react negatively to the oil demand forecasts presented by OPEC and the IEA. However, market participants can use the fact that the Keystone Pipeline that delivers crude oil from Canada to the US is still lying idle.

According to Baker Hughes, the number of active drills in the US has dropped by 2 over a week, reaching 625 units.

On H4, Brent has reached the local goal of the wave of decline at 75.33. Today the market is forming a structure of a wave of growth to 89.40. A link of correction to 82.30 is expected, followed by growth to 101.00. Technically, this scenario is confirmed by the MACD: its signal line is headed strictly upwards to zero. A breakaway and further growth to new highs should follow.

(Click on image to enlarge)

On H1, Brent has formed the first impulse of growth to 77.00. A link of correction to 76.06 is not excluded. Then a new structure of growth is expected to develop to 78.78. Technically, this scenario is confirmed by the Stochastic oscillator. Its signal line is under 80, headed strictly down to 50. A bounce off it and growth back to 80 are expected.

(Click on image to enlarge)

More By This Author:

EUR Decided To Sky-Rocket

Crude Oil Started With Crash

Crude Oil Inclined Down

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more