Brent Finds Relief In Easing Fed, China Fears

Brent oil has seen several catalysts for gains ahead of the weekend, ranging from the prospects of a less-aggressive Fed to China’s reduction of the required quarantine period for inbound travelers.

The cooler-than-expected US inflation print, which implies the opportunity for the Fed to downshift on its rate hikes, triggered a tumble in the US dollar which in turn alleviated pressures off dollar-denominated commodities.

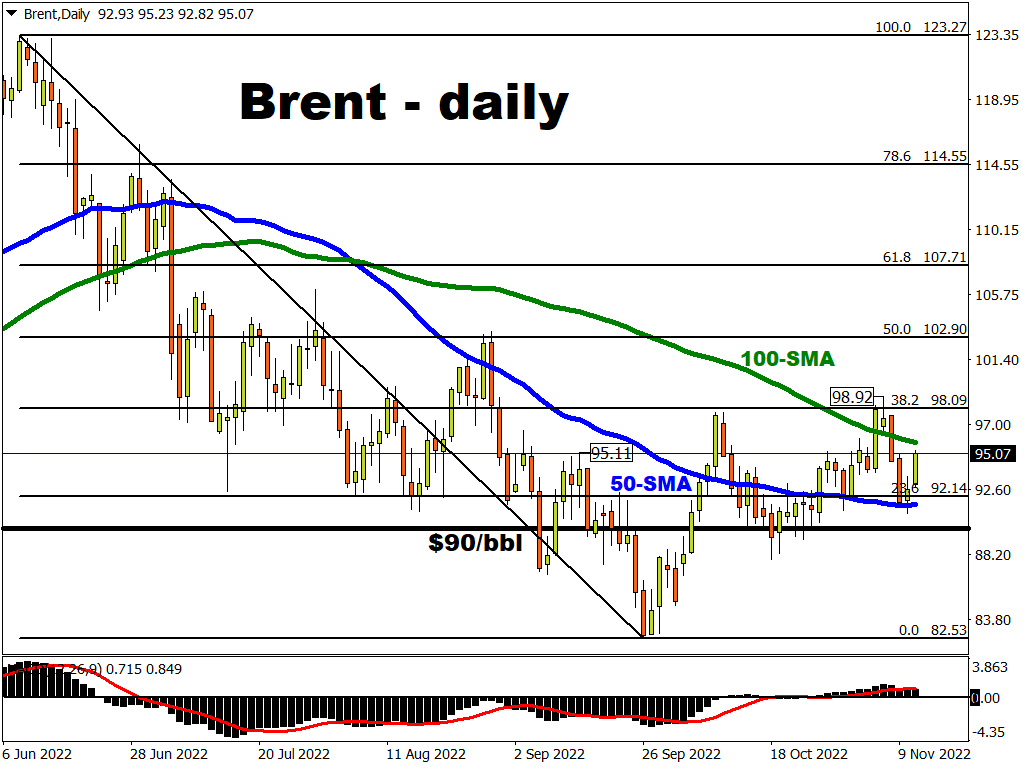

Brent prices have managed to find support at their 50-day simple moving average (SMA) of late, with oil bulls now racing to try and conquer the 100-day SMA resistance.

Ultimately, whether oil prices can carve out further meaningful gains would depend in large part on the global demand outlook.

If the Fed follows in the footsteps of other major central banks and eases up on its demand-destroying rate hikes, that should translate into more relief for oil prices.

With significant supply-side risks in play, including further OPEC+ intervention as well as the looming EU ban on Russian crude just weeks away, oil benchmarks should find adequate fundamental support over the near term.

More By This Author:

Stocks Sink Ahead Of Crucial Inflation DataDollar Subdued After Midterms And Into CPI

FOMC Meeting Looms Over FX Markets

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial ...

more