Brent Falters On Risk Of More Fed Hikes

Brent oil is paring some of last week’s gains as the US dollar reasserts its negative correlation with this key commodity.

Oil markets are now warier of the prospects of more demand-destroying Fed rate hikes over the coming months, while sentiment was further soured by US inventories having risen this week by the most since 2021.

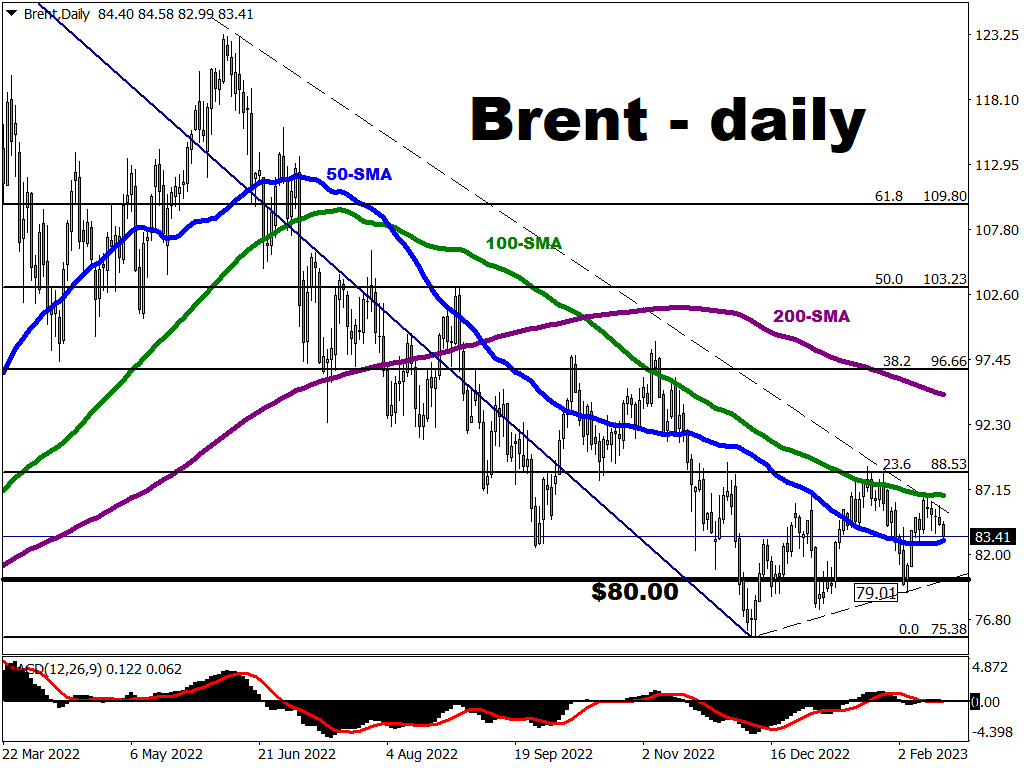

Brent oil has been thwarted at its 100-day simple moving average (SMA) once more, and is testing its 50-day SMA for immediate support.

In order for oil to break above its 100-day SMA resistance, the optimism surrounding China’s economic reopening must be able to punch through.

And of course, the clearer signal for oil bulls to finally go charging once more would be when the Fed as well as other major central banks can officially signal an end to their respective rate-hike regimes.

More By This Author:

Solid US CPI Sees Rates Move HigherThis Week: Higher US CPI Could Drag S&P 500 Back Below 4,000

Brent Surges On Potential Russian Output Cut

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial ...

more