Brent Crude Prices Edge Higher Amid Middle East Tensions

Brent crude oil prices are currently hovering around $82.00 per barrel this Monday, with market sentiment influenced by recent developments in the Middle East. Although concerns over disruptions to energy supplies from the region have somewhat subsided, the possibility of supply disturbances continues to support oil prices.

The rejection of a ceasefire offer by Israel from Hamas last week led to a near 6% increase in oil prices, as the market remains sensitive to geopolitical tensions that could impact oil supply.

It's anticipated that trading activity in the oil market may be subdued this week due to holidays in much of the Asia-Pacific region, including China, Hong Kong, South Korea, Taiwan, and Japan.

Brent Technical Analysis

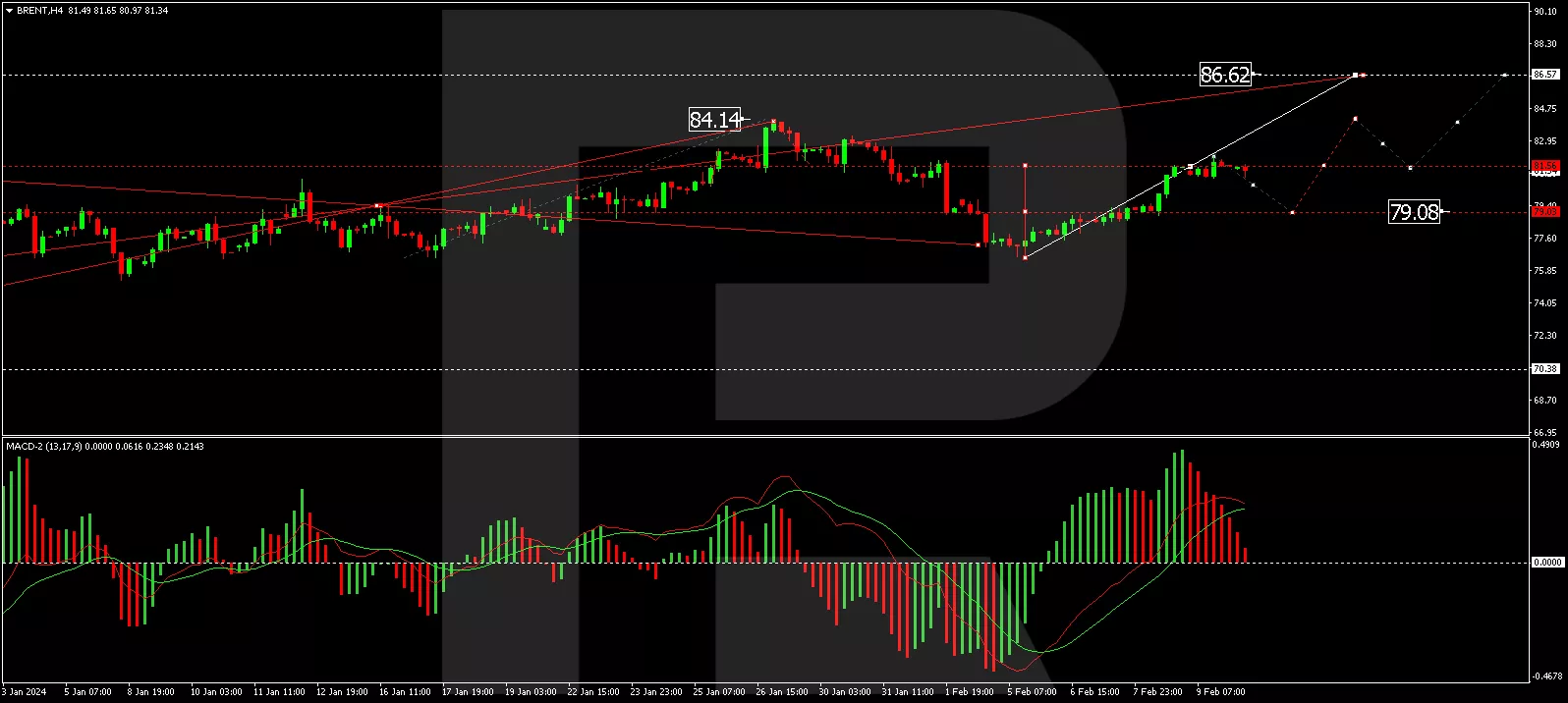

The H4 chart analysis for Brent indicates the formation of a new growth wave, with a recent structure completion at $82.12. The market is now forming a consolidation range below this level, and a correction down to $79.10 is not out of the question. Following this correction, a new upward trajectory towards $84.20 is expected, potentially extending to $86.68. The MACD indicator supports this view, with the signal line at the highs and anticipated to cycle back towards zero.

(Click on image to enlarge)

On the H1 Brent chart, a consolidation phase is observed under $82.12. A downward escape could lead to a correction towards $79.10, followed by an expected growth wave to $82.20. An upward breakout could set the stage for a movement towards $84.20. The Stochastic Oscillator, with its signal line above 50 and targeting 80, corroborates this growth potential.

(Click on image to enlarge)

More By This Author:

USD Strengthens Following Strong Employment Data

USD In Limbo As Market Anticipates Fed's Decision

Brent Crude Oil Prices Inch Upwards Amid Demand Speculations

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more