Brazil’s Dryness Hurts 2nd Crop Corn, Tightening US/World Stocks

Market Analysis

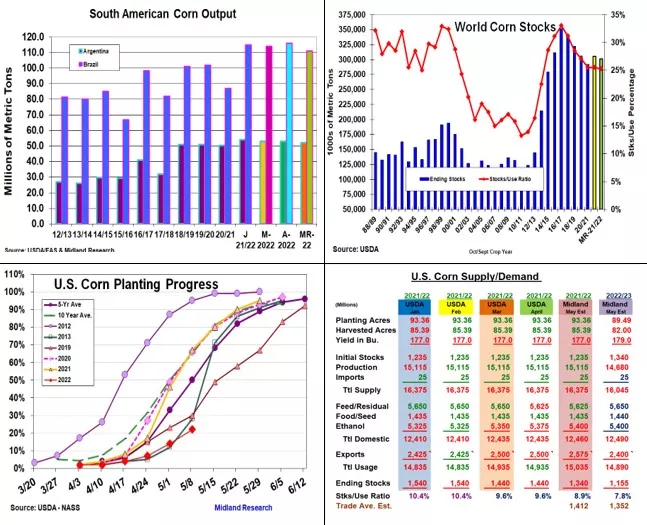

Another set of dramatic world events is occurring as the US 2022/23 feed grains growing season begins. The Black Sea conflict continues to hurt Ukraine’s production and curtail their old-crop exports reducing available world supplies. The 2nd year of La Nina’s weather pattern in the Pacific Ocean has reduced S Am’s corn output & curbed western US feed grain prospects. This year’s cool & wet spring from the N Plains through the Eastern US has restricted this spring’s US corn plantings to their lowest level for May 8.

However, the uncertainty of the upcoming USDA 1st world 2022/23 supply/demand forecast and a burst of above-normal temperatures had prompted heavy investor liquidation.

La Nina’s dryness has hurt Brazil’s & Argentina’s early corn output. However, the early retreat of Mato Grasso’s rainy season has many Brazilian analysts slicing the safrina corn by 4-5 mmt to 111 mmt this month. After Ukraine’s port closures raised corn’s world stocks last month, Brazil's smaller crop may reverse this trend and open exports to others this summer. If the current dryness continues during seed filling, Brazil’s crop could even shrink further.

Reduced Ukrainian corn exports & a smaller Brazilian 2nd crop suggest 75-100 million larger US old-crop exports. Ethanol plants’ April supply chain rail shipment problems seem to be clearing so this demand should remain strong with gasoline at record prices. Corn’s old-crop US carryover could decline from 100 million to 1.34 billion this month.

This spring’s cold & wet Corn Belt weather has curtailed US plantings to 22%, the lowest 1st week of May planting level in the USDA’s database back to 1975. The three I- States being at or below 15% might be a record, too. With most northern states at single digits, a substantial jump in 2022’s prevent plant acres also exists. Even with a big jump, next week’s May 15th US seedings could be below 50% suggesting 2022’s corn yield is below trend. Will the USDA reduce its 2022 yield on their initial 2022/23 supply/ demand report from their baseline project.? If so, corn’s 1st ending stocks forecast could be under 1.2 billion bu.

What’s Ahead:

The US corn planting pace and how Brazil’s 2nd corn crop output proceeds during May will be the driving force in the world’s corn market. The size of Brazil’s exportable supplies and the overall production of the US 2022/23 crop are likely the major price factors going forward. Hold remaining old-crop sales at 90% and 2022/23 marketings at 25-30% at this time.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more