Bitcoin, Banks, & Black Gold Bid As Tech Stocks Tumble Ahead Of CPI

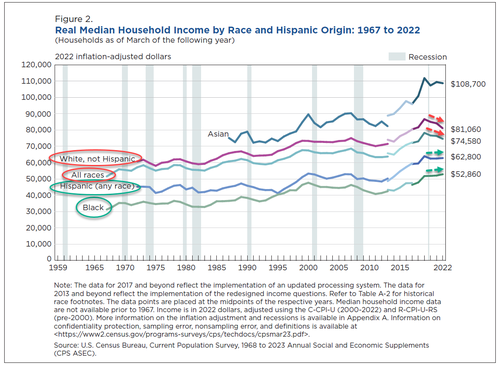

Weaker US Small Business optimism and German sentiment back at COVID-lockdown lows were the only macro catalysts of note today as micro-events dominated (ORCL earnings and AAPL launch event). Though we do have to caveat that with the fact that the Census Bureau reported a decline in real household incomes in the US for the 3rd year in a row...

So much for Bidenomics.

Slowing cloud business growth sent Oracle shares crashing (down 14%, the most since Dec 2011)...

Apple stock slid on its big innovative new iPhone/Watch release (on lower than expected price points)...“There is some disappointment the company didn’t raise iPhone prices on models other than the Pro Max, but the presentation spent a lot of time emphasizing the higher-end devices over the base ones (which could help drive the mix in favor of Pro and Pro Max vs. 15 and 15 Plus)”

Banks were bid today...

Both of which dragged down the Nasdaq (and S&P). About 30 minutes into the AAPL launch event (around 1330ET), all the majors started to see heavy selling pressure which dragged Small Caps and The Dow into the red...

All the majors closed below their 50DMAs (Russell 2000 below its 100DMA)...

Treasuries were mixed with the short-end lagging (2Y +2bps, 30Y -3bps)...

Source: Bloomberg

The 2Y Yield pushed barely back above 5.00% but the ranges were very narrow once again...

Source: Bloomberg

The yield curve (2s30s) flattened, erasing yesterday's steepening...

Source: Bloomberg

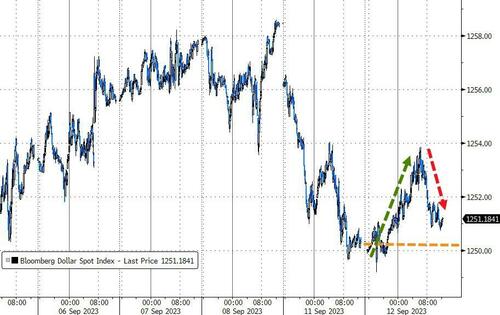

The dollar ended higher on the day but was sold for most of the US session...

Source: Bloomberg

After yesterday's puke back below $25k briefly, today saw Bitcoin panic-bid back up to $26,500...

Source: Bloomberg

Oil prices surged, breaking out of their pennant pattern with WTI tagging $89 - its highest since Nov '22...

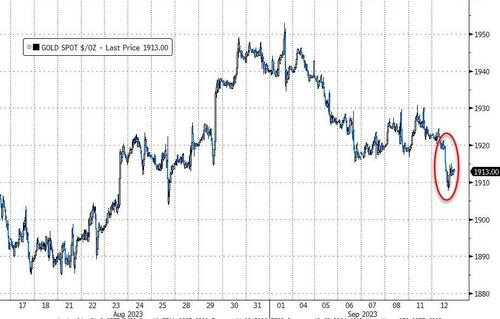

Gold was lower on the day with spot trading below $1910 intraday...

Source: Bloomberg

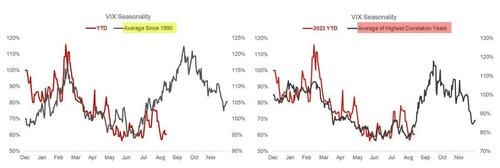

Finally, with Triple-Witching looming, you are here...

Brace for the unclench.

With all eyes focused (for now) on tomorrow's CPI, we are seeing inflation expectations (1Y inflation swap) surging higher again...

Source: Bloomberg

That will spoil the 'Goldilocks' narrative.

More By This Author:

US Real Household Incomes Slide For 3rd Year In A Row As White Incomes Tumble; Blacks, Hispanics GainFeuding Fed-Watchers: Gross Gores Gundlach Over 'Bond King' Title

New iphones Don't Create As Much Buzz As They Used To

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more