Big-Tech Best, Bitcoin Battered As Event-Risk-Ridden Week Looms

A relatively news-less day saw mega-cap tech (and the dollar) shrug off rising rates as bitcoin was clubbed like a baby seal.

Source: Bloomberg

Tesla (TSLA) soared on an MS upgrade (related more to AI)...

And so Nasdaq outperformed. The Dow and Small Caps limped lower after early gains but held on to the green. The S&P was in the middle. With about 15 mins to go in the day, we saw some profit-taking

0-DTE helped lift the S&P above its 50DMA but then covering dragged it back down...

This sent the Nasdaq to its all-time high relative to Russell 2000...

Source: Bloomberg

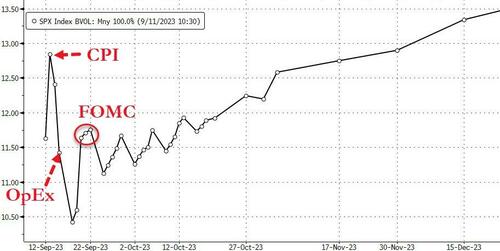

From here on it gets interesting with CPI, PPI, Retail Sales, Triple-Witching OpEx, and The Fed coming up...

Source: Bloomberg

Treasuries were mixed today but traded in very narrow ranges. The long-end underperformed with all the selling coming at the Asian open...

Source: Bloomberg

NYFRB one-year inflation expectations ticked higher (from 3.5% to 3.6%) in their latest survey echoing the recent uptick in the market's pricing for inflation expectations...

Source: Bloomberg

2Y yield topped 5.00% briefly today before falling back but ranges were very narrow...

Source: Bloomberg

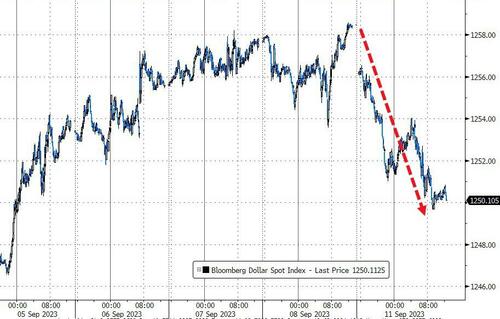

The dollar dumped today, its 2nd biggest daily decline since Feb...

Source: Bloomberg

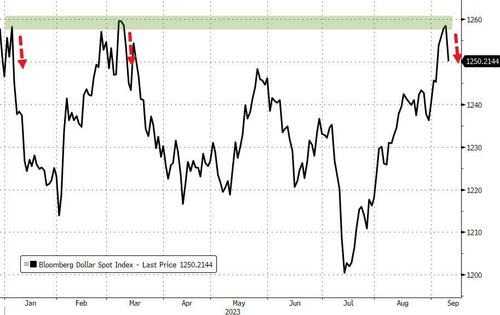

The dollar's drop hit at key resistance once again...

Source: Bloomberg

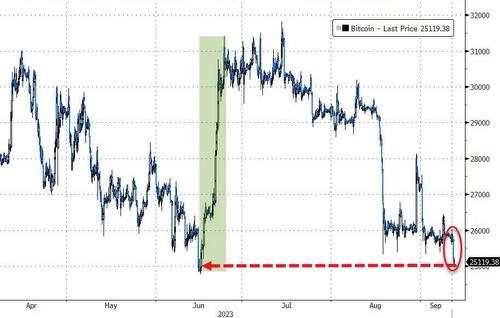

Bitcoin tumbled back below $25,000 - with some talk of FTX dumping assets - erasing all of the post-BlackRock ETF gains starting in mid-June...

Source: Bloomberg

A lot of chatter in crypto that Altcoins face significant downside as FTX potentially seeks to dump its $3.4BN digital asset holdings. And this is happening as BTC is close to a 'death cross' - 50DMA dropping below 200DMA...

Source: Bloomberg

Oil prices were modestly lower on the day, but looks like they are coiling up/consolidating after the big jump...

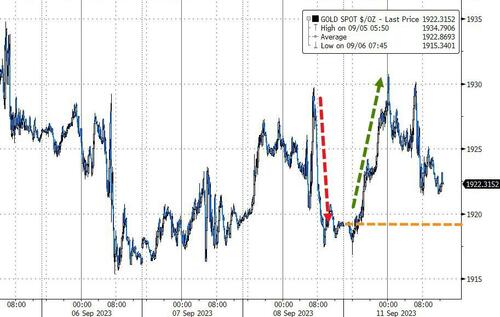

Gold (GLD) ended higher, holding some of the overnight gains (twice topping $1930 Spot)...

Source: Bloomberg

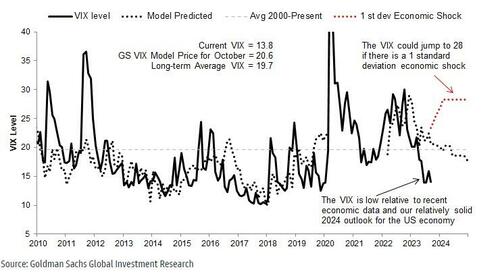

Finally, with Triple-Witching looming, we note that Goldman suggests VIX is significantly 'cheap' (low) relative to the macro-environment...

And remember, the seasonals favor you...

More By This Author:

China New Credit Rebounds Sharply On Surge In New Mortgage LoansKey Events This Extremely Busy Week: CPI, PPI, Retail Sales, ECB, China Data Dump, new Iphone, ARM IPO, UAW Strike And More

Yen Surges, JGBs Tumble After Ueda Hawkish Comments Spark Countdown To End Of Japan's NIRP

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more