Bent Pressured By OPEC+ Output And US Inventories

- Brent trades near $64 after a week of heavy losses

- Weekly decline amounts to almost 8%

- OPEC+ may lift output by 500,000 barrels per day

- US oil and fuel inventories showed another increase

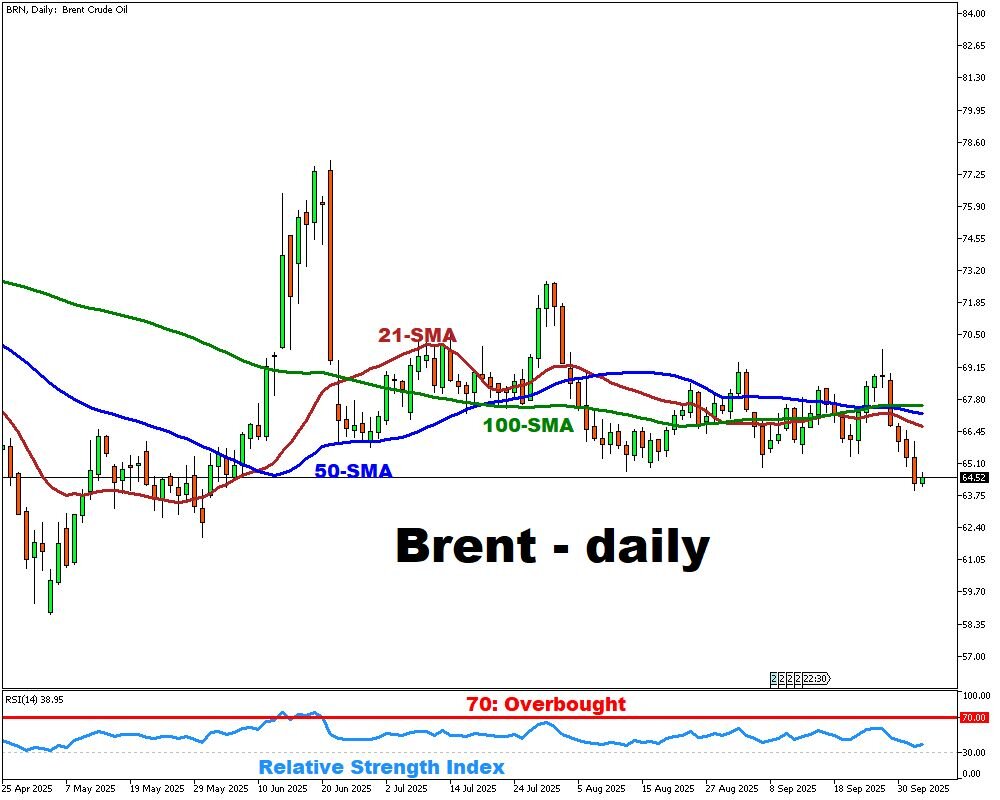

The Brent crude market remains under pressure despite a brief rebound at the end of the week.

BRN edged up to about $64.52 per barrel after four consecutive sessions of losses, yet still nearly 8% lower for the week – the steepest fall since late June.

The main bearish catalyst is speculation that OPEC+ may increase output by up to 500,000 barrels per day in November, a move that could add significant supply to an already softening market.

At the same time, demand indicators are weakening: U.S. crude and distillate inventories rose, refinery runs slowed due to seasonal maintenance, and consumption trends remain muted.

Additional supply-side factors are also weighing on sentiment. The restart of Kurdish oil exports from Iraq is expected to increase global flows, adding to oversupply worries. The International Energy Agency has cautioned that supply growth in 2025–2026 is likely to outpace demand, leading to stock builds and pressure on balances.

Analysts suggest that if OPEC+ confirms a large production hike, Brent could retreat further, potentially testing the $58–55 per barrel range, unless geopolitical disruptions or tighter sanctions enforcement provide stronger support.

More By This Author:

Gold Poised For $4,000 As Rally Extends Into 2026?Gold Steadies, Oil Slides On Fed, Geopolitics

Gold Steady, Brent On Track To 3rd Daily Gain

Disclaimer: This material should not be viewed as financial advice. The content provided, including views and opinions, is for information purposes only.