Bear Of The Day: Royal Gold (RGLD)

Landing a Zacks Rank #5 (Strong Sell) and the Bear of the Day, investors may want to be cautious of Royal Gold’s (RGLD) stock for the moment.

This is not to say that Royal Gold won’t be a viable investment among the basic materials sector in the future. However, the current business environment is weakening for the precious metals stream and royalty company.

To that point, the Zacks Mining-Gold Industry is currently in the bottom 26% of over 250 Zacks industries. Royal Gold could be susceptible to a potential slowdown in the space and the company's Penasquito mine remains closed following union strikes.

Valuation Concerns

Amid a softening business environment, the premium being paid for Royal Gold stock is more concerning. Royal Gold currently has an “F” Zacks Style Scores grade for Value.

Royal Gold's price-to-earnings valuation is less reassuring right now. Shares of RGLD trade at a 31.3X forward earnings multiple which is noticeably above the industry average of 20.8X and the S&P 500’s 21.2X.

(Click on image to enlarge)

Image Source: Zacks Investment Research

More concerning is the premium being paid for the company’s price to sales. Investors are paying $10.96 for every $1 of sales Royal Gold makes. This translates into a P/S ratio of 10.9X compared to the industry average of 3X with the optimum level being less than 2X. Royal Gold also trades alarmingly above the benchmark’s 3.9X sales.

(Click on image to enlarge)

Image Source: Zacks Investment Research

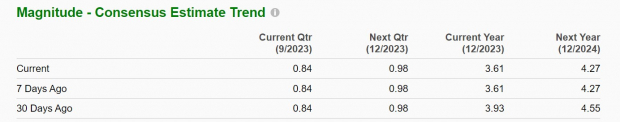

Declining Earnings Estimates

Declining earnings estimates are the reason for Royal Gold’s less attractive P/E valuation at the moment. This is also reason to believe Royal Gold’s stock may have some short-term weakness ahead.

Notably, fiscal 2023 earnings estimates have declined -8% over the last 30 days from $3.93 per share to $3.61 a share. Furthermore, FY24 earnings estimates are down -6% over the last month.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Royal Gold’s stock look’s less attractive considering the premium investors are paying relative to its peers.

This is compiled by the Mining-Gold industry dealing with a softening business environment at the moment which serves as a further warning that it could be time to sell Royal Gold stock.

More By This Author:

Bull of the Day: Royal Caribbean CruisesApple Tops Q3 Earnings And Revenue Estimates

4 Crypto Stocks To Watch As Fed Seems Open To More Rate Hikes

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more