Bank Silver Short Position Falls Just Shy Of All-Time Record

Image Source: Pixabay

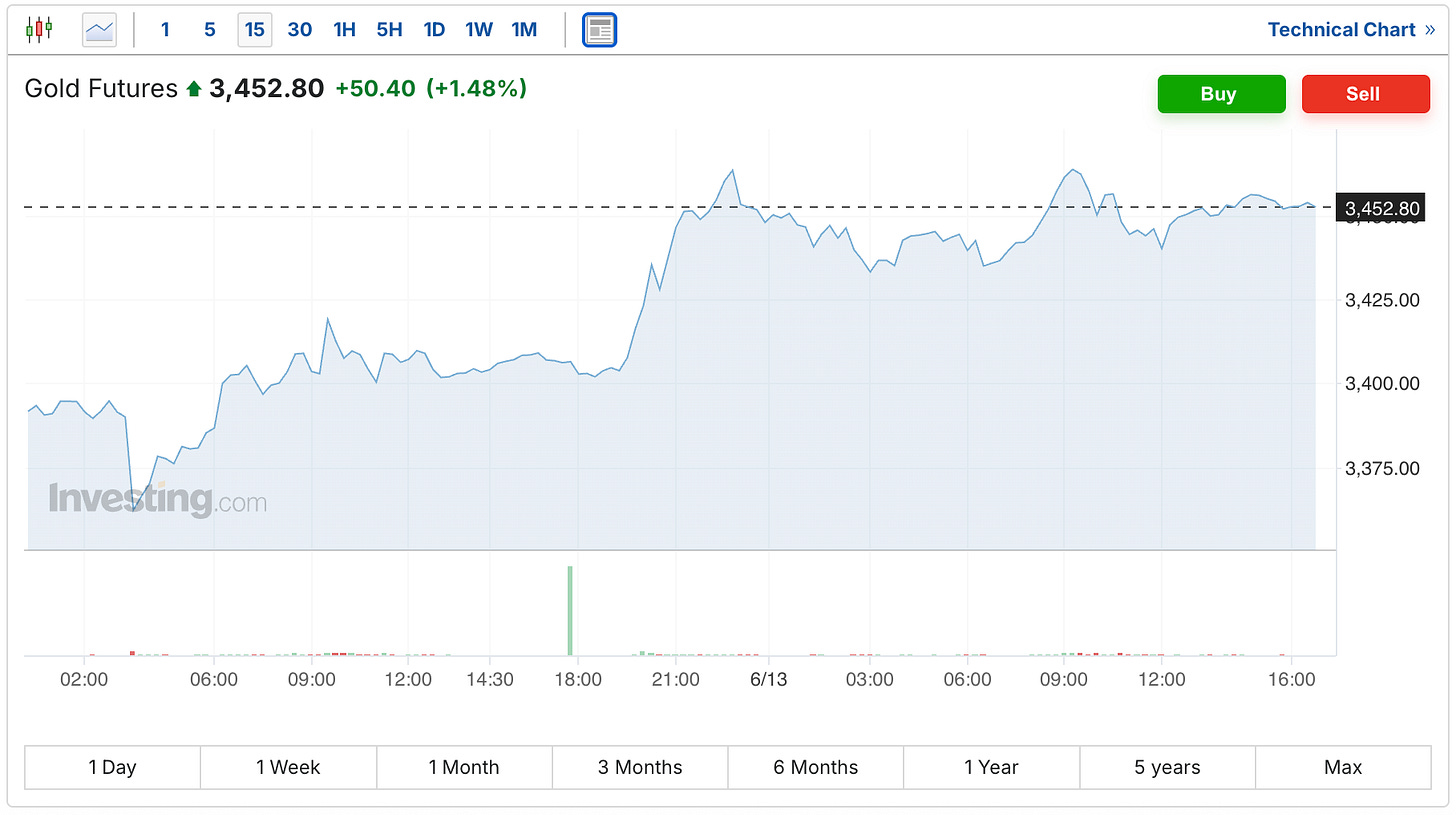

The gold futures rallied on Friday following the unfortunate Israeli air strikes on Iran Thursday night, finishing $50 higher to close the week at $3,452.

The silver futures had a quieter day, finishing 8 cents higher at $36.73.

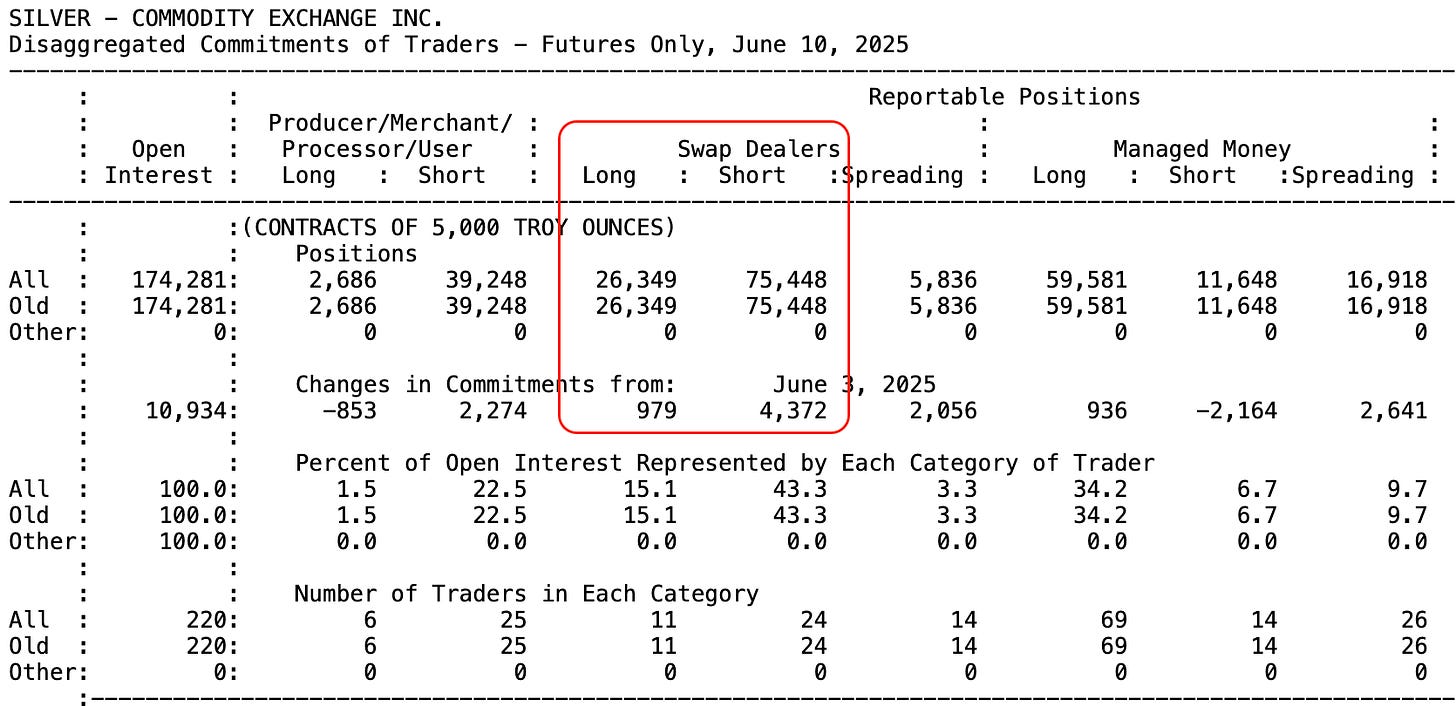

Although as I mentioned in the post that I sent out earlier this afternoon, the CFTC’s COT report gets released each Friday, and after last week's report featured a net-bank short position that was the second highest in history (and within shouting distance of the all-time record high of 49,609 contracts back in July of 2016), it appeared that we could break the record this week. Especially since the open interest increased, and the price was higher during the reporting week.

But alas, while the banks’ silver short position did indeed increase, it fell just a fraction shy of the record at 49,099 contracts.

So it came really close to the record, but fell just short. Although perhaps more importantly, the fact that the short position is that large, whether it's the all-time record or not, still leaves the silver market at a bit of a crossroads.

Despite the fact that there is some hedging that occurs (with the actual amount being an open debate), there is still some short exposure out there. And if you sit down someday and look at the history of what happens when the bank's position gets really large or small, you'll see that there’s often a strong correlation with the price.

My gut tells me that we have a correction in our near future, especially given how rapidly the price climbed last week. Although again, when the short position does get that large, there is always the risk that someone panics to cover, and the price could jump higher quickly.

In option-trading parlance, this is the type of situation where I would want to own the straddle - the combination of being long both a put and call.

And how that works is that if you own the $36-strike call and put, you win if the price is far enough away from that $36 level to compensate you for the premium you paid for that option package, regardless of whether the move is up or down.

You're making a bet on how volatile the price is likely to be, and the options have allowed you to strip out your directionality. So in a situation like we find the silver market right now, where at least my own feeling is that there's an increased chance of a larger than your average day move in one direction or the other (although I'm not particularly swayed in one direction versus the other), that would be one way of expressing that type of opinion.

Which by all means is not a recommendation to go out and start speculating with option leverage. Although hopefully it does put into context the primary takeaway from the fact that the short position has grown this large.

Hopefully there will be some positive news that the military escalation doesn't escalate further in the next couple of days, whether that's in Iran, Israel, Gaza, Russia, or Ukraine. I know I have a hard time sometimes handling some of the things we see take place in the world, especially with our propensity to blow each other up.

But hopefully you can take this weekend to enjoy if you're fortunate enough to be safe, healthy, and happy, and I’ll look forward to checking back in with you next week.

More By This Author:

Gold Crosses Back Over $3,400, While Trump Calls Powell A 'Numbskull' For Not Cutting RatesGold Rallies, Silver Sells Off, & Banks Keep Increasing Their Price Targets

Bank Silver Short Position Grows To 2nd Largest In History