April Inflation & Retail Sales Data Ahead, But Why Earnings Will Matter More

Image Source: Pexels

Market Recap

It’s amazing what can happen when tariffs with our third-largest trading partner go from 245% to a potential 30%, in 90 days, of course. For proof, all you need to do is observe yesterday’s broad equity index returns. The Dow gained 2.81%, the S&P 500 added 3.26%, and the Nasdaq Composite rose 4.35%. Even small caps rode the wave, closing up 3.42% by the close. As it turns out, there will be dolls enough for everyone, and they may even cost less than “a couple of bucks more.”

As you can tell from the broad index results, Mag 7 and technology exposures were additive. Indeed, Mag 7 names, including Broadcom (AVGO) and JP Morgan Chase (JPM), made up the top 10 contributors to return for holdings of the SPDR S&P 500 ETF Index Trust. That these names only contributed to just over 50% of the fund’s 3.30% result speaks to the broad nature of the rally, as does the 410/93 advance decline line for fund holdings. Except for Utilities, which fell 0.60%, sectors were higher across the board, led by Consumer Discretionary (4.97%) and Technology (4.64%). Amazon (AMZN) and Tesla (TSLA) contributed to just over 50% of Consumer Discretionary returns while Technology’s 3 Mag 7 names - Apple (AAPL), Nvidia (NVDA), and Microsoft (MSFT)) only took credit for 40% of that sector’s result, again speaking to the broadness of the rally in Technology.

Gold traded lower but only to $3,237.90/oz, or down 2.63%, so there seems to be at least some investors who are looking beyond the current 90-day tariff moratorium to what effect a 30% tariff on Chinese goods may have. To be clear, gold demand has the potential to reflect global geopolitical risks so while today’s tariff pullback is being counted as a win by US equity markets, there’s still plenty of potential risks worth hedging for some.

The Tematica Select Model Suite shared in today’s positivity, with a number of strategies outperforming both the S&P 500 and their respective broad sector indexes as well. Leading the pack was the CHIPs Act, followed by Homebuilding & Materials, Cloud Computing, and Luxury Buying Boom. Aside from Market Hedge, the only strategies to lose ground yesterday were Cash Strapped Consumer, as various discount broadline retailers traded off, and EPS Diplomats, which was negatively impacted by gold moving lower as well as the corresponding sympathy trade in silver miners.

April Inflation & Retail Sales Data Ahead, But Why Earnings Will Matter More

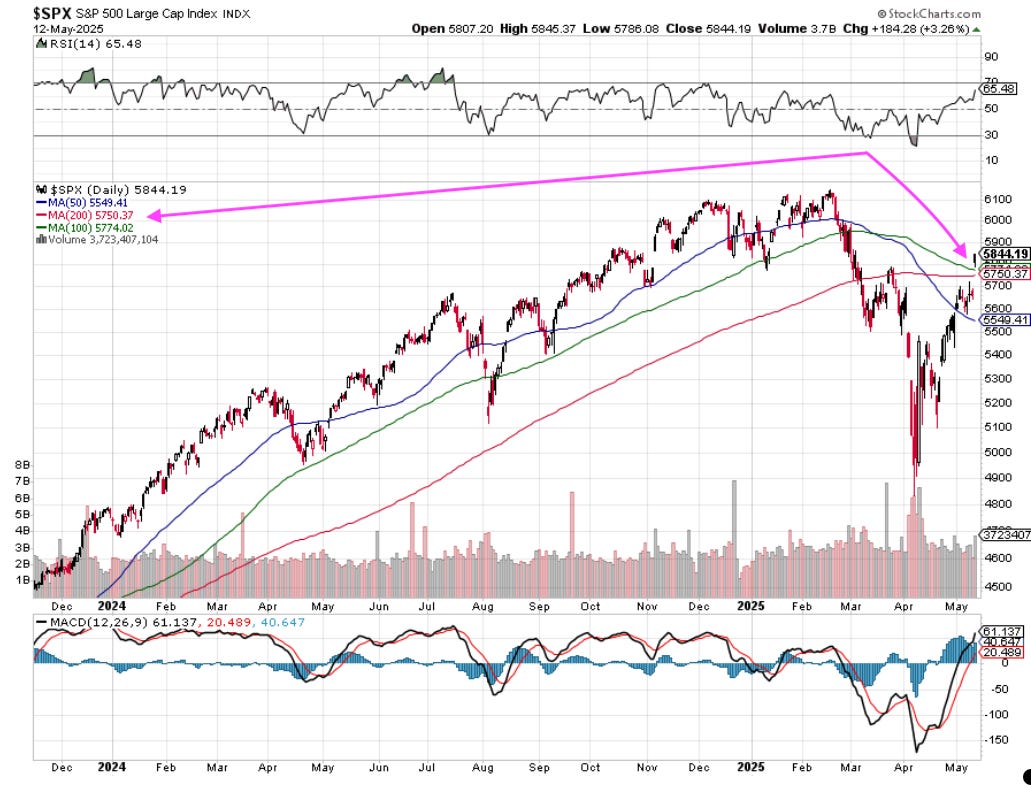

Following yesterday’s strong move in the market, it’s not surprising to see it give some of those gains back. From a technical perspective, folks will be looking to see how the S&P 500 holds against its 100 and 200-day moving averages. Will that broad market index successfully test those levels, making them a layer of support, or will they remain resistance levels?

The answer should become clear in the next few days, ones that include multiple April inflation figures, fresh comments from Fed Chair Powell on Wednesday, the April Retail Sales report, and quarterly results from Walmart (WMT).

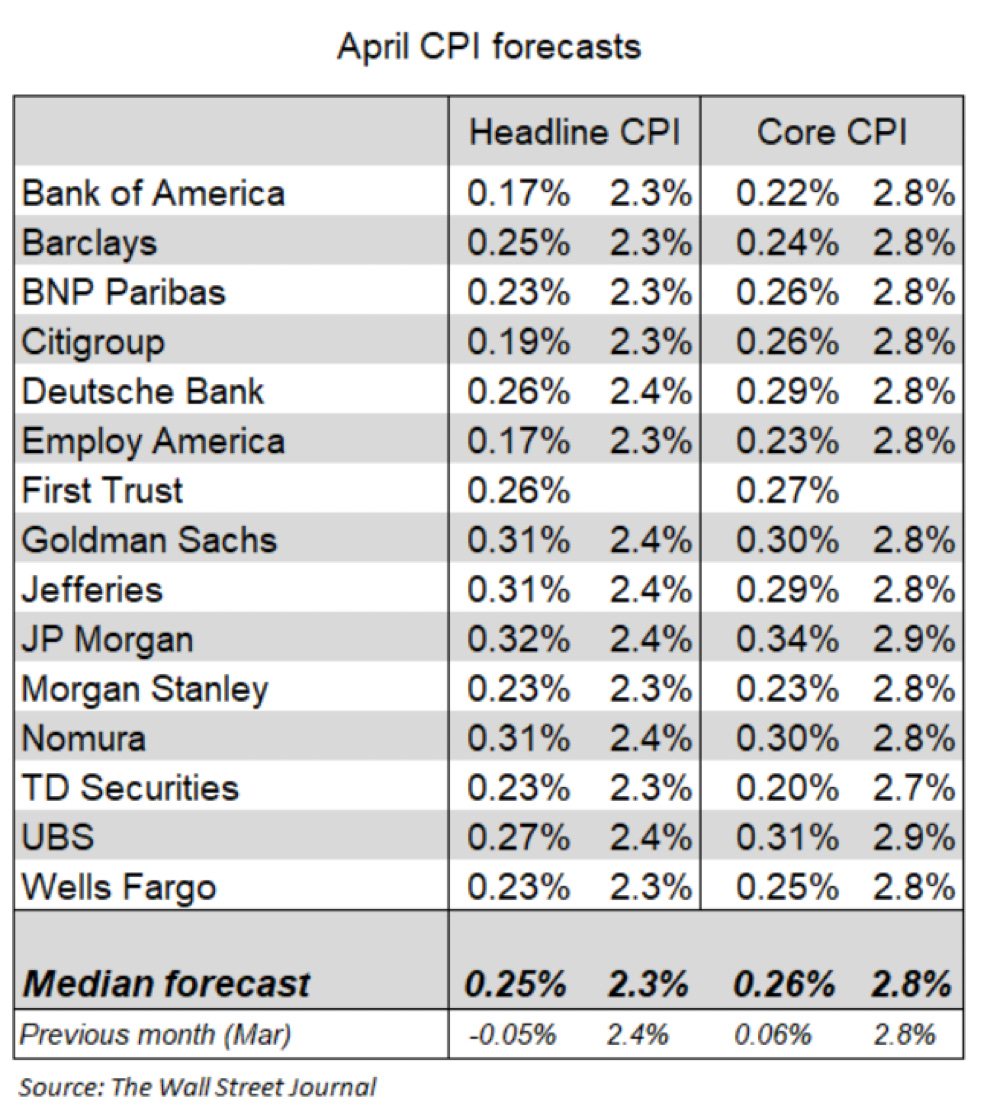

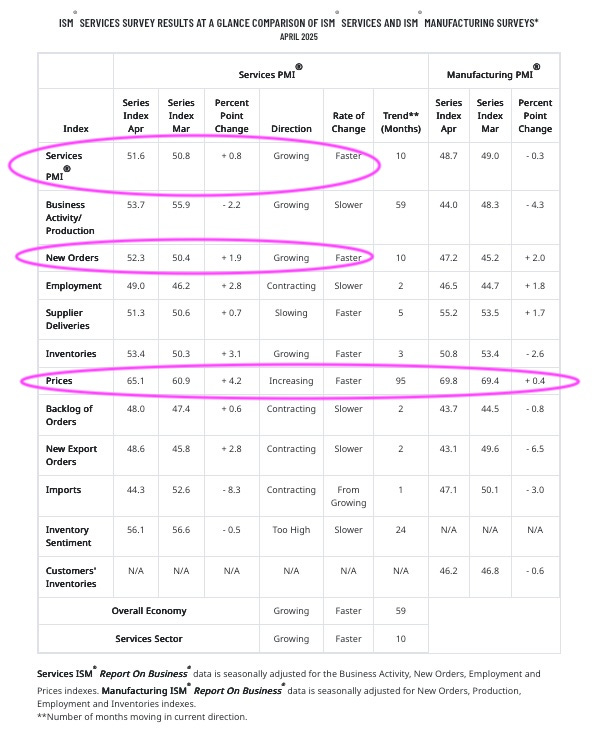

Our view is that US-China trade developments will likely give a pass of sorts to the April data, even though it will likely show core inflation perking up sequentially as the impact of tariffs is felt, echoing what was seen in the April PMI data from

We’re not expecting as much of a sequential increase for headline inflation, largely due to the April fall in oil prices, which leaked through to gas prices

When it comes to April Retail Sales, investors will be comparing the data against the March report more so than usual to determine if spending was pulled forward ahead of expected April tariffs. One factor that may complicate that analysis is the timing of this year’s Easter holiday (April 20) compared to last year (March 31). Aside from the April data, we’ll utilize the three-month trailing data found in the April Retail Sales report as a yardstick by which to measure the latest quarterly results from retailers, seeing which ones are gaining or losing share.

Setting the stage for that will be Walmart’s April quarter results, but candidly, we’ll be more interested in its forward-facing comments as it discusses port cargo traffic and the rollback in US-China tariffs. Those insights will reset expectations for the likes of Best Buy (BBY), Macy’s (M), Target (TGT), TJX Companies (TJX), and a host of others

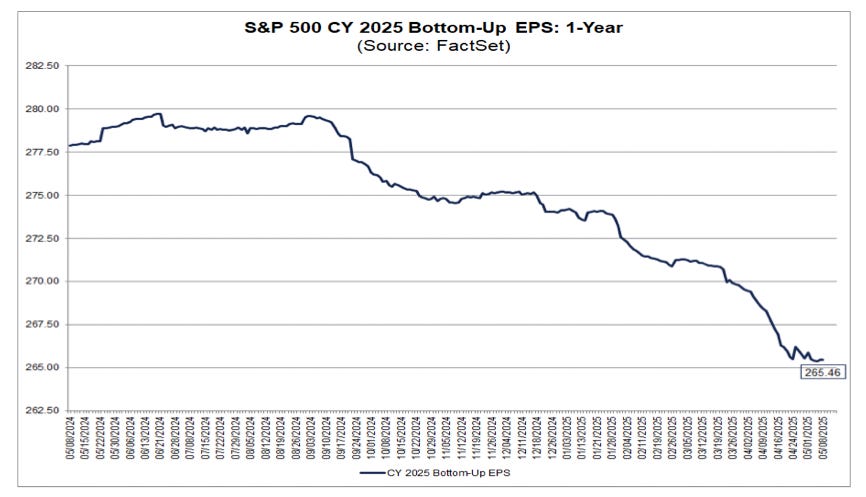

As those quarterly results are digested and guidance updated, it will lead to another round of EPS revisions for the S&P 500. As folks contemplate what that means for EPS growth, it will likely trigger questions about the appropriate market multiple. On that, we’ll share that over the last 10 years, excluding 2020 because of the pandemic, the S&P 500’s average peak P/E is 20.8x. If we go back to 2000, that multiple is 19.4x.

Doing the math, one can see why Trump may be more anxious about his ability to close trade deals and push through tax cuts than he admits.

More By This Author:

Tariffs Continue To Take Their Toll As We Wait For The FedTariffs And Uncertainty Take Their Toll On Corporate Guidance

China & The European Union Push Back On Trade Talk Progress

Disclosure: None.