Apocalypse Day Coming? Gold’s Fate Rests In The Fed’s Hands

The Fed’s dovish period is likely to be over today. Does this mean a total catastrophe for gold and other precious metals? We’ll find out soon.

Today is the day when the Fed decides and speaks. It’s also the day when the markets are likely to react. Since some market participants will presumably be surprised by whatever is said and done, reactions might be volatile.

However, the markets appear to be already indicating where they want to move. In particular, the USD Index. Let’s start by quoting what I wrote about USD’s 4-hour chart yesterday:

In short, the USD Index has been consolidating in one of the most classic ways possible. Namely, it formed a triangle. Triangles are generally “continuation patterns,” which suggests that the USDX is likely to break to the upside and rally.

Taking a closer look at the triangle, we see that earlier today, the USD Index tried to move above it, but so far it was not successful. The move higher was really small, so I don’t view it as a major invalidation.

Still, I wouldn’t be surprised to see the USD Index continue its back-and-forth trading within the triangle until we get some news from the Fed. In other words, we’re likely to see some major price action tomorrow.

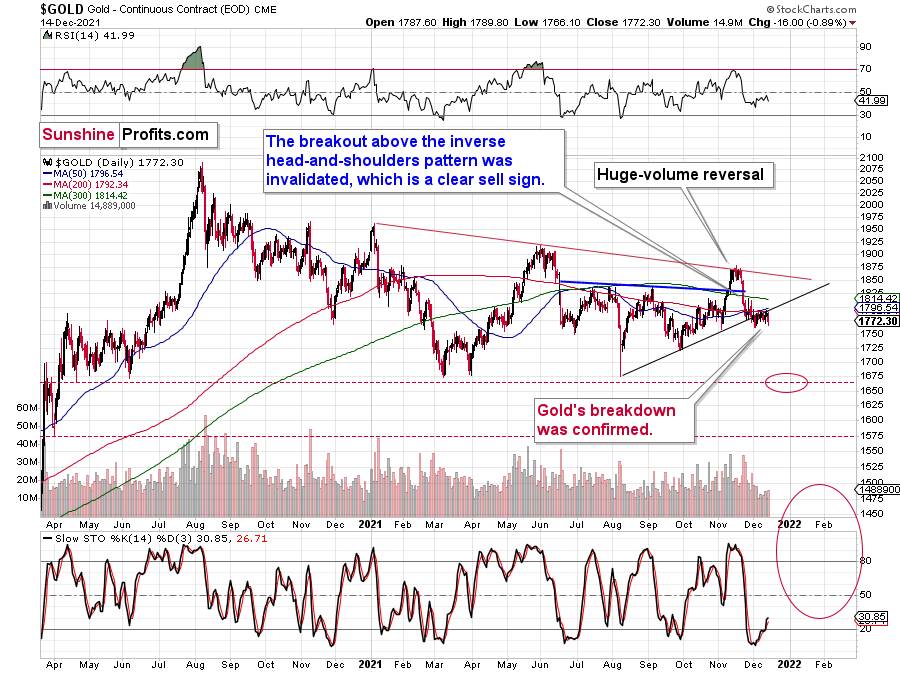

The above, plus the fact that gold has been consolidating below its rising support line, suggests that the next move in the USDX is going to be to the upside, while gold is going to decline.

Still, let’s keep in mind that it’s also possible that we see a fake move lower (USDX) and higher in gold right before or right after the FOMC. That kind of volatility around important news announcements is relatively normal. Whatever happens initially, please don’t take it at its face value. It might or might not be the market’s true reaction, especially if silver rallies much more than gold.

The trends support higher USDX values in the near and medium-term, and lower gold prices in the near and medium-term.

After I wrote the above, the USD Index moved lower, but then, at its next attempt, it managed to rally above the upper border of the triangle, and it’s now verifying the breakout. In short, this is bullish, and the short-term outlook for the USD Index improved based on that.

Again, we might see huge volatility in either direction today, but based on what we saw, the short-term outlook for the USDX is more bullish. It’s also more bearish for the precious metals sector.

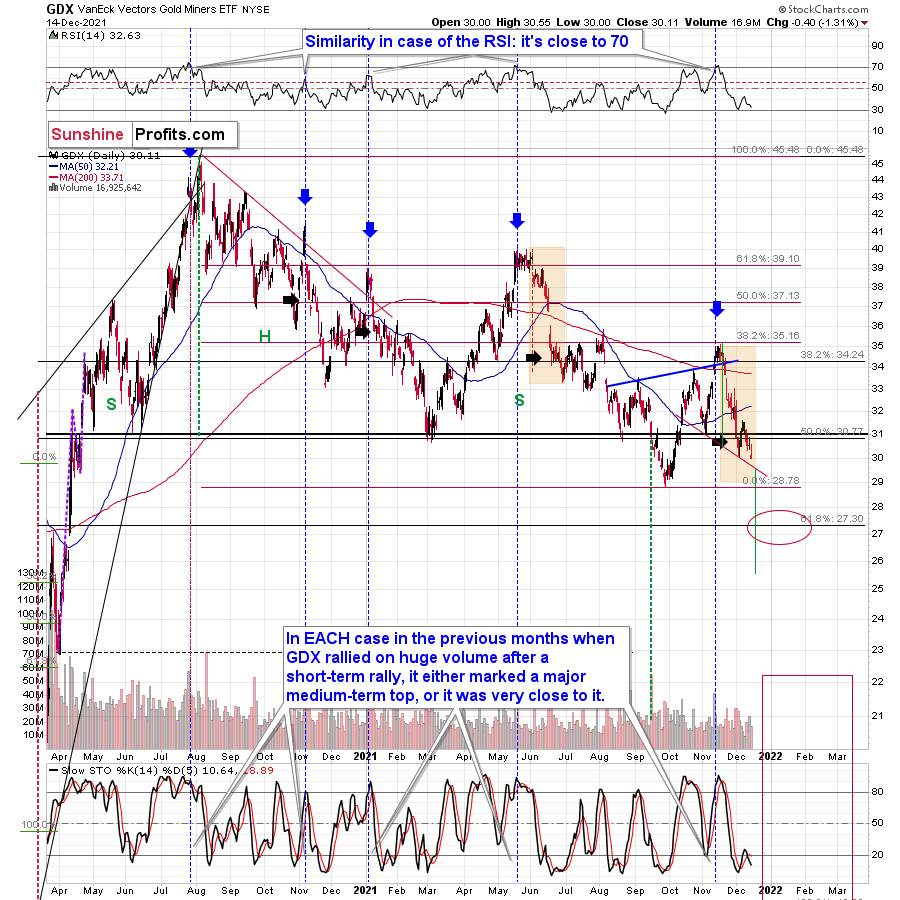

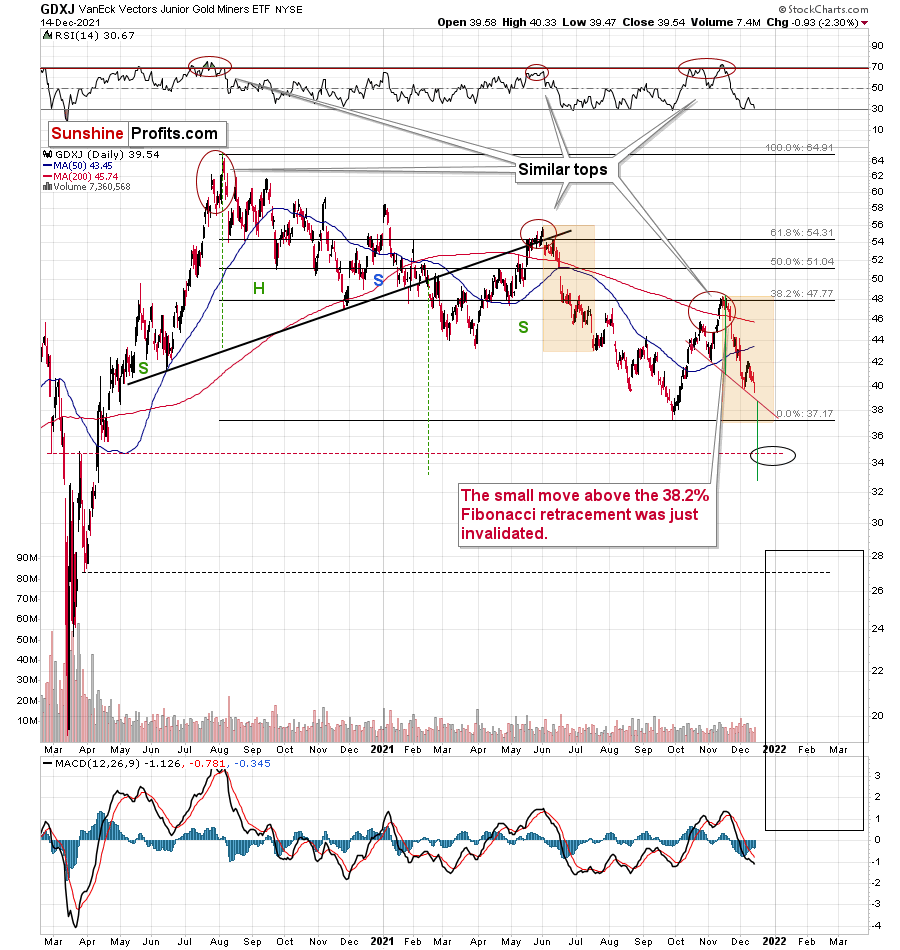

In other news, based on yesterday’s price moves, the GDX ETF and the GDXJ ETF both closed at new monthly lows.

After they decline some more, they will break below their head and shoulders patterns (I marked the neck levels with red, solid lines). Those patterns will open doors to declines even below my previous interim bottoming targets. The implications, of course, are bearish.

Gold didn’t decline below its previous December lows, but it’s now crystal-clear that the breakdown below its rising support line has been more than confirmed. Consequently, the next move is likely to be to the downside, even though we might (!) see a very quick rally after the news hits the markets later today.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more