Another Recession Signal: Plunge In Demand For Gold In The Electronics Sector

Image Source: Unsplash

With much stronger-than-expected second-quarter GDP growth and continued labor market strength, a growing number of people in the mainstream now think the US has escaped the clutches of a recession despite the Fed driving interest rates to the highest level in 16 years. But there are plenty of signs that a recession is looming. For instance, a big plunge in the sale of cardboard boxes indicates a slowdown in economic activity.

There’s another off-the-beaten-path indicator that flashes recession — a big drop in the demand for gold in the technology sector.

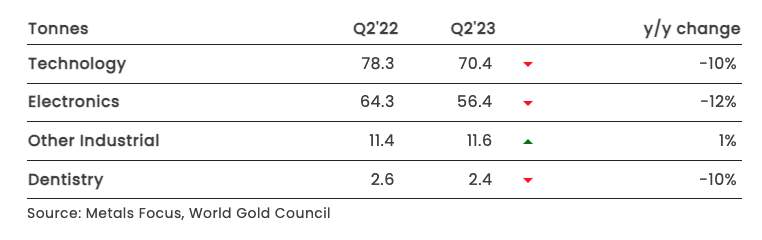

The demand for gold in tech fell by 10% year-on-year in the second quarter to 70 tons.

The big second quarter drop continued a trend we’ve seen since the beginning of the year. Tech demand for gold through the first half of 2023 came in at 140 tons, the weakest H1 since the World Gold Council has tracked the data. This includes the first half of 2020 as governments shut down their economies due to COVID-19.

According to the World Gold Council, the big drop in demand for gold in tech was driven by weak consumer spending on electronics.

The weakness in gold demand in industrial applications carried into Q2 as surging inflation rates continued to severely impact the entire electronics supply chain, from chip manufacturers to end-users.”

Electronics production used 56 tons of gold in Q2, a 12% decline.

According to the World Gold Council, this is “a direct consequence of weak end-user demand for consumer electronics – the major demand area for gold in electronics applications.”

This has led to negative shipment forecasts for most major device categories in 2023, including smartphones, PCs and laptops. And the weakness is reflected in chip manufacturer financial reports.”

For example, Samsung recently reported a 96% fall in second-quarter operating profit.

Breaking down various categories within the electronics sector we find the amount of old used to produce light emitting diodes (LEDs), circuit boards, and memory chips all dropped in Q2 in response to constrained consumer buying.

The drop in demand for gold in the tech sector reveals a global slowdown in consumer spending. Price inflation and rising interest rates have squeezed consumers around the world. The drop in demand for electronics reflects real consumer behavior. It’s a much better indication of the condition of the global economy than government-produced numbers.

Despite the drop in demand for gold in technology, overall demand for physical gold was strong in the second quarter, driven by investment and central bank gold buying.

Industrial demand pales in comparison to the demand for gold in jewelry-making and investment purposes. Nevertheless, gold is one of the most useful metals on the planet and would probably have even more practical applications if it wasn’t so rare and expensive. The truth is gold did not become money because it wasn’t useful for anything else. Its role as money evolved because it is so valuable and has so many uses.

For instance, gold was an integral component in the mirrors on the James Webb Space Telescope (JWST).

Gold has also enjoyed a growing role in healthcare. Yellow metal is used in a large number of diagnostic tools and is of increasing interest to companies developing innovative new ways to treat disease.

Some uses for gold in medicine sound like something right out of a science fiction film. A team of Chinese researchers announced they were able to partially restore the sight of blind mice by replacing their deteriorated photoreceptors – sensory structures inside the eye that respond to light – with nano-wires made of gold and titanium.

Ultimately, gold is money, but it serves many other useful purposes and that’s part of what gives it enduring value.

More By This Author:

Debt Chickens Are Coming Home To RoostAustralia Ratcheting Up War On Cash

Another Recession Warning: Credit Card Spending Suddenly Plunges