Another Day, Another Win For The Dollar

At the moment of writing these words, gold continues to move around the $1,800 level, so nothing really changed in the last several hours. Not much changed during yesterday’s session either. While gold, silver, and mining stocks made new highs in terms of the closing prices, they didn’t move to new intraday highs, and today’s small intraday upswing also ended at lower highs. This divergence suggests that something could be about to change.

Let’s check what happened in the key markets yesterday.

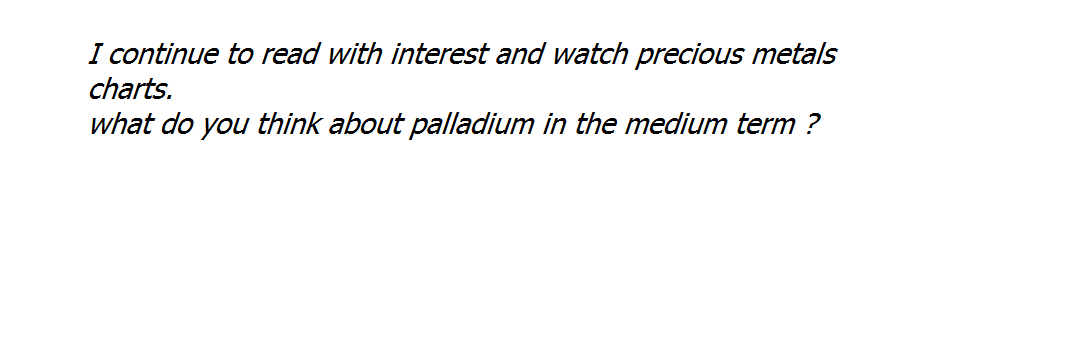

Yesterday’s session can be summarized in two words: “another attempt”. Friday’s intraday rally was invalidated before the closing bell, and this week bulls made another attempt to take the previous highs. Both: GDX and GLD closed above their previous highs, and the GLD even closed above its declining resistance line. In other words, we saw a breakout.

The key thing about this breakout, however, is that it’s not confirmed, and it seems that it won’t be confirmed. And that’s not just because of lower intraday lows; that’s not “just” because of the epic analogy between now and 2013 (and 2008) either. It’s the case because of what’s happening in the USD Index and of how the markets are likely to perform in the period between the tapering announcement and when it actually starts.

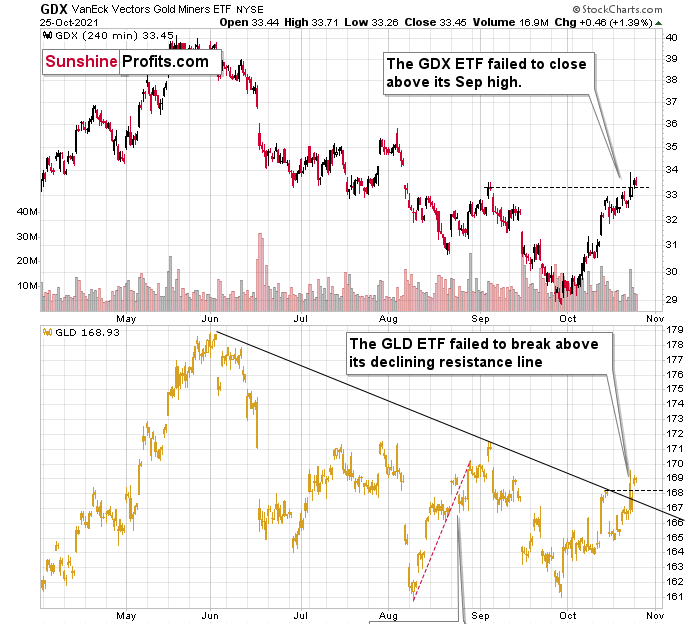

Let’s take a look at the USD Index first.

The key thing about the USD Index is that it didn’t invalidate its breakout to new 2021 highs. Instead, it verified it. The August high held as support and yesterday’s move higher confirms that.

The situation now appears to be the same as it was at the beginning of August, where the bottom also took several days to form, but when the USD Index finally moved higher once again, gold plunged. To be precise, back then, the bottom formed over 5 trading days, and yesterday was the fifth trading day of the current bottom. On the sixth day – back then – the USDX did very little and gold declined modestly, and it was the seventh day when the action really started. And… the short-term decline was over on the very next day. It was not easy to catch this decline if one wanted to wait for a big confirmation that it is indeed taking place. It seems that the same – patient – approach is justified in the current situation.

The RSI indicator (upper part of the chart) continues to confirm this similarity.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more

thank you