Aluminium Is Entering A New Era

The path to a net-zero economy has dual implications for aluminium on both the supply and demand side. That may see the aluminium market shift into deficit in the medium term. In the short run, rising disruption from China has already suppressed production growth this year.

A worker at an aluminium factory in Hebei Province, China

The dual-implication from ‘green’ recovery and net-zero economy

The path to a net-zero economy has dual implications for aluminium. First, the supply growth of primary aluminium is contained, especially from China. As the world's largest primary aluminium producer, China's total capacity is likely to hit its 'cap' during the country's 14th Five Year Plan (FYP) and primary production could plateau in the longer term.

Secondly, world aluminium demand growth is set to shift up a gear driven by energy transition-related sectors such as transportation and renewable energy from China, the US and Europe. This is also driven by major economies' pursuit for 'net-zero' and the speeding up of steps towards electrification and renewable energy. That's a trend that has already seen a fascinating growth in electric vehicles sales in European countries and China.

Aluminium's price will need to stay higher for longer so to incentivise more supply

This trend could see the global aluminium market continue tightening into a deficit towards 2025. Elsewhere, the price will need to stay higher for longer so to incentivise more supply. The increasing awareness about climate change among consumers along with growing pressure on producers to adopt low carbon materials should boost demand for low carbon aluminium, leading to a massive structural deficit of aluminium with a low carbon footprint in the future.

Primary supply growth to plateau

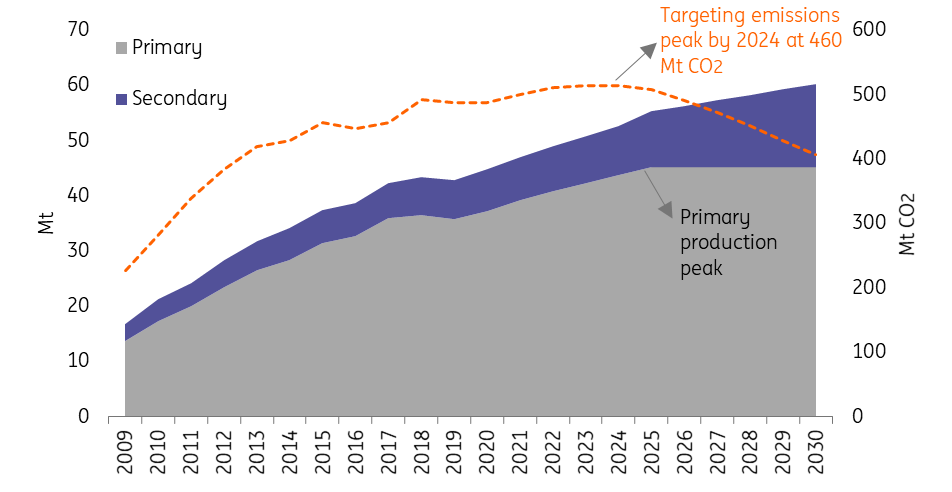

The last decade has seen rapid capacity growth, especially from China. However, as the country is now pushing towards peak carbon and carbon neutrality, this puts pressure on the growth of primary aluminium production growth. The state authorities have been in talks to work out a plan to align with national goals. The Nonferrous Metals Industry Association (CNIA) has set a provisional goal to bring emissions to a peak by 2025 and cut them by 40% by 2040.

In 2020, total carbon dioxide emissions from primary aluminium smelting were 420mln tonnes, and the target is to see this peak by 2025. This suggests that China should insist on a cap of total primary aluminium smelting capacity under 45 mln tonnes. These targets are based on certain assumptions that include:

- The efforts from industry to bring emissions down by technology innovations and more investment

- An increase in the usage of renewable energy, which is tied to ongoing capacity migration to Yunnan province

These targets would presumably imply a steady increase of secondary aluminium productions as it contributes to aluminium supply at a much lower energy and emissions intensity that are both below 5% compared to primary aluminium. Yet it’s a big uncertainty as the secondary supply of all metals is notoriously inelastic and subject to many changing conditions. The base case assumption is that secondary production will need to grow by CAGA 5.8% in the next five years, faster than the primary.

China primary aluminium supply trajectory

Source: IAI, BNEF, ING

Rising disruption weighs on production growth

Besides the long-term goal, there are risks of disruption to existing operations that have already weighed on supply growth. As a result, China’s primary aluminium production growth could be slower to 5% year-on-year than the 7% pencilled in at the beginning of this year.

First, similar to the emissions target, Inner Mongolia’s exercise on the so-called ‘dual control’ (energy intensity per GDP & total amount of energy consumption) has led to around a 400kt production loss on an annualised basis, and about 800ktp/a project being unable to ramp up as planned. Risks may well exist with major aluminium production provinces to follow the same practice.

Secondly, smelters have been migrating to Yunnan province in recent years to benefit from the cleaner and cheaper hydropower from the region. However, more recently, they have been asked to slash peak power consumption by 10% as the power supply was caught by a shortage of coal supply and low rainfall during the dry season compared to historical levels.

This increases the risks of a delay to those 'ramp-up' projects planned for this year. The risks stemming from rainfall level could remain a threat as we advance, especially when considering rising power demand along with new capacity growth. Questions remain as to whether power supply stability is able to accommodate the growing capacity.

Demand set to remain strong leading to widening supply gap

On the other hand, China is likely to maintain strong consumption growth by 2025. Aluminium consumption in a traditional sector such as transportation should see accelerated growth due to the increasing adoption of aluminium ABS in cars and Chinese electric vehicles shifting up a gear.

China's push towards renewable energy such as solar panels should see strong demand growth for aluminium alloy-made frames. For this year, exports of goods containing aluminium are one of the strong pillars supporting demand.

In a nutshell, the Chinese market is likely to remain in deficit and it may widen towards 2025. As a result, China may continue importing primary aluminium and alloys going forward. In the meantime, exports of semi-fabricated products may have peaked in 2019, and we shall see a steadily decline. This suggests that China is likely to compete with the rest of the world in absorbing the surplus in the market.

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more