AgMaster Report - Wednesday, Sep. 18

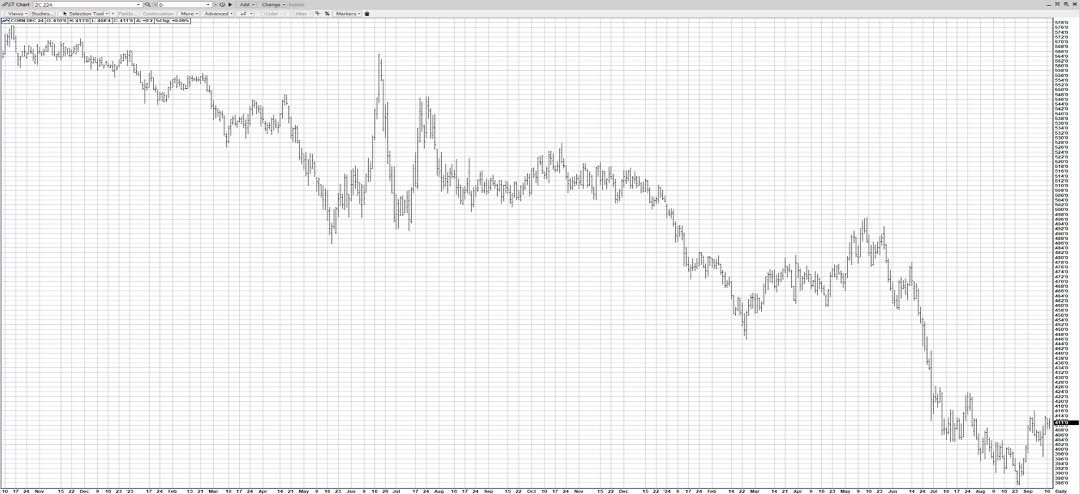

DEC CORN

(Click on image to enlarge)

Two USGA Reports (Aug & Sept) & a Pro Farmer Tour have established the final crop yield in the 181-183 BPA range! We see it closer to 181 in the Oct Report due to the rash of hot/dry weather in the past 2 weeks! It appears that the current $4.00 level at a 4 yr low was cheap enough to attract substantial exports from the US – globally the lowest corn around! The mkt is anticipating a .25% rate cut tomorrow from the Fed – which energized a record high DJI close Mon & a plummeting US Dollar! The mkt will most likely chop higher thru harvest – underpinned by the ongoing drought in N Brazil!

NOV BEANS

(Click on image to enlarge)

Nov Beans are easily the weakest link at the CBOT with big supplies & suspect demand! But that doesn’t mean it can’t rally from its current 4-year low! Especially with a little help from its friends – corn & wheat! Non-US grain producers are having an off-year & N Brazil is very hot & dry! Should that continue into October, then it becomes a major issue! and La Nina is forecast into 2025 – which could compromise world crops everywhere! And the US economy appears very strong & US Dollar very weak – both offering Macro support! Beans are 6% harvested (3% avg) with a good-excellent rating of 65% – down 1%!

DEC WHT

(Click on image to enlarge)

Geopolitical factors rallied Dec Wht sharply last week enroute to a 60 cent upmove since late July! There were reports of Russian attacks on Ukraine grain-carrying ships! The mkt was quite overbought off this news & is correcting this week – with the help of a toning down of the rhetoric out of the Black Sea & replenishing rains headed for the central US Plains Dec Wht has bottomed & should follow Corn & Beans higher after the mid-point of harvest – particularly if drought issues around the globe persist!

DEC CAT

(Click on image to enlarge)

Despite negative fundamentals of higher weights & slaughter & steady/lower cash, Dec cat has pushed higher over a month-long trading range – with a $1.50 up today! With Labor Day in the rear view mirror, the best demand period is winding down but possibly the mkt senses additional demand from a record high DJI -energized by coming rate cuts from the Fed by year end!

DEC HOGS

(Click on image to enlarge)

Today, Dec Hogs challenged the summer highs of $74 – with renewed demand in the supermarket – even though the “grilling season demand” has come & gone! We feel th current DJI is extremely strong – yesterday setting new historic highs – as it anticipates interest rate cuts from the Fed on Wed – the 1st in 4 years! And add to that the built-in natural competitive advantage of Pork over Beef in your local grocery store, and a “bull story” can be built for Dec Hogs – despite predictions of larger production in the 4th quarter!

More By This Author:

AgMaster Report - Wednesday, Aug. 21AgMaster Report - Tuesday, July 23

AgMaster Report - Tuesday, July 16