AgMaster Report - Tuesday, June 4

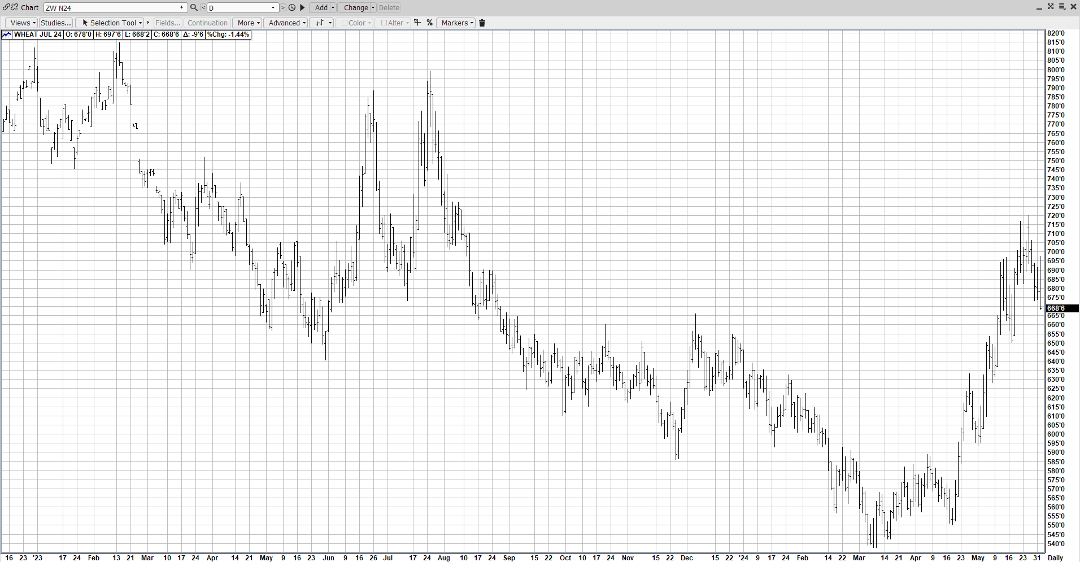

JULY WHT

(Click on image to enlarge)

After a $1.70 rally in just 6 weeks off “hot & dry” in Southern Russia, the mkt is still grappling with the fall-out! The latest crop estimate is under 80 mmt! And the mkt has corrected $.50 off the top due to an overbought condition! July Wht is fighting headwinds from corn & beans as early benign growing conditions have pressured those two mkts! Improved exports & continued dry in the Black Sea could well result in a resumption of the uptrend with prices going back over $7.00!

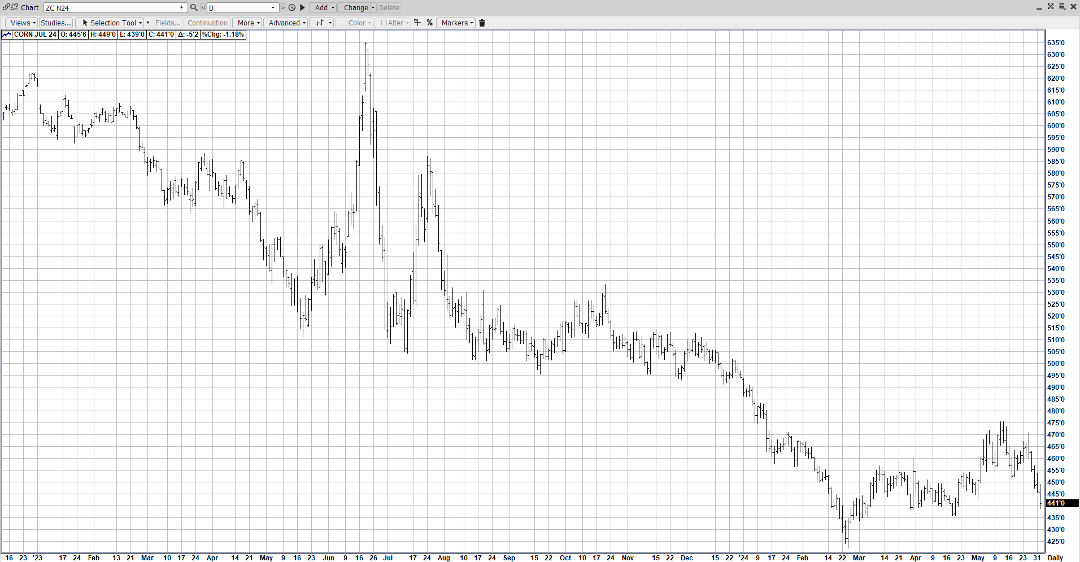

JULY CORN

(Click on image to enlarge)

Today at 3 pm will be corn’s 1st condition report – expected to be 70-72%good-excellent! As well, planting progress is expected to be 87-89% – right on the 5-yr average! Export inspections this morning were excellent at 1.374mmt (lw-1.130) & also Spain bought 110,000mt of US Corn – first announced this morning at 8 am! The US growing conditions are quite favorable early-on but it’s a long growing season & La Nina is forecast! And serious weather issues exist in the Black Sea, Mexico & China which could raise corn exports further in 2024! They’re already running 30-35% over last year!

JULY BEANS

(Click on image to enlarge)

A general lack of “threatening weather” has pushed the mkt lower this morning with current losses at 20 cents! The 3 pm Crop Progress Report is expected to reflect 75-77% planted – right on the 5-yr average! The path of least resistance is certainly lower now with the crop almost fully in – amidst favorable climes & moisture! However, the mkt is plenty cheap – currently 2.40 under last summer’s high with a protracted growing season ahead! And myriad weather issues exist with our global trading partners! Exports could easily increase!

AUG CAT

(Click on image to enlarge)

Aug Cat was the obvious beneficiary of solid Memorial Day W/E beef demand as it completed a $15 (167-182) just before the holiday W/E & has corrected ever since! However, demand fell off after that W/E, exports for this time of the year have been the lowest since 2020 & bird flu rumors continue to resurface – being a general drag on demand! Still, grilling season continues with Fathers Day & the 4th of July dead ahead so demand could push the mkt back up to its MD highs!

JULY HOGS

(Click on image to enlarge)

Recent downtrend momentum from the month-long $14 plummet (110-96) seems to be waning and the recent sideways action could be an indication prices are ready to bounce! Exports were up over last year & the highest since April 4! The ever-widening gap between pork & beef prices of course favors pork & could well energize a demand upsurge for pork in the supermarkets! Plus, the pork cut-out came out higher than the previous week!

More By This Author:

AgMaster Report - Wednesday, May 22AgMaster Report - Wednesday, May 15

AgMaster Report - Tuesday, May 7