AgMaster Report - Friday, Oct. 3

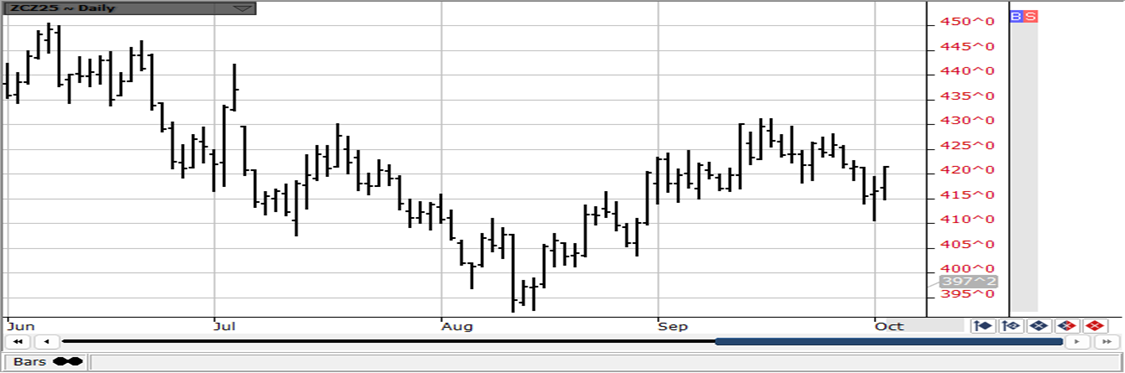

DEC CORN

(Click on image to enlarge)

The mkt clearly from the above chart bottomed after the August WASDE Report which issued a high-ball estimate of 188.8bpa! Since then the popular estimates are running 184-185 – as yields have lessened due to late dryness & disease! As well, the “record crop” news has been around for several months & is getting dialed in! The Sept 30 Qtly Stocks report was negative but was quickly offset by Trumps message on social media that he & China will be meeting on 10-31-25 to discuss Ag Trade! The gov’t shutdown has muddied the water – with no exports or USDA Reports but we know exports remain robust – in some cases exceeding 2024 by 50%! The cheapness of corn prices & the US Dollar will keep exports firm thru 2025!

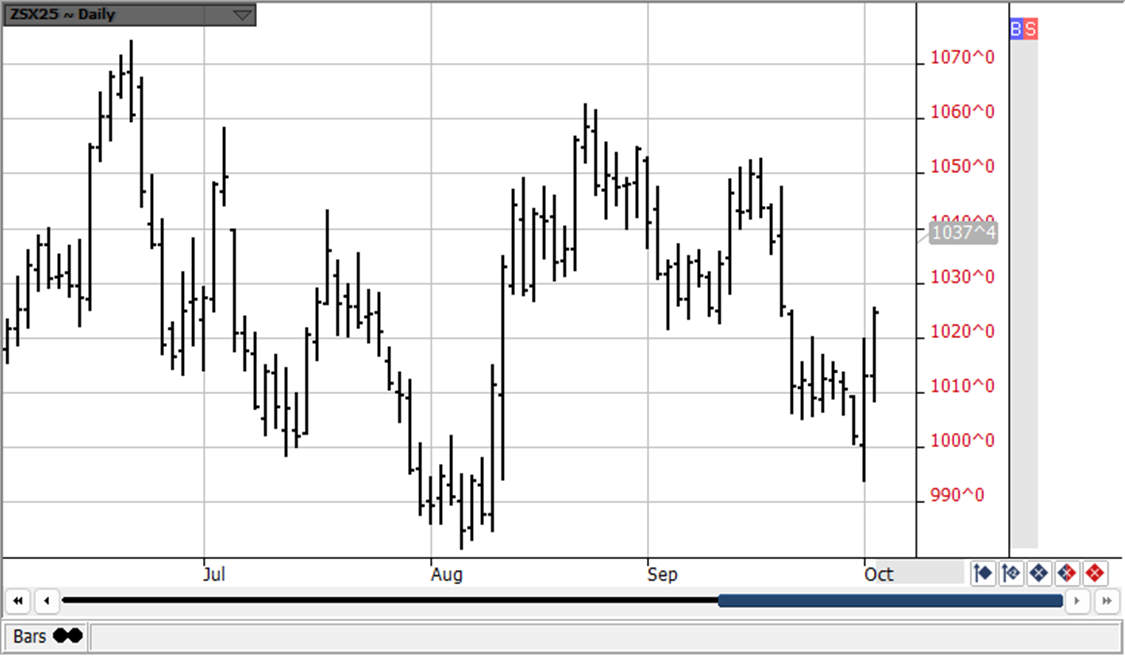

NOV BEANS

(Click on image to enlarge)

The above chart speaks volumes – indicating the mkt cratered – much like corn – after the Aug WASDE – then had the lows successfully tested after the USDA 9-30-25 Report & since rallied off of Presidents recent post on TRUTH SOCIAL of his upcoming AG MEETING with President Xi! Non-China exports have been impressive but it looks like China will come back in the fold before year-end! The Bean crop – unlike corn – is NOT a record – forecast to be the same as 2024 – so supplies are not plentiful! US beans at $10 – are amid the cheapest anywhere & that plus a slumping US Dollar should support a post harvest rally – which the crop currently at 20% in!

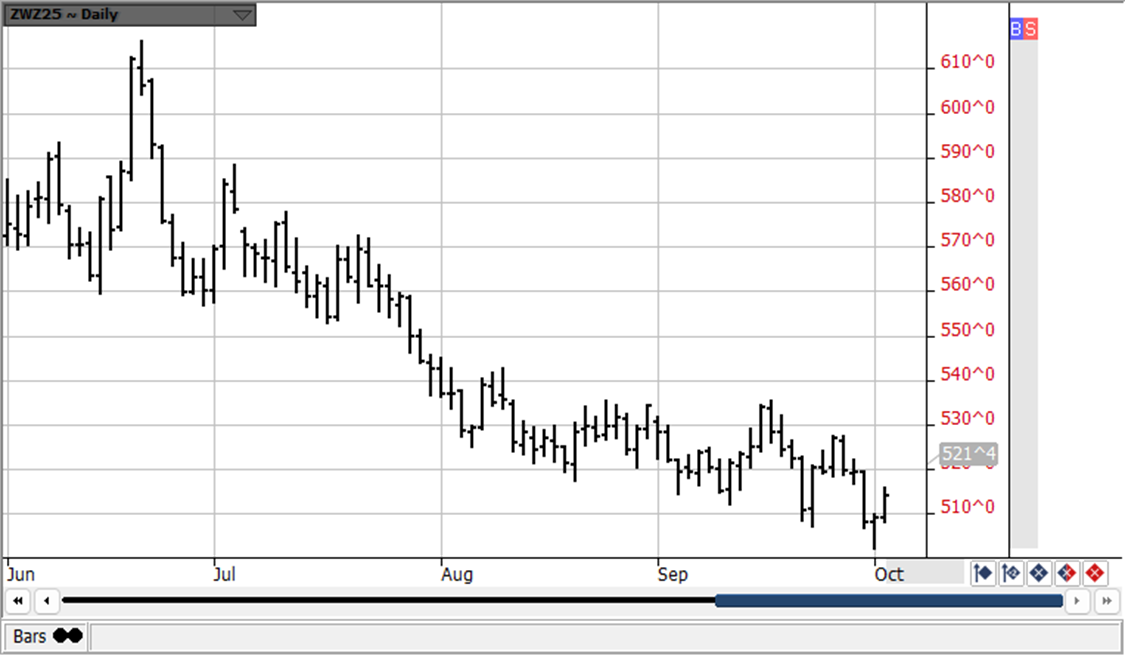

DEC WHT

(Click on image to enlarge)

Dec Wht is currently playing “weak sister” to Corn & Beans with adequate supplies but historically cheap! It will follow post-harvest rallies in corn/beans with exports also supported by very low prices & a very cheap US Dollar!

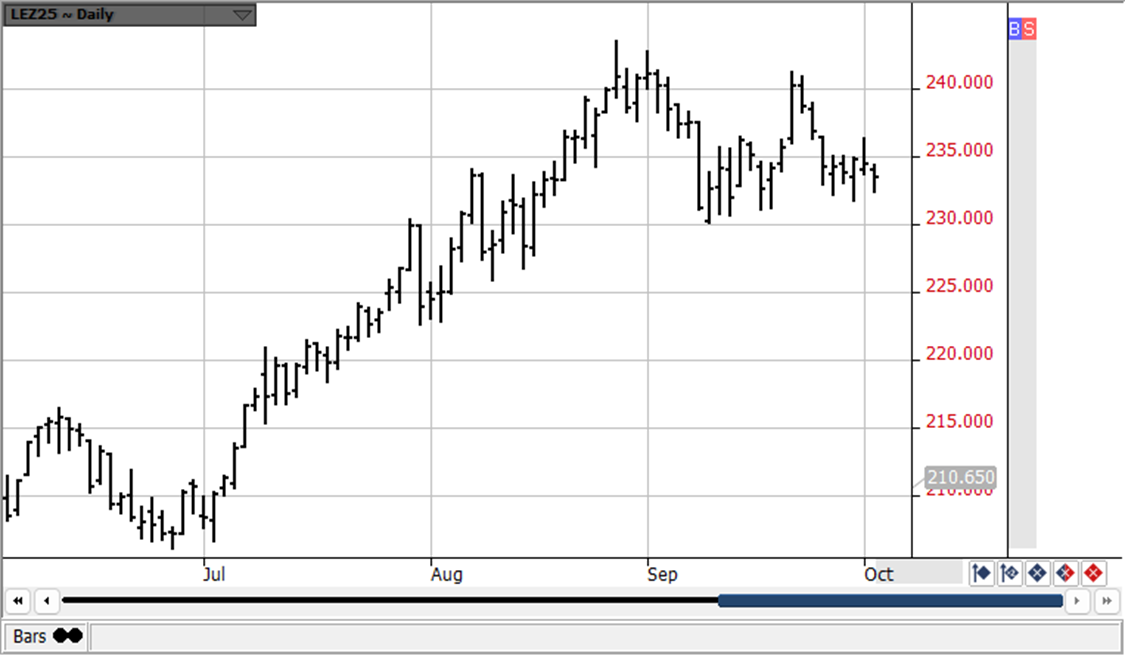

DEC CAT

(Click on image to enlarge)

Dec Cat hasn’t made new contract highs since late Aug – yet it hasn’t really fallen out of bed either – maintaining a trading range $10 under Aug highs! The recent USDA reports have supported the cattle prices – which are still drawing adequate demand at these record high prices! And total cattle #’s are still historically low! Normally demand falls off sharply after Labor Day! So the jury is still out as to whether a top has been made or that the current $10 break is just another correction!

DEC HOGS

(Click on image to enlarge)

The recent bull hog rally has set back $5 but the correction feels like a “buy” due to the ongoing wide gap between pork & beef in the supermarket! With the consumer being inundated with higher prices from every corner, the cheapness of pork compared to beef is hard to pass up! Plus a bullish PIG CROP REPORT last week has supported the bullish scenario for pork – as it continues to be the upside leader in the meat complex!

More By This Author:

AgMaster Report - Wednesday, Sep. 24AgMaster Report - Thursday, Aug. 22

AgMaster Report - Wednesday, Aug. 6