AgMaster Report - Friday, Jan. 24

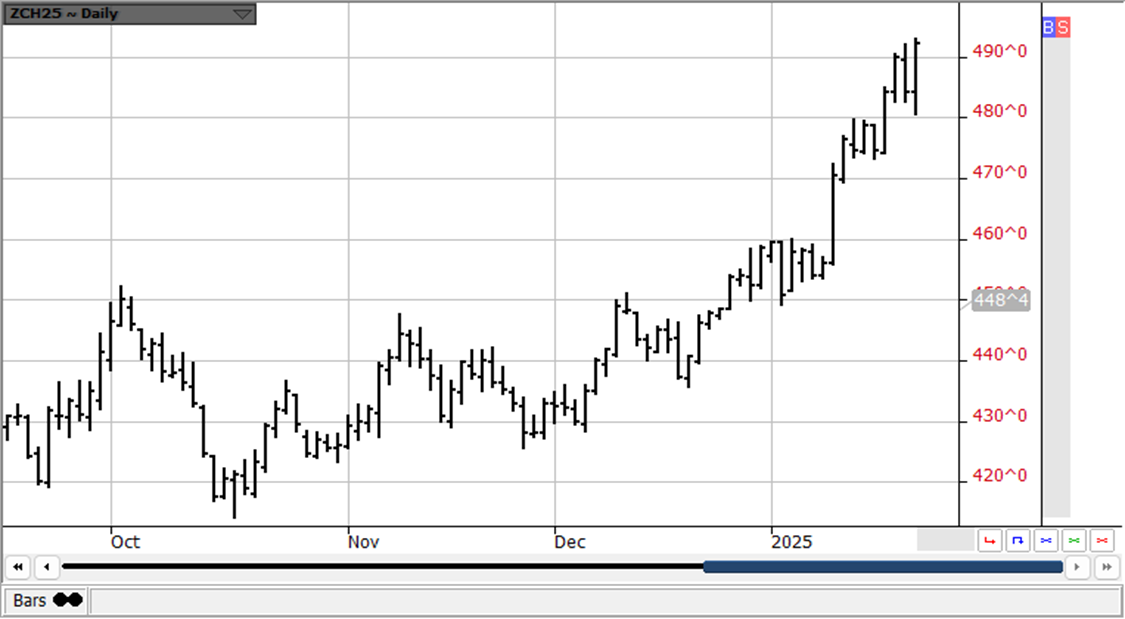

MAR CORN

(Click on image to enlarge)

The Jan 10 USDA Report was a bullish surprise – lowering corn yield from 183.1 to 179.3 & carryout from 1.738 to 1.541! So what was a comfortable supply situation for Corn suddenly became tight – and adding fuel to the fire was a plummeting US Dollar & dryness concerns in Argentina & South Brazil! As well, solid exports have underpinned the mkt all along! The net result is a Mar Corn Contract knocking on the $5.00 door! Going forward into 2025, there is no margin for error for crops out either hemisphere!

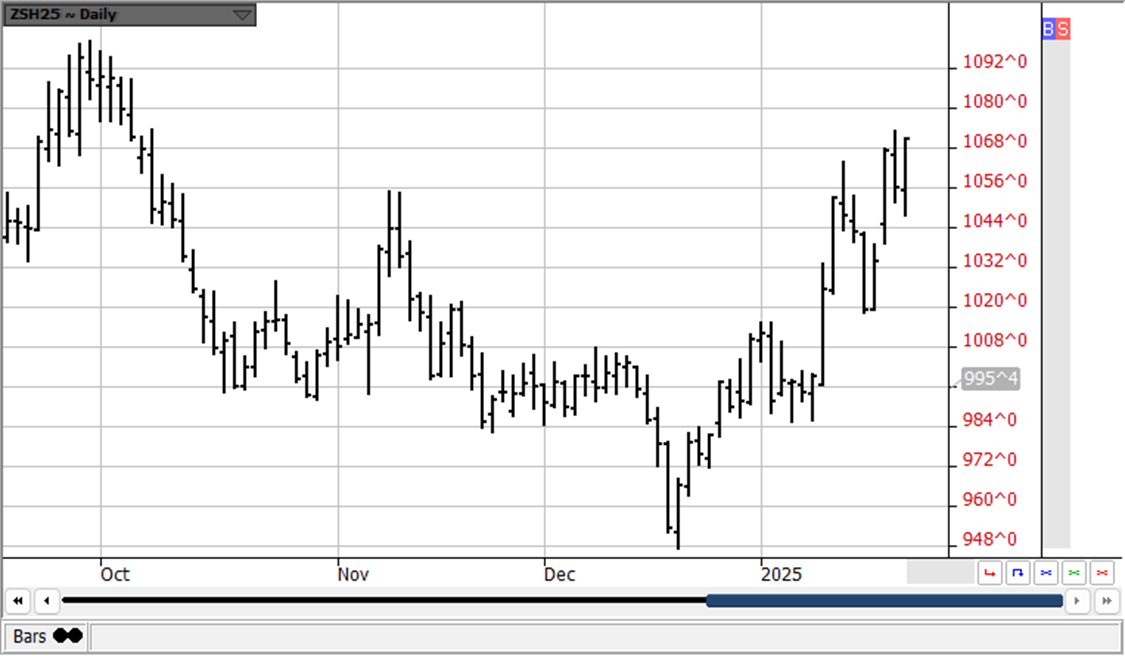

MAR BEANS

(Click on image to enlarge)

Since mid-Dec, Mar Beans have staged an impressive $1.20 rally (948-1068) mostly off of dry weather concerns in Arg/S Brazil & lately off news the long-threatened Trump Tariffs have been delayed until at least Feb ! He has warned that tariffs of 10% in China & 25% in Canada & Mexico would be enacted – to limit the immigration & drug flow across Our border! But what’s not certain is if these are a reality or just a bargaining chip for Trump! The big headwind for beans for the longest time is the massive crop in Brazil currently in harvest! But that has been well documented & may be pretty much baked into the current price! The Jan USDA Report, the lower US $ & respectable week-to-week exports are supporting the mkt on breaks!

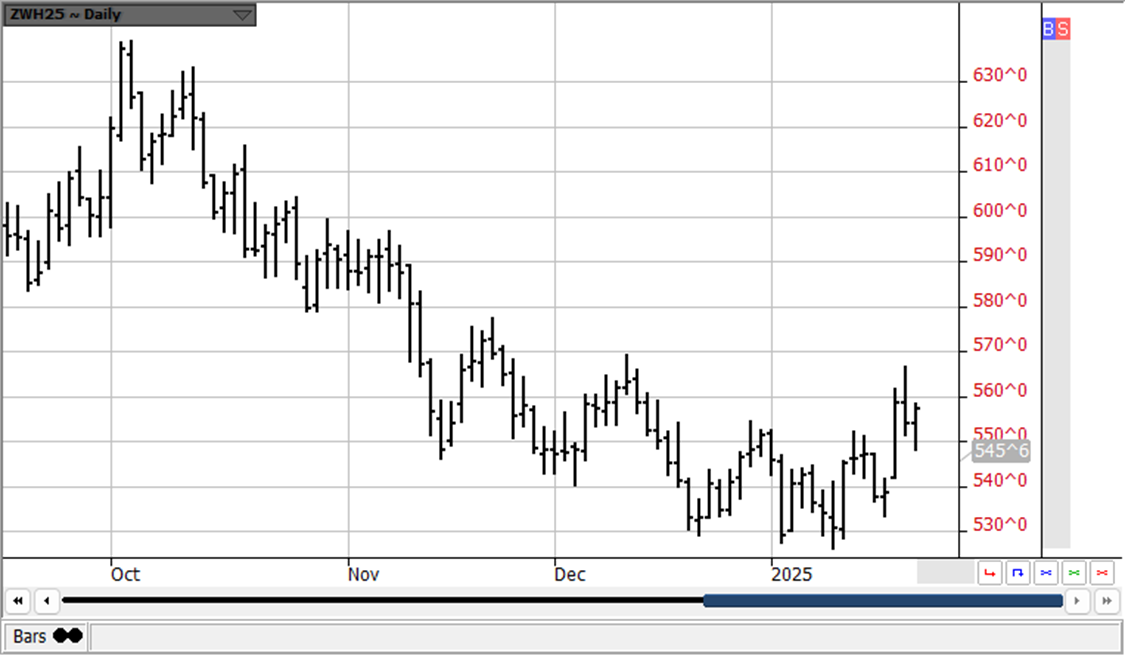

MAR WHT

(Click on image to enlarge)

Despite a $1.20 rally in Beans & $.60 in Corn since Mid-Dec, Mar Wht has stubbornly stayed confined to its 40 cent trading range (530-570)! Despite some artic climes in the Central Plains, Russia’s lower production & solid export inspections running 20% over 2024, the wht mkt can’t get out of its own way – even with strong upsurges in its sister mkts! However, should corn & beans continue to rally, the wht mkt will eventually climb on board!

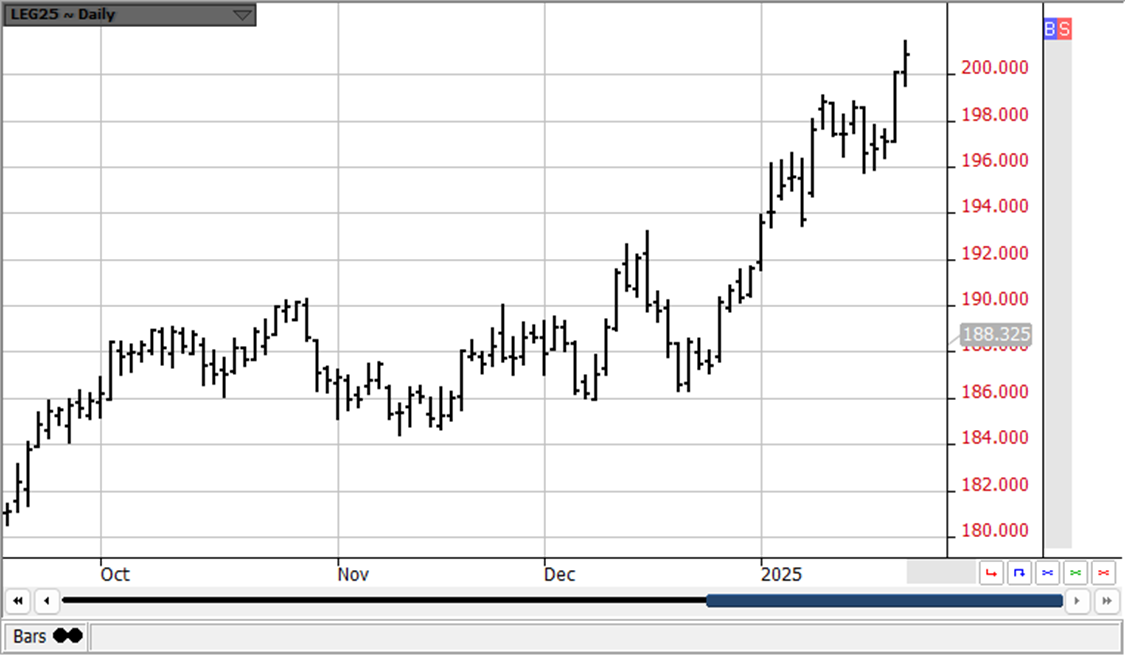

FEB CAT

(Click on image to enlarge)

Feb Cat is a bullish juggernaut – as both fat & feeder cattle skyrocketed yesterday both reaching new contract highs & new all-time highs in Feb Cat! With the strong cash, Feb Cat is still at a discount to cash! The mkt is feeding off solid domestic demand & lessening supplies thru the 1st Qtr! However, with the Jan Cattle-on-FeedReport due out Friday, the mkt might take a break from its upsurge as traders even up! COF – 99.7 Plcmt 101.2 Mkt – 101.4 the technicals are very strong & the long Fund OI is large!

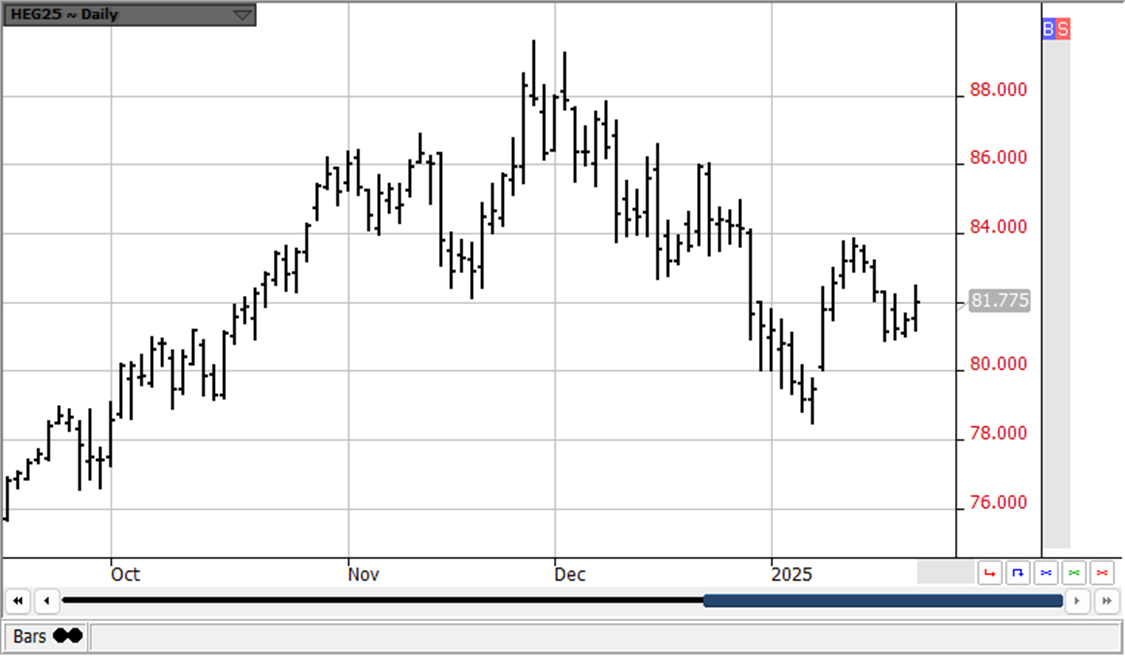

FEB HOGS

(Click on image to enlarge)

Feb Hogs are clearly the weak sister of late – as Feb Cattle surges, Feb Hogs are languishing about $3.00 off their lows & $8.00 off their Dec Highs! But yesterday, they seemed to hold their 100 day moving average & rallied late! Eventually the big price gap between pork & beef in the supermarket will catch up with the mkt & demand will flow into the Pork Sector!

More By This Author:

AgMaster Report - Tuesday, Jan. 14

AgMaster Report - Tuesday, Jan. 7

AgMaster Report - Tuesday, Dec. 31