Ag Master Report - Tuesday, June 23

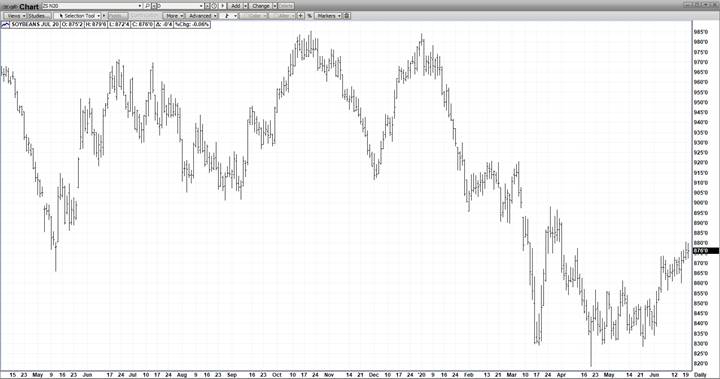

JULY BEANS

(Click on image to enlarge)

A bearish weather forecast (no ridge in sight) & COVID anxiety over the US/China trade deal has kept the grain complex under wraps – still July Beans have managed to trade to the top end of a 2-month range (820-860)! Monday Inspections the past two weeks have hovered between 250,000 & 400,000MT. Thursday sales were a whopping 1.9 MMT. The upcoming June 30 acreage report could reflect a 1.5-2.0 million acre increase in bean planting! However, Brazil’s beans for exports are now priced higher than the US which should favor China’s buying of US beans! The Macros have been flat – there is no weather premium.

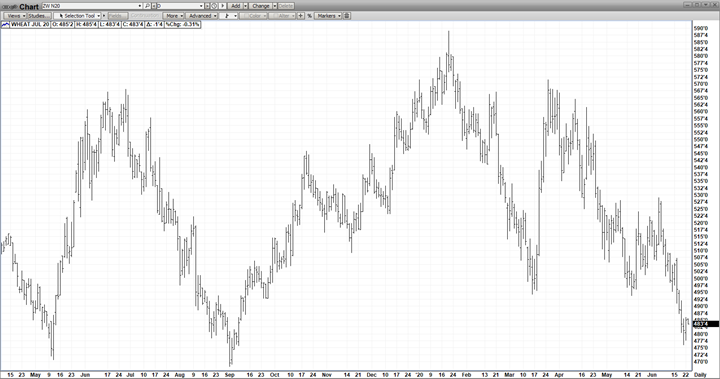

JULY CORN

(Click on image to enlarge)

The July Corn contract managed to close 2 cents higher last week despite very favorable weather with gd/ex crop ratings in the mid-’70s! However, today the market is succumbing to a benign growing conditions – trading 4 cents lower! The “outside markets” are in a holding pattern – albeit very favorable for the grain complex! The DJI is at 26,000 – 8000 points off its Covid-19 lows – Crude Oil is $22 off its April lows & the US Dollar is 700 points off its March Highs! US & Global stocks are large but have been traded on for some time & are pretty well dialed in! The 6/30 acreage report could show a 2 million acre reduction in planted corn acres! Indeed, the crop looks good but, of course, is not in yet. Also, there is no weather premium in the price – and finally, corn prices are already cheap – sitting on 10-year lows!

JULY WHEAT

(Click on image to enlarge)

July Wheat acts sold-out & justifiably so as a “perfect storm” of bearish factors have descended upon the wheat complex– winter wheat harvest pressure, better than expected yields, Increasing Russian Wht Production – 79.5 (78.0) & general bearish weather for its sister markets – corn & beans! However, it appears enough is enough as the mkt may have gone low enough to attract some solid demand! Reversal type chart action occurred today!

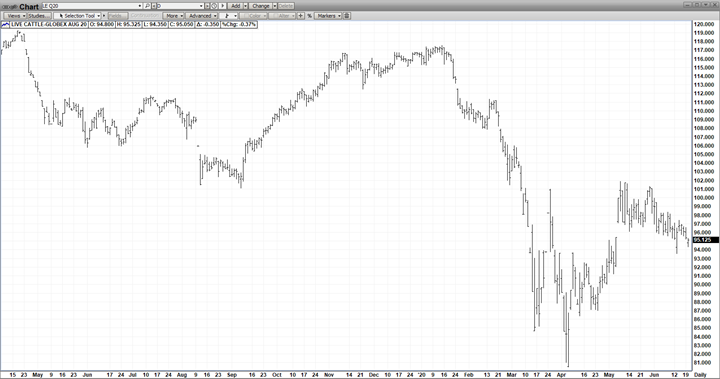

AUG CAT

(Click on image to enlarge)

The market has been consolidating since its $20 run-up this Spring (81-101) but increasing production due to the re-opening of packing plants has pushed the mkt down to the lower end of its trading range! Adding to that pressure was a bearish Cattle-On-Feed Report issued last Friday – Mkt – 72% (74)–Plcmt – 99 (96)– COF -100 (99). However, with the re-opening of America well underway, resurgent beef demand should underpin the mkt at current levels!

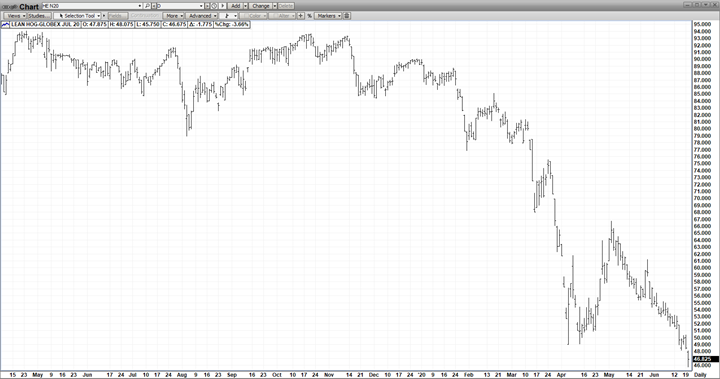

JULY HOGS

(Click on image to enlarge)

A mkt inundated with bearish supply & demand news received more bad news today as fears of new restrictions on food moving through China triggered selling in July Hogs! And the mkt scored new lows! Generally, sluggish demand & fears of back-ups have fueled the down – also, the mkt is concerned about a Pig Crop Report – issued late week – that may reflect even more burdensome supply.

Really well written!