After Sharp Pullback, Where Does Gold Go Next?

Image Source: Unsplash

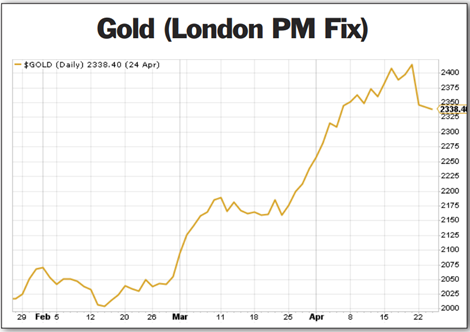

Even when you know it’s coming at some point, the shock of a market sell-off like what we saw recently in gold is still unsettling. After seven weeks of dizzying gains with few interruptions, gold had gotten tremendously overbought. The good news as I write is that this medicine, while harsh going down, was just what the doctor ordered for this gold market.

Silver and mining stocks had begun to significantly outperform gold, which served as important confirmation that a secular bull was charging. Western investors, while still not buying gold ETFs, had jumped into the futures markets head-first.

“Managed Money” positions on the disaggregated Comex commitments of traders report (i.e. hedge funds) had soared. Even the geopolitical situation was joining in to turbocharge the action. Alas, those last two factors proved to be the trip wire for gold.

After Israel’s restrained retaliatory action against Iran, and Iran’s failure to counter over the weekend, trigger-happy hedgies decided to take their gold profits and run as overseas gold trading opened on a Sunday evening. The resulting price decline continued with more selling in New York.

By the end of it all, gold had dropped about 2.5% (around $60), while silver had fallen about 5%. The long-awaited and dreaded smash had come. That waterfall drop on Monday tested the mettle of gold bulls.

But as you can see from our opening chart, the big drop loses much of its significance when you consider how far gold has come over the last three months. Although it seemed pretty severe at the time, the selling brought the price back down to the lows of only the previous week. After a seven-week rally that had taken the price of gold nearly $400 higher since the end of February, a $60 setback doesn’t seem like much.

In fact, the big effect of the selling wasn’t the damage to the price chart, but a more positive one: Convincing investors that this gold market wasn’t a runaway train heading for a crack-up, but rather a normal bull market driven by conventional factors. That simple fact was in doubt as gold took off with seeming disregard for any bearish influence.

Many investors were also waiting for a pause in the relentless rally to get in. They certainly got that, although it doesn’t seem to have lasted long, with both gold and silver rebounding well as I write.

Longer term, it is the powerful monetary argument that will drive gold far higher. Gold is the insurance, and investment, that you’ll want to own as this process plays out.

Recommended Action: Buy gold.

More By This Author:

META: Spending Worries Trip Up Market Sentiment, But Bullish Outlook Prevails

CALF: Bet On The Little Guys With This Cash Cow ETF

Make No Mistake - Debt Matters

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.