About Gold

In the midst of multi-hundred and multi-thousand percent gains over the past year, gold has been left out in the cold. After getting above the psychologically important $2,000 level, it fumbled and stumbled its way down by about 20% and only recently begin to show a pulse.

(Click on image to enlarge)

Looking closer, you can see how in just the past few sessions the gold contract manage to scrape its way above its trendline. That’s a nice little accomplishment, but this is hardly the firm foundation upon which massive bull markets are built. It could be just a “poke” through only to be followed by more disappointment. It’s going to take more than this.

(Click on image to enlarge)

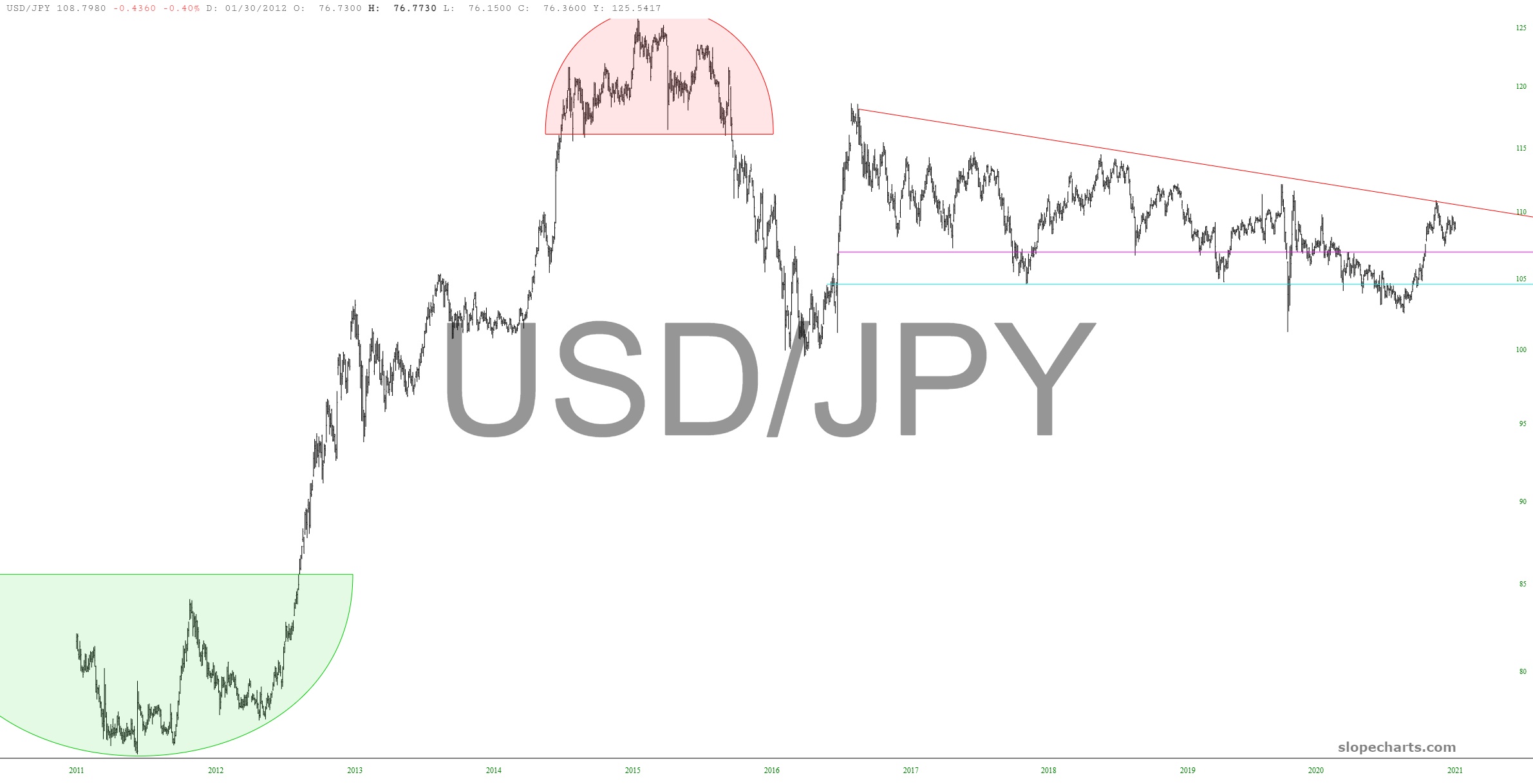

For one thing, the dollar’s strength against the Japanese Yen hasn’t helped. If this went into a free fall, gold would probably flourish. However, it seems the world has reach a bit of an equilibrium, coming to a consensus that the trillions of worthless US fiat dollars is about as valuable as the quadrillions of worthless Japanese fiat yen.

(Click on image to enlarge)

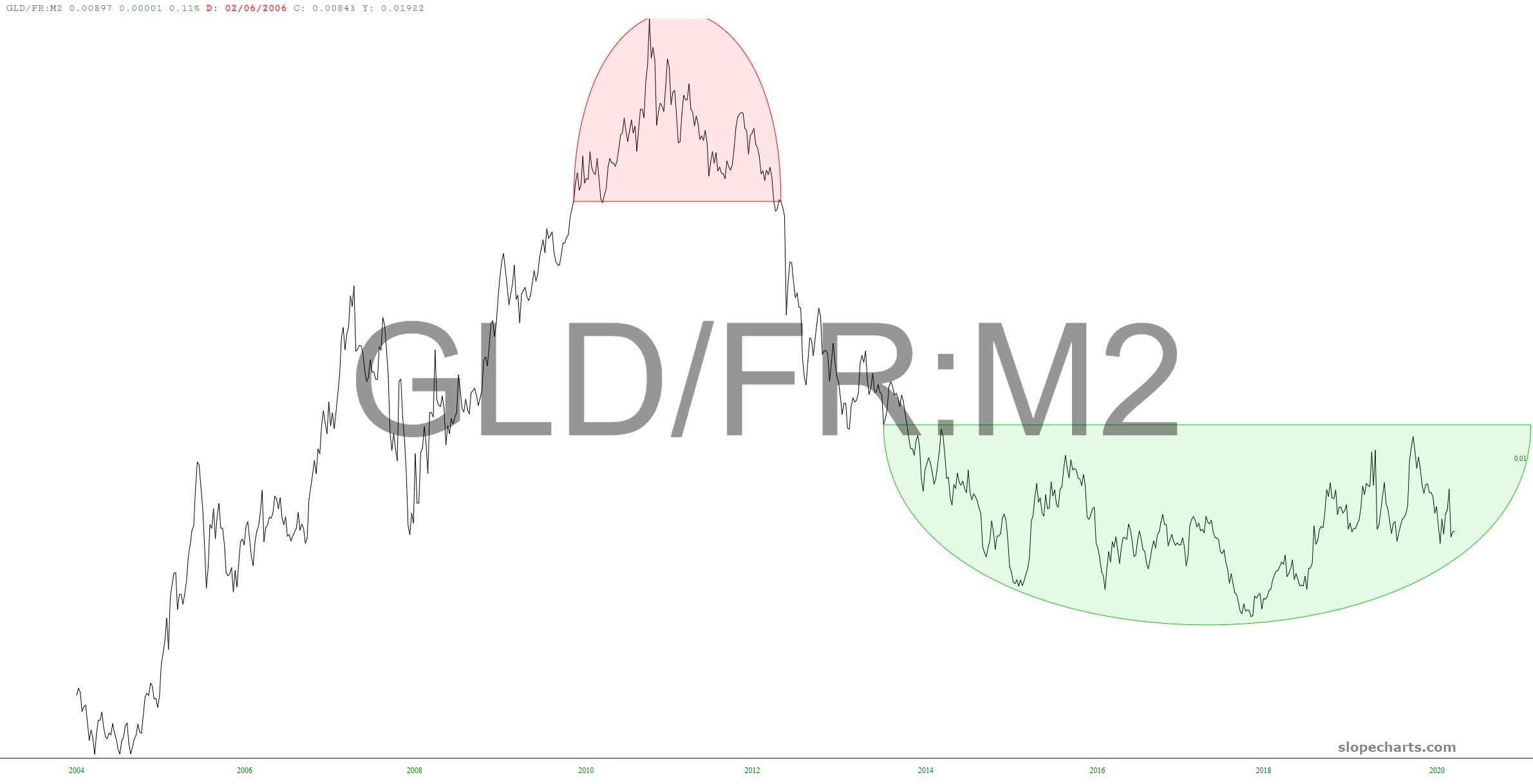

Still, don’t count gold out. What I am watching most closely is gold’s relationship to our (constantly-growing) money supply, and the saucer pattern is as solid as ever.

(Click on image to enlarge)

I would also point out that precious metals miners have achieved “breakout” as well.

(Click on image to enlarge)

My general feeling is that gold probably has a decent future, but it is likely to be a grinding, plodding one, and unlikely to attract any attention from the younger crowd, who have become absolutely morphine-addicted to the rat-a-tat action of GameStop and crypto. Investing in something solid and reliable that slowly and steadily hacks its way a little higher in price year by year just isn’t going to turn them on.

the article is too vague and unclear.

The author talks about gold, but can't say.

- I see 1500 for the fall.

or vice versa 2000 by winter.

Stop Loss is out of the author's question.