A Third Dimension In Oil Production

There is a much talk about the shale revolution in oil production but perhaps shale is not the only answer. While a lot of money is moving into shale projects, one company is moving away from it. A company called Petro River (OTCBB: PTRC) believes that conventional oil production is still the most economical method but adds a 21st Century twist. A twist that if successful, could put shale oil production to shame. Think of it as some unconventional thinking on conventional oil production or perhaps a new dimension: a third dimension. Petro River's plan is to reduce the cost of oil production to below the cost of shale production with the motto that 3D seismic technology is the new production frontier.

I recently had the opportunity to speak with Scot Cohen, the Executive Chairman of Petro River. He reminded me of the type of person that has the same spirit that came to define the U.S. oil industry. Cohen has the desire and vision to look at the status-quo and then look for a way to do things better and more efficiently. He has the heart of a wildcatter, but one he says, that is backed with incredible new technology.

While many are throwing money at the shale revolution with its promise of quick returns, in a world of growing global oil demand, the shale may not be the best or enough of the answer. Shale oil production, with its high decline rate and relatively prohibitive costs, may not be able to stay afloat, especially with the amount of leverage and debt that many shale operations have. Not to mention the inability to withstand downturns in the market and the price of oil.

Scot Cohen has played the shale game and realized that there must be a better way. Instead of embracing shale production that will grind to a halt if prices crash, he looked for an alternatives solution So, like those who originally started the shale revolution by combining the technology of the old and the new, Cohen and Petro River decided to do something different by thinking outside of the proverbial box and look at the conventional unconventionally. How? By using 3D seismic imaging technology where it has rarely, if ever, been used before.

Petro River’s current drilling projects in Oklahoma and California can have significant upside for the small company and can prove their application of 3D seismic to conventional drilling.

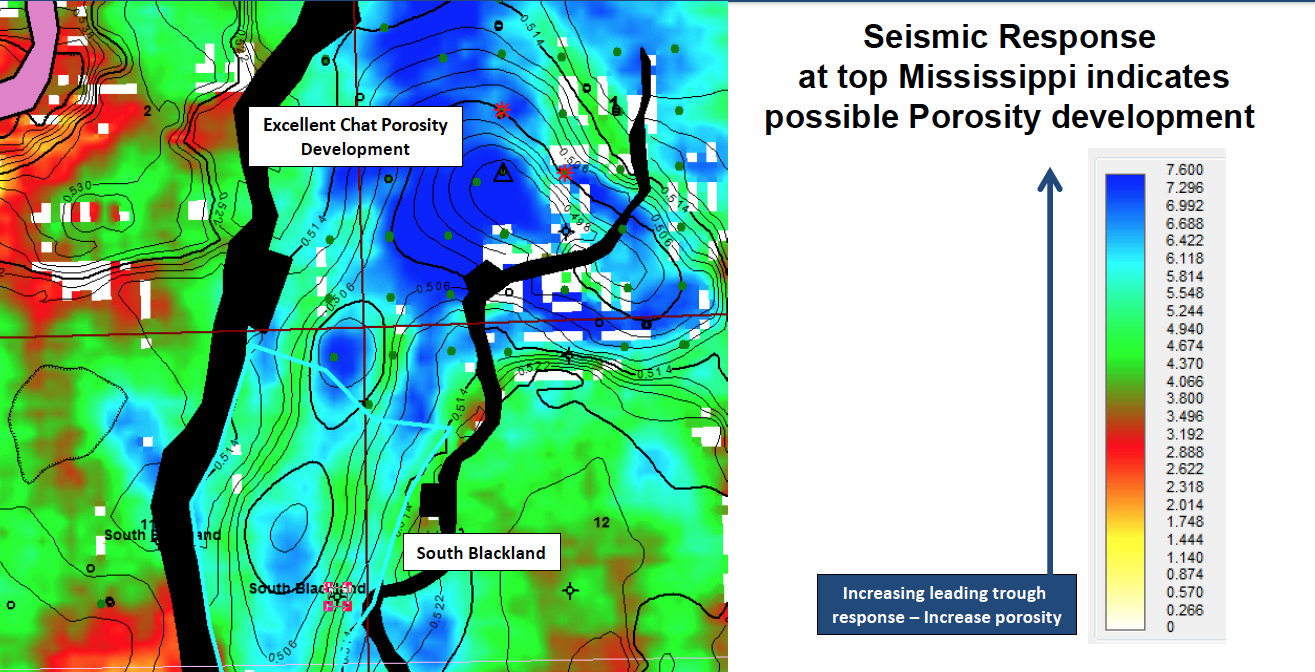

(Click on image to enlarge)

Cohen’s first experience with Petro River comes out of his experience co-founding and running a hedge fund in 2003. Out of that came a private equity fund that ran non-operational and operational domestic and foreign energy projects. The first project he invested in just happened to be Petro River, in 2010, and it is the one company he held onto after his hedge-fund days were over.

Originally, Petro River was investing in heavy oil projects with shallow wells using enhanced oil recovery, also called tertiary recovery, as opposed to primary and secondary recovery. They were going to springboard that early success into the new shale oil revolution. Petro River leased almost 100,000 acres of land and they were planning to partner with a Chinese company to drill the shale wells. But the deal with China fell apart as oil prices plunged, taking the shale market with it. So Cohen looked to revitalize and reshape the business. He restructured his whole team, cleaned house and put in place an entirely new structure by securing additional capital for a new direction. Petro River is now a much different business than the shale game Cohen left behind.

Cohen started off taking a 20% position in a company called Horizon, a privately held operator. Behind that company was an entrepreneur that was with another privately held company, Century Oil, a large Gulf of Mexico oil producing concern. Petro River ended up with direct and indirect interests in several prolific basins in US and Western more than 105 acres of land in Oklahoma as well as a direct interest in Horizon's assets in California. Coupled with legacy assets of 106,500 acres in Osage Country, Oklahoma, and there is more than enough land to test Petro-River's 3D seismic vision.

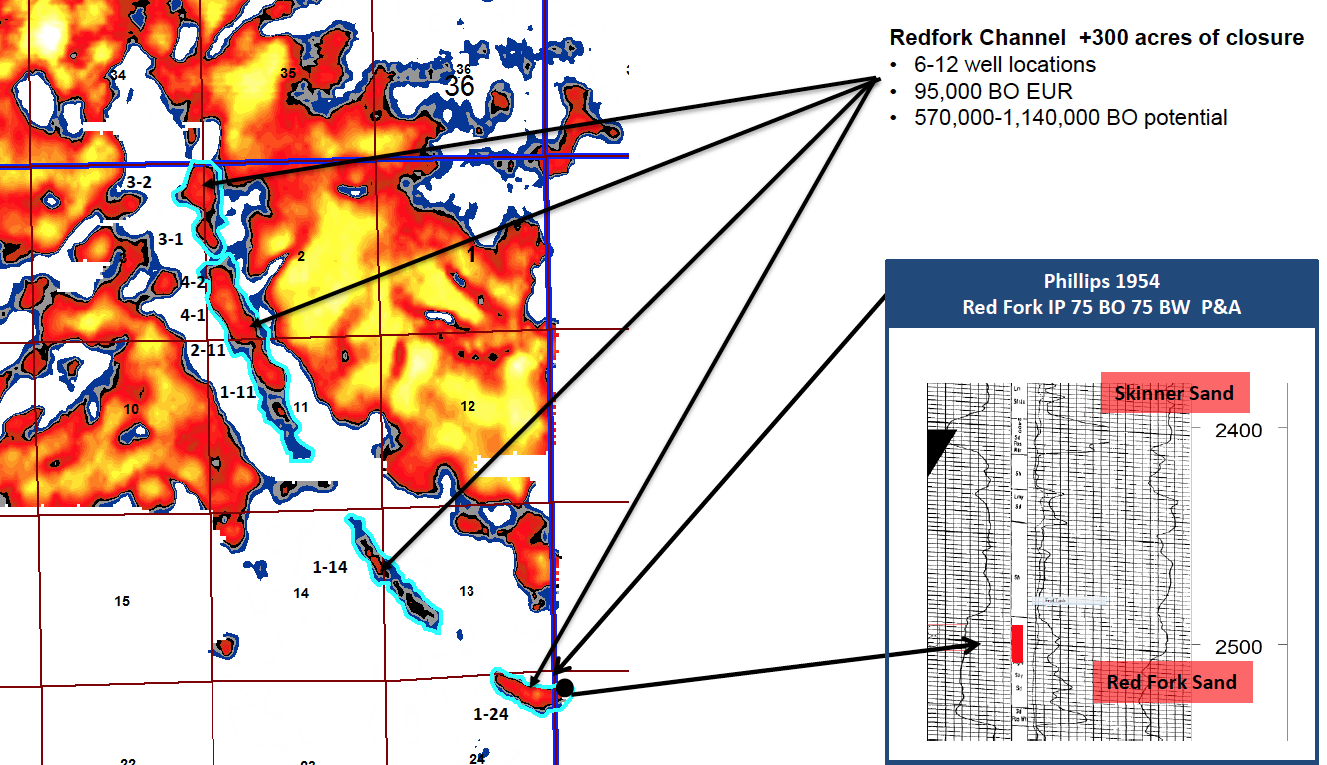

(Click on image to enlarge)

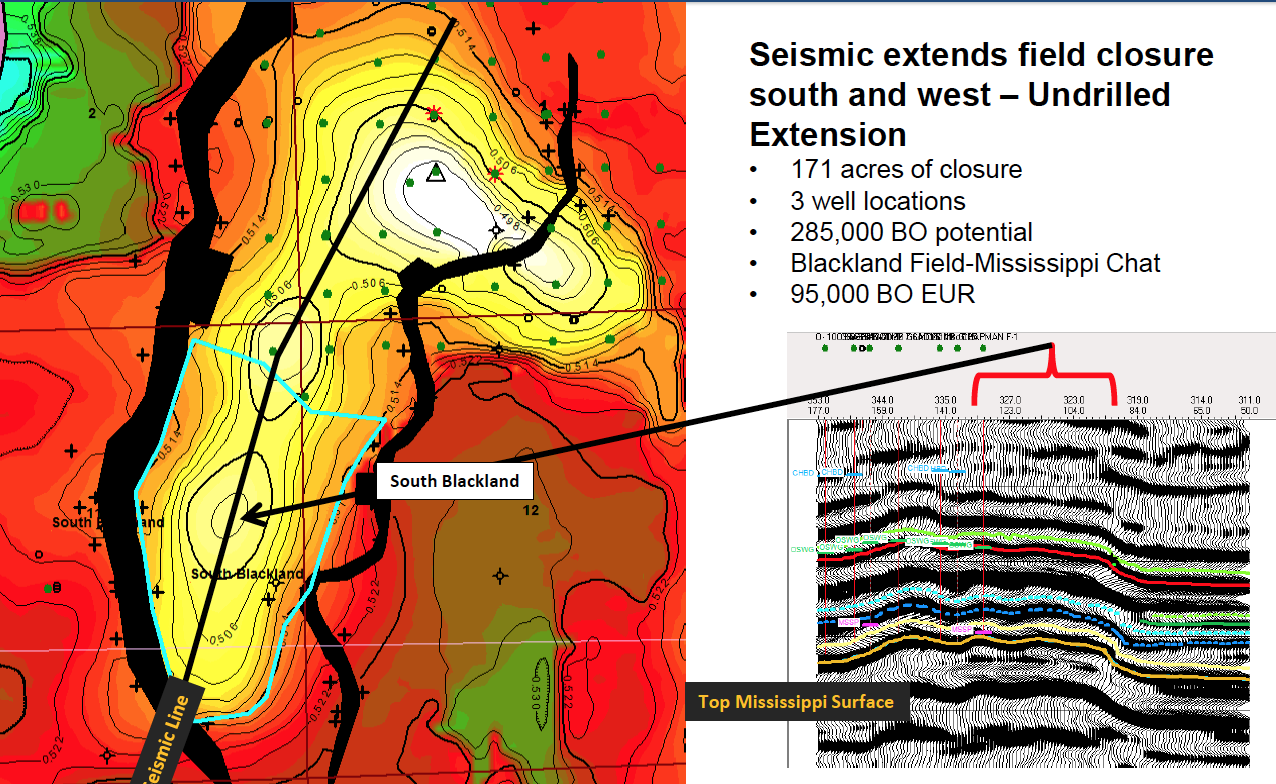

Petro River recently spud its first well in Oklahoma on April 5, 2017 with results expected in May or June. Two additional wells in California will be spud in June and July 2017. The 3 projects can materialize into a drilling program that can realize a potential of over 21 million barrels of recoverable oil.

Petro River is getting ready to ramp up production in Oklahoma and the general theme of 3D seismic imaging is Scott Cohen's greatest asset in discovering oil reserves. In Oklahoma, 3D technology is being used where everything is seismic centric, meaning everything is mapped and shot and pictured. Petro River has a talented team of experienced geologists and petro physicists with great local teams in both California and Oklahoma. They are using the type of 3D seismic imaging that is normally only used in underwater mapping called AVO Response. Simply put, this takes 3D seismic data to the next level and requires special talent for reading the data, significantly reducing the risk associated with prior conventional drilling.

By using this data Cohen believes that Petro River's lifting cost for oil will be a fraction of what the shale oil producers have to pay. He says that his lifting cost is $10.00 a barrel in California and under $10.00 a barrel in Oklahoma, making it possible that, if his hunch is right, his costs could be even lower than that. This all translates into higher asset values across all of Petro River’s projects.

Petro River hopes to substantiate these lower production costs after the wells start producing very soon. Cohen states that even the best players in the Permian Basin, shale’s sweet spot, cannot produce oil that cheap. Cohen explains, “It is very straight forward: If the price of oil goes down, the shale oil players will not be able to compete and they'll have to shut production down. We won’t. We can accelerate in a low-cost environment because we can keep cash flow going while the shale producers will be running into creditor issues with their banks.”

Cohen says that the conventional oil business is an old business. Adding 3D seismic technology with AVO Response to the process is not understood by the Wall Street players and investors yet. He says there are not many companies that are 3D centric and the complexities make it so that Wall Street doesn't fully understand how Petro River's current model is different than what has been done before. But if his company succeeds, the process is scalable.

(Click on image to enlarge)

Petro River has no debt, industry changing assets, a talented team and is testing its vision by initiating drilling. If the numbers hold up to what they believe should happen, we could be saying goodbye shale and hello seismic. Is it time to get seismic centric?

Petro River Oil Corp. (PTRC) is an independent energy company focused on the exploration and development of conventional oil and gas assets. Having just completed a corporate reorganization, including the addition of new management, the acquisition of several promising new assets, and an infusion of cash, Petro River is taking advantage of the downturn in oil prices to enter highly prospective plays with industry-leading partners.This diversification of several projects, each with low initial capital expenditures and strong risk-reward characteristics, reduces risk and provides cross-functional exposure to a number attractive risk-adjusted opportunities.

Images source: Petro River Oil

Disclosure: This article is part of a new “UnderCovered” series of exclusive articles featuring companies with limited coverage. Authors are compensated by TalkMarkets for their time, and ...

more

There's a good article about $PTRC out today: www.talkmarkets.com/.../petro-river-oil-corp-ptrc--going-back-in-time-with-modern-technology

What do you think about $PTRC oil discovery news. finance.yahoo.com/.../...-oil-field-120000219.html. 2.5M barrels=110M value? possible 6x return here

Very smart for $PTRC to ecorporate #3D imaging into the drilling process. Why aren't other companies doing this?

Maybe other companies are, I'd like to know either way. @[Phil Flynn](user:33688) or @[Scot Cohen](user:44126), is $PTRC the only #oil company doing this?

I made a good call buying $PTRC after reading this. Stock has been way up!

I wonder if it's too late to get on the $PTRC bandwagon. Wish I had bought in when I first read the article.

Good stuff. Bullish on $PTRC

Very impressive. I plan to be taking a closer look into $PTRC. Thanks for tipping me off to this company @[Phil Flynn](user:33688), I wasn't previously aware of them.

Interesting stuff, but can someone explain the significance of the seismic images in the article? It's beyond my level of expertise.

Intriguing article. @[Scot Cohen](user:44126), how did you first get the idea to utilize 3D technology in this fashion? I expect it will pay off in spades.

I agree. I'd like to take a deeper look at $PTRC, but there doesn't seem to be much info out there yet. Can any one refer me to additional articles on this company?

Fascinating, I admit I've never heard of #PetroRiver before this article. But I'd like a better understanding of what 3D seismic imaging is. Where can I learn more about how/why this will give Petro River an edge over the competition in #oil production? $PTRC