A Swiss Treat Or A Swiss Miss?

Image Source: Unsplash

The Geneva Convention

Markets head into the weekend locked and loaded. Yet, there is a sense of apprehension surrounding the so-called Swiss Mini-Summit or the “ Geneva Convention”—that appetizer round of U.S.-China trade talks where even a flicker of optimism would be enough to justify the risk-on positioning that has been quietly accumulating since Liberation Day. Although it’s just the start of the talks, any hint of de-escalation between the two heavyweights is welcome. However, traders didn’t sprint for the skies this time—we’ve seen this film before. Enthusiasm was tempered, especially after Thursday’s UK trade deal sugar high faded into the reality of sticky 10% tariffs and no grand slashing headline.

The market is still sniffing for ASEAN trade deal fireworks next. Think of it as the amuse-bouche before the real “ Art of the Deal” feast. Things will get interesting if Japan and South Korea show up with pen in hand. But make no mistake—the main course is still China. Until Beijing signs something meaningful, the market is just moving pieces on the risk chessboard, not flipping it over.

Equities? Flat. Sleepwalking on Friday. The S&P ended the week down about 50 basis points as investors digested a buffet of macro crosscurrents: on-again/off-again trade headlines, evolving AI narratives, a hawkish Fed, and first quarter earnings still defying gravity. The index is up 17% from the April 7th lows—no small feat—but still stuck below pre-Liberation Day highs, having rejected the breakout attempt like a bad trade idea in the final hour.

Like we saw on April 9, the White House flipped the script again this week—this time on UK trade. Thursday’s deal lit a fuse under risk assets, a sharp reminder that being short in this headline-driven market is a dangerous game. One tweet, one handshake, and the tape can rip higher—even if the underlying economic structure hasn’t budged.

In this trading regime ( cycle) , optics beat fundamentals. Markets aren’t trading balance sheets—they’re trading momentum, tone, and trajectory. And when the White House pivots, the market re-prices fast.

It’s not about the deal—it’s about the signal. If the UK can cut a side deal, so can others. And if Trump is now playing tariff-whack-a-mole with carrots instead of just sticks, that’s enough to keep risk bid—even if the actual policy meat is still missing from the plate.

The dollar closed the week with a modest gain, its third straight in a tight range, as the broader downtrend stalled out. USD/JPY managed to close above 145, EUR/USD held below 1.1260—two key technical lines in the sand that traders will watch the weekend peace pipe signals from “ The Geneva Convention” over the weekend for Monday morning conviction. But on Friday, it’s a sideways chop with

Rate-cut expectations took a hit this week. Treasury yields rose across the curve, with the belly underperforming, and last week's NFP print didn’t support the easing bias — short of an outright collapse in payrolls, this Fed isn’t flinching. The market now prices in cuts at less than 70bps this year, and the bar to restart the cutting cycle keeps rising. Powell held the line, but his potential replacement, Kevin Warsh, threw a policy grenade into the room by suggesting the Fed’s tariff-induced inflation read is an admission of impaired credibility. Ouch!!.

Crude oil caught a bid this week, bouncing off post-Liberation Day lows. Why? A three-part combo: (1) Shale producers flashing red on breakevens, (2) the U.S. economy still grinding forward, and (3) China—despite a U.S. trade cliff—still flooding the globe with excess supply, holding up headline exports. But the wildcard remains Iran. A nuclear deal? Oil drops fast, possibly toward $55. No deal? The shale breakeven acts as a de facto floor—call it $58–$60 WTI support—with geopolitics keeping a floor under energy even as macro demand signals stay muddy.

Gold? Stuck in its dollar dance. Next week’s direction depends almost entirely on trade talk outcomes. If the dollar rips on a China breakthrough or ASEAN rollouts, gold heads back to $3300. If talks collapse or stall, expect a push back to $3350 + as hedgers reload.

Markets aren’t fully committing to the trade war resolution story just yet, but they’re pricing in the possibility. The UK deal was a test case. ASEAN could be next. But China is still the trophy, and until we get something concrete from Beijing, don’t expect a breakout—just more chop with tactical long-dollar lean and a nervous bid under U.S. equities. Rate cuts are slipping from view, trade policy is now a macro volatility driver, and this tape is still trading tweet-to-tweet.

Week in Review: Trade Chess Moves to Midgame

Equity markets traded mixed this week, with the Fed standing pat and traders sifting through incremental—not revolutionary—progress on the trade front. The S&P 500 closed the week down 0.5%, as strength in consumer discretionary and industrials couldn’t offset the drag from health care and comms.

The Federal Reserve delivered a non-event, keeping rates steady and playing it straight down the middle. But the tone was revealing: the Committee flagged rising risks to both mandates—higher unemployment and higher inflation. That’s the classic trade war bind: stagflationary tension, with growth softening while costs creep higher.

So what’s a central bank to do? Nothing—for now. The Fed’s watching which side of the mandate blinks first, and with June nearly priced out for a move, July becomes the real pivot month. If the data rolls over, especially on the growth side, the next cut is back on the table.

The U.S.-UK deal was a symbolic win on the trade front, but more sizzle than steak. Steel and aluminum tariffs scrapped, auto duties cut to 10% under quota—but the 10% base tariff is locked in, even for one of America’s most “well-behaved” allies. That sets the bar. If that’s all London could extract, others—like surplus-running Asia—are in for a grind.

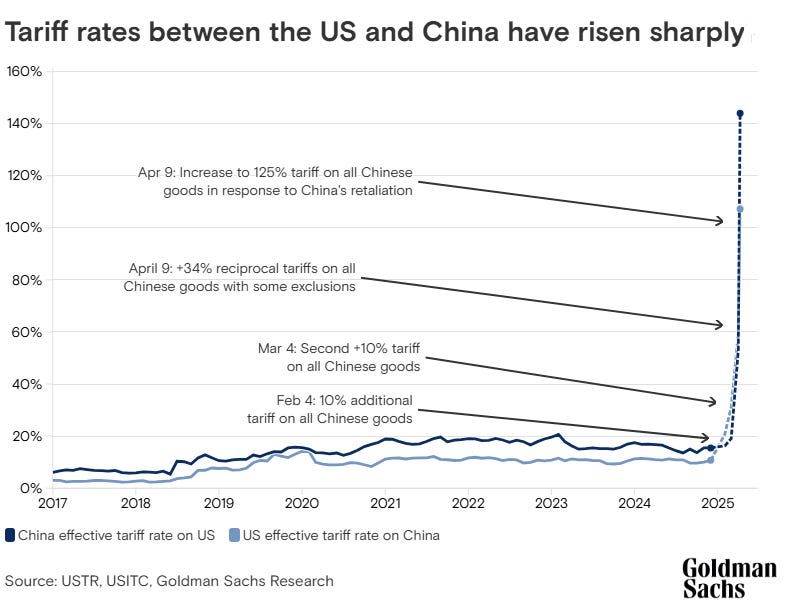

And then there’s China. The numbers don’t lie( as I type with a smirk) —April exports to the U.S. collapsed: down 21% YoY, 24% MoM (seasonally adjusted). Sure, there was some front-running in Q1 and a diversion of flow into ASEAN and Europe, but trade between the U.S. and China is under serious strain. This weekend’s Swiss summit isn’t a breakthrough moment—but it’s a read on tone. The market’s desperate for signals, even soft ones.

As for equities? This is where sentiment disconnects from substance. Post-Liberation Day bearishness was so thick, any news that’s “less bad” now feels bullish. Markets aren’t reacting to fundamentals—they’re reacting to a drop in perceived downside velocity. That's enough to keep things bid—for now

Wall Street’s Riptide Rally: The Bear Market Bet Massacre

What a difference four weeks make. In the April washout, the playbook looked bulletproof: short the dollar, fade equities, load up on vol, and hunker down in recession-proof slop. The trade desk mood? Grim. Fast forward to now, and that same playbook looks like a blueprint for pain.

Stock exposure metrics showed institutionals ran for cover in April, cutting levels near 2020 lows. Then the S&P caught a bid—and they scrambled to chase, adding rocket fuel to the rebound.

The real kicker? Retail’s back in the winner’s circle. That’s right—while the pros were hedging like it was 2008 redux, retail was buying the dip, riding the melt-up, and banking tidy gains. Once again, the so-called "dumb money" front-ran the reversion.

Welcome to the great bear wipeout.

Every so-called “bear” bet that got crowded during the tariff tantrum went up in flames. The dollar’s bouncing, not breaking, equities have ripped higher in 11 of the last 14 sessions, hauling the S&P back from the brink like it never heard the word recession. Junk bonds? Ripping. And the VIX? Bleeding out by the basis point, caught in a classic squeeze—a textbook forced unwind of bloated macro trades gone bad.

Anchored or Adrift? Inflation Expectations Are Now the Market’s Real Tell

Powell’s post-FOMC refrain has become almost ritual: “inflation expectations are well-anchored.” But this last press conference? That confidence cracked—just slightly. For the first time, the Fed Chair flagged a move higher in short-term expectations, both market and survey-based. The long-term? Still anchored, he says. But the tone is shifting. And in a world of sticky core inflation, tariff-induced cost pressure, and shelf-level sticker shock about to show up, that shift matters—a lot.

We're less than a month away from the visible onset of Trade War 2.0 inflation—when retail shelves stop absorbing the impact and start reflecting it. Consumer and business surveys are already front-running it. The University of Michigan’s 5–10 year inflation outlook just hit its highest since 1991. The Conference Board’s short-term gauge spiked back to 6.0%. The New York Fed’s April survey? A mixed bag—but with the 3-year horizon climbing to its highest since mid-2022.

Market-based inflation gauges like the 10-year breakeven are ticking up, not exploding—but the trend direction is enough to keep the Fed watching closely. Meanwhile, prices-paid components from April’s ISM data are flashing 2022 vibes, with both manufacturing and services input costs creeping back toward uncomfortable territory.

Here’s the policy reality: the Fed can’t ignore this surge in expectations, especially with core PCE still dancing around 4.0 % on year-end expectations. But at the same time, they know tariffs are distorting the signal—inflating prices while decelerating real demand. It’s a stagflation trap, and the Fed’s threading the needle with every meeting.

The base case? Rates stay on hold, but not because the economy’s overheating. Rather, the Fed needs time to see which side of the dual mandate cracks first. Right now, they're betting inflation expectations don’t fully unmoor, and cooling crude prices (off 20% since Jan) plus softening global demand give them cover. There’s also growing confidence that tariffs, while noisy up front, will eventually drag on consumer and business spending hard enough to flatten demand-side inflation into Q4.

Some desks are trimming inflation forecasts, now eyeing headline CPI peaking around 3.5% and core PCE at 3.7 % by year-end—still high, but manageable. And with demand projected to roll over by late Q2, the path to rate cuts reopens in July, even if tariffs keep the optics messy.

Powell’s still clinging to the “anchored” narrative, but markets see the rope fraying. Inflation expectations aren’t unhinged, but they’re drifting—and the Fed knows it. If oil stays soft, demand fades, and tariffs don’t fully entrench themselves in the pipeline, the Fed can afford to hold for now and pivot mid-summer. But if expectations surge further and consumer inflation psychology gets rewired? Then the Fed’s 2% “bedrock” looks more like a pipe dream.

CHART OF THE WEEK

The Key Number: 6,000,000,000,000 RMB

Beijing’s about to open the fiscal floodgates—6 trillion RMB (~$830 billion) in net government spending this year—to cushion the blow from Washington’s tariff barrage. But make no mistake: this is damage control, not stimulus-driven acceleration. Even with the bazooka locked and loaded, base case growth is sliding.

Forecasts for 2025 and 2026 GDP are now shaved to 4.0% and 3.5%, respectively, down 50 bps each. And frankly, that still assumes this wave of U.S. tariffs doesn’t get even uglier.

The problem? Policy easing can’t fully offset external body blows, especially when the global supply chain is re-routing, foreign investment is recoiling, and the domestic consumer is still navigating a confidence crisis. Throw in opacity around key economic data and capital flight whispers, and the margin for error narrows fast.

$830B in lifelines will help cushion the drop—but if U.S. tariffs stick north of 100%, China’s growth glidepath is heading lower. This isn’t stimulus for upside—it’s a fiscal airbag to soften the geopolitical collision. Markets hoping for a China-led demand bid in 2H might want to mark that to reality.

(Click on image to enlarge)

More By This Author:

Tariff Relief For Sale - Price Tag? Buy American

Powell Channels Cool-Hand Luke, And Trump Ropes The Bears With AI Rhetoric

From Risk-On To Risk-Gone: Markets Buckle As Trade Fog Thickens