A Rough Week At The Office

Image Source: Unsplash

MARKETS

It was an ugly week for stocks, and Friday piled on the pain. The latest jobs report did little to calm nerves, while AI hype got another reality check, sending tech stocks into a tailspin.

The U.S. economy added 142,000 jobs in August, a modest bump from July but falling short of economists' hopes. The unemployment rate dipped ever so slightly, but the mixed signals left investors with more questions than answers—especially regarding the Fed’s next move. Will they slash rates by a hefty half-percentage point? Nobody knows, and that uncertainty is rattling the markets. The benchmark 10-year Treasury yield mainly dived to its lowest point during Friday’s volatile session.

The key number here was 150k, the approximate replacement rate for jobs, and with August clocking in at 142k, the market is staring down the barrel of a rising unemployment rate. This signals we're flirting with a "growth recession," where things slow down but don’t fully collapse. It's not catastrophic, sure, but it's far from a sunny outlook. Earlier in the week, the Beige Book dropped an even gloomier forecast, hinting at something more dire than a sub-100k payroll report could suggest. It feels like the markets are bracing themselves as if the economic gates of purgatory are about to creak open.

Then there’s the tech sector, where dreams of AI-driven profits hit yet another harsh dose of reality. The Nasdaq got hammered, dropping about 2.5% on Friday alone and logging a brutal 5.6% loss for the week.

Broadcom (AVGO) took the biggest hit after its revenue forecast fell short of analysts' rose-tinted projections, dragging the index down. Nvidia (NVDA) wasn’t far behind, as investors questioned whether AI demand could justify those sky-high valuations. It looks like the AI dream machine just hit another significant speed bump.

Longer-term rates have quietly slid since April as the market eagerly awaits rate cuts. But here’s the kicker—economic surprises have been underwhelming, and interest rate-sensitive cyclical stocks are having difficulty finding their footing. It makes you wonder: will those rate cuts be the magic bullet everyone’s banking on? Or are we watching a market running on fumes, clinging to the hope of miracles that may never come? Hence, sell the first cut, is in play.

Here’s the psychological twist: slashing rates big right from the jump could send the markets into a full-blown panic. Historically, a bold 50bps rate cut screams "emergency mode"—and that's definitely not the image the Fed's trying to project. But here’s the kicker: dropping a half-point cut on September 18 would have investors whispering, “Wait, what do they know that we don’t?” And the Fed? Yeah, they're not looking to ignite a Wall Street guessing game.

Fed’s Christopher Waller stuck to the script, signalling that a "careful" rate cut in September is on the table, but he left the door open for more aggressive moves if the data calls for it. Interestingly, with the latest NFP data, it seems Waller wasn’t as rattled as the markets. Speaking at his old stomping grounds, the University of Notre Dame (#GoIrish), Waller pointed out that Friday’s jobs report aligns with an economy growing at a modest pace.

"Today’s job report continues the longer-term pattern of a softening labor market that’s consistent with moderate growth in economic activity," Waller noted. In other words, while the market might be biting its nails, Waller sees a measured slowdown—nothing to panic about just yet.

FOREX MARKETS

It was one of those sessions where you had to be light on your feet. In a rollercoaster day for USDJPY, the yen finally found its stride, riding the risk-off wave, buoyed by falling 10-year UST yields. It wasn’t smooth sailing, but the volatility gave the JPY the edge as the market pivoted into risk-off mode. The yen has been a reliable hedge all week, soaking up the pain from the equity market. Meanwhile, crowded trades like gold didn’t fare well, as traders cashed out to cover stock losses—typical of a rough day at the office.

We witnessed a textbook display of risk-off dynamics in the FX market: the safe-haven JPY flexed its muscles, gaining strength, while high-beta currencies took a stumble, falling victim to the market's retreat from risk assets.

OIL MARKETS

Oil prices, which have been utterly defenceless lately, didn’t stand a chance as the risk-off wave crashed through broader markets. Like the yen, which has been used as a haven, short oil is now used as a hedge against economic downdrafts . Forward pricing has slipped into the eerie landscape of negative payroll expectations, signalling that traders are looking straight past OPEC’s decision to delay adding voluntarily cut barrels back to the market for two months. The economic writing is clearly on the wall here, with traders likely aiming for sub-$70 Brent as early as next week.

NUTS & BOLTS

It’s been two weeks since Fed Chair Powell laid down the gauntlet: “The time has come for policy to adjust,” setting the stage for the much-anticipated rate cut on September 18. He also threw in a zinger, stating: “We do not seek or welcome further cooling in labour market conditions.” Translation? The Fed's next moves would be laser-focused on labour market data, and boy, did we get a lot of it this week.

First, payrolls came in at 142k for August, with a hefty 86k worth of downward revisions to the prior two months (July now at 89k vs. 114k, and June at 118k vs. 179k). The three-month average is now down to 116k, a far cry from the March high of 267k—clearly, the labour market is running out of gas.

Household employment posted a modest 168k gain, a five-month high, but let’s not throw a parade just yet—the broader trend has been weaker than payrolls.

The unemployment rate dipped slightly to 4.2%, with the labour force ticking up by 120k. Still, the "Sahm Rule" is in play, signalling we're not out of the woods. The current three-month average jobless rate is 0.57 percentage points above its low during the past 12 months.

Average hourly earnings ticked up 0.4% in August, pushing the annual growth rate to 3.8%, a two-tenths increase. It's not exactly inflation-busting, but it's still enough to make the Fed sweat a little.

The Fed’s Beige Book painted a mixed picture: “Employment levels were generally flat to slightly up... but a few districts noted reductions in shifts, hours, or headcounts through attrition.” Layoffs? Still rare—at least for now.

Meanwhile, initial unemployment claims fell by 5k to 227k for the week ending August 31, with the four-week average at 230k—its lowest in nearly three months.

But here's where things get a little hairy: job openings dropped by 237k in July, with labour demand shrinking by 148k after accounting for the 89k payroll rise. Openings have now fallen in four of the last five months.

The job openings rate slid 0.2 points to 4.6%, while the ratio of openings to the unemployed fell from 1.16 to 1.07. The quits rate nudged up to 2.1%, and the hires rate climbed to 3.5%.

Put it all together, and we’re staring at a cooling labour market—but not enough to make the Fed hit the panic button with a 50-bps cut. It’s looking more like a 25-bps move on September 18, but as always, stay tuned for the twists and turns as we roll into November and December.

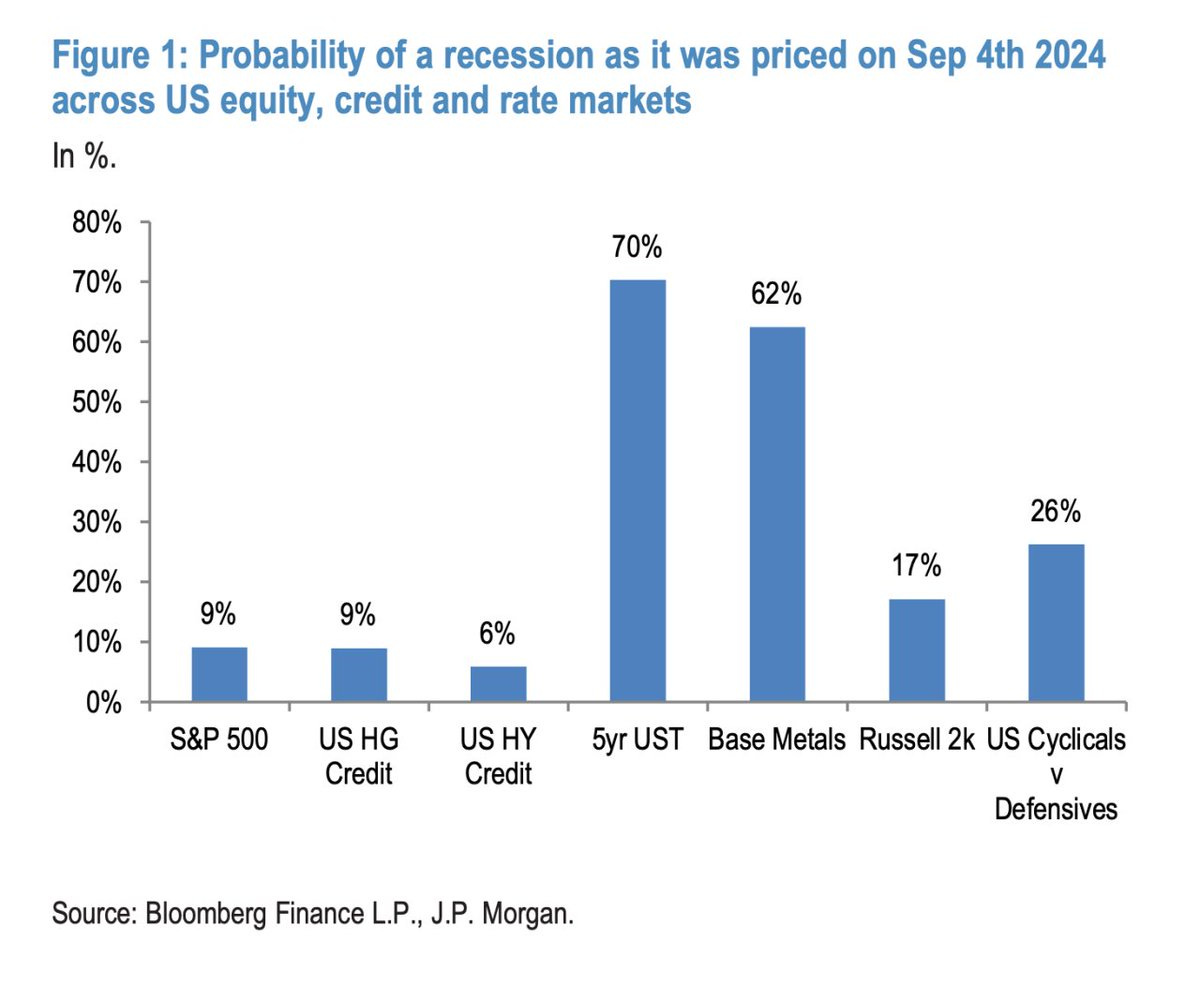

CHART OF THE WEEK

It's a bit dated now, given that stocks are increasingly pricing in recession risks, but you get the picture. The glaring disconnect between FX, bonds, commodities, and equities is like watching four different movies at once, each with its own plot twist. FX, bonds, and commodities are gearing up for a negative jobs number, while equities are still clinging to that soft landing dream. Something’s got to snap, and when it does, it’s going to be quite the plot twist.

More By This Author:

The Glaring Disconnect: Investors Pin Hopes On Miracles That May Never Materialize

Risk Sentiment Shaken By JOLTS Report

Resurgence Of Growth Fears