A Peek Into The Fed’s Rate Hike And The Thriving Stock Market

Image Source: Pixabay

In an era of financial unpredictability, today’s economic landscape offers a blend of anticipation and assurance as we delve into rate hikes, global GDP predictions, and the resilience of the stock market.

A Highly Anticipated Announcement from the Fed

All eyes are on the Federal Reserve today, set to make its critical rate decision at 2:00 pm. The market has its calculations ready, with a 97% probability of a 25 bps rate hike to 5.5% expected. It will be the 11th time the rate has increased since the start of 2022. However, it seems as if the tumultuous times of rampant inflation and incessant rate hikes are finally behind us. Instead, the stock market is flourishing, fueled by a newfound sense of clarity and stability.

The IMF’s Global GDP Projection

As per the figures available at 4 pm EST on July 25, 2023, the International Monetary Fund (IMF) predicts the global GDP will grow by 3% in 2023. The prediction, an upgrade from the 2.8% projected in April, still falls short of last year’s 3.8% growth. Even as the IMF leaves its forecast for 2024 growth unaltered at 3%, it forewarns that risks continue to be “tilted to the downside”. These risks encompass tighter credit conditions, diminishing savings, and a less-than-ideal recovery in China.

Revival of the Chinese Economy

The Chinese authorities, acknowledging the struggles of their economy, have pledged support. The Politburo in Beijing has resolved to take stimulus measures. These efforts will primarily concentrate on property, local government debt, household consumption, and employment. In the wake of this announcement, Chinese stocks witnessed their most significant rally since March, driven by property developers.

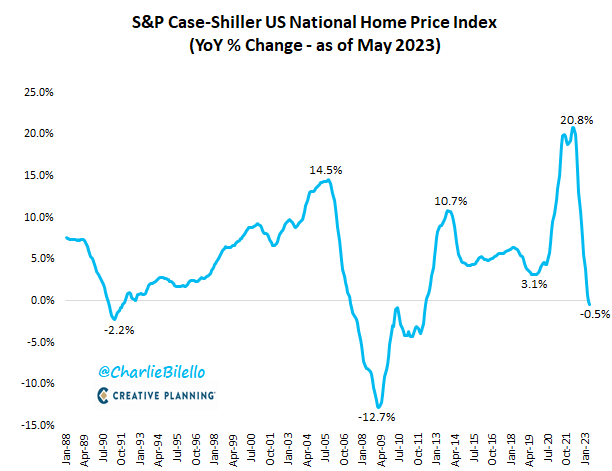

U.S. Home Prices On the Rise

For the third consecutive month, U.S. home prices have outperformed expectations. The Case-Shiller Index reports a rise by 0.7% month-on-month in May, marking the fourth continuous gain. Even though prices dropped by 0.5% annually, they are a mere 1% below their peak in June 2022. The limited inventory, when compared to buyer demand, is continually exerting an upward push on prices, although regional data fluctuates broadly.

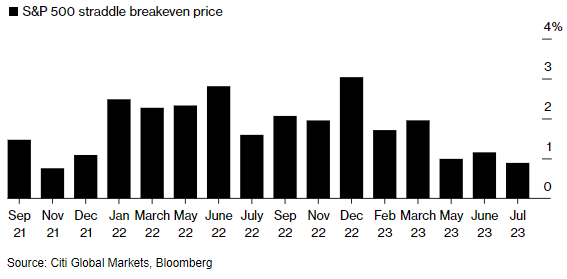

Fed Rate and the Impact on Market

Today is a day eagerly awaited by many — Fed Day! The Federal Reserve is nearly guaranteed to increase rates by 25bps this afternoon. However, how much of this is already factored into the market prices? If options traders are any indication, almost everything. In fact, they anticipate the tightest trading range (0.9%) for a Fed Day since November 2021.

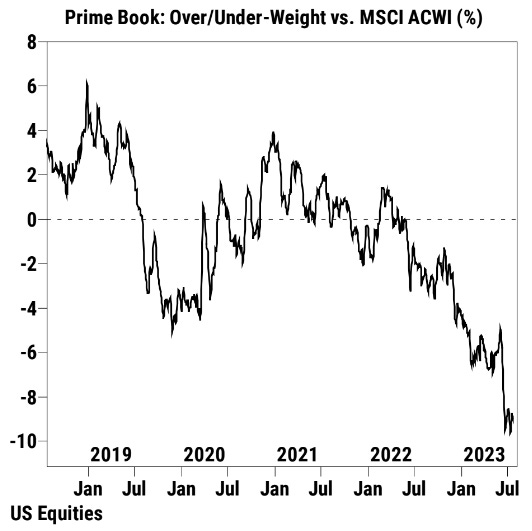

Hedge Fund Activity

So what has the “smart money,” i.e., hedge funds, been doing? These funds have modestly increased their U.S. stock purchases in July, following a sell-off in June. Yet, they remain underweight. The majority of this month’s buying has been spurred by short covers. The tech sector, especially semiconductor and software stocks, has seen the most shorting in July. Looking at the bigger picture, hedge funds are almost at their most underweight U.S. stocks relative to global stocks (9th percentile).

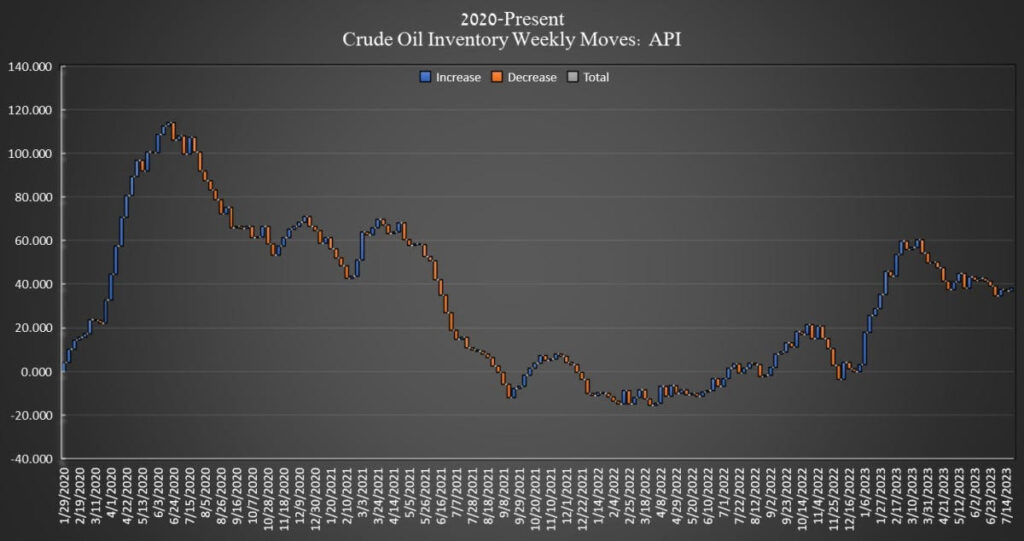

Crude Oil Prices Remain Steady

Lastly, oil prices maintained their position above the 200-day moving average yesterday. This stability comes despite an unexpected increase in crude oil inventories, offset by optimism about Chinese stimulus and an improved global outlook from the IMF.

More By This Author:

Financial Markets Weekly Performance Analysis vs Portfolio FlagshipFiscal Forecasts: A Deep Dive Into Current Economic Indicators

Heading Towards A Soft Landing: Economic Expectations And Key Insights

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. On average around 80% of retail investor accounts loose money when trading with high ...

more