A Golden Valentine

Today is Valentine’s Day. It’s also CPI report day. On this interesting day, will there be love for gold?

For some insight into the matter,

(Click on image to enlarge)

short-term gold chart

For the past few days, gold has been oozing around $1860 after staging a $100/oz “price sale”.

The drop happened after roughly a $350/oz rally from $1610 to $1960.The bottom line: Given the size of the rally, the $100 pullback, although violent, is normal and expected.

(Click on image to enlarge)

daily gold chart

The good news is that the lead line of the 14,7,7 series Stochastics oscillator is now oversold.

The next positive event would be a crossover buy signal for the oscillator that occurs with the gold price above the 618-day moving average (a key Fibonacci number).

(Click on image to enlarge)

On the weekly chart, the 14,5,5 series Stochastics oscillator is overbought and flashing a sell signal.

All investors can do is cheer for higher prices and hope for a “flat line” event for the oscillator in the overbought zone.

What about the fundamentals? Well, hopes for a duty cut from the Indian government are gone for now, but China’s economy continues to rebound.

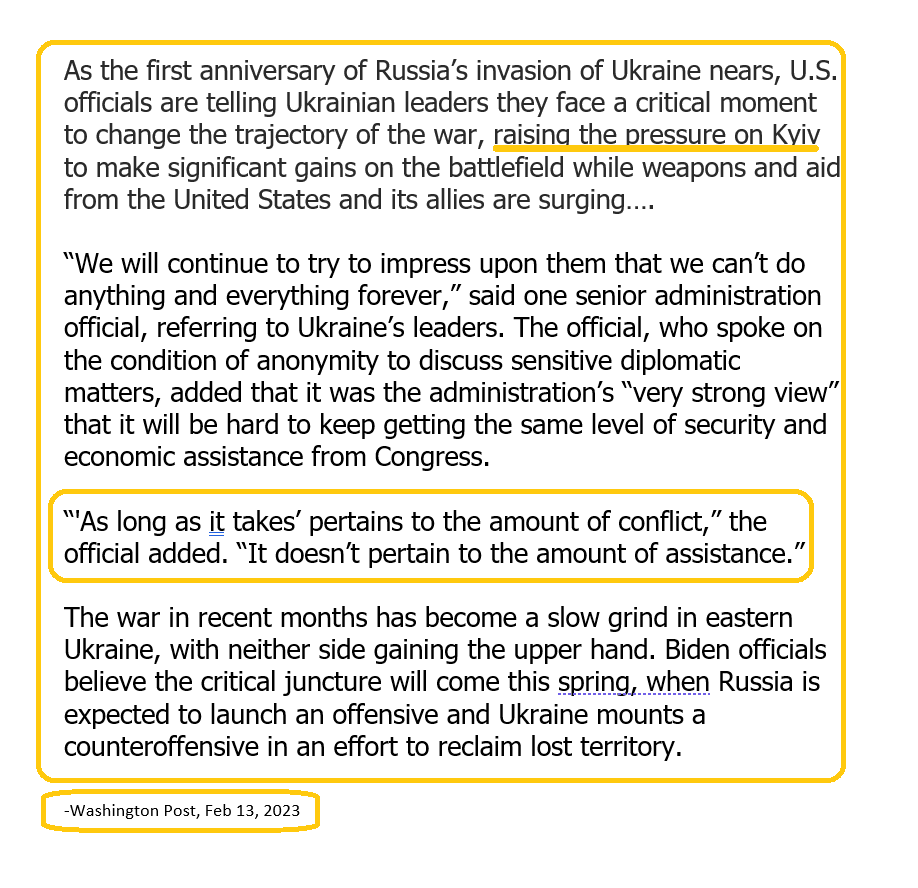

In the last election, some republicans decided that the endless bravado and “America is number one!” tweets of gibberish from President “Super Trumpy Man” were reason enough to vote for a deranged draft dodger turned chicken hawk. They got President “Jackboot Joe”.

While it’s obvious that the US government has already failed in yet another disastrous debt-funded war (Ukraine), what’s more concerning is that money and arms for the corrupt Ukrainian government may be diverted towards starting an even more horrifying war against China in Taiwan.

While this is horrifying news for the citizens of Taiwan and for the whole world, it’s great news for gold.

What about the US stock market? Well,

(Click on image to enlarge)

The consensus of US money managers is that the Fed will cut three times in 2023 and go on a wild cutting streak in 2024.

That’s the basis of the maniacal buying of the US stock market that has occurred since I issued my shocking buy signal at Dow 30,000.

Fed leader Jay has been adamant that these anticipated rate cuts won’t play out as expected. If his actions match his words, the stock market rally will die.

The money managers expect America to slide into recession. If that happens and Jay remains firm, the stock market won’t simply decline… it will turn into what is best described as… a towering rice paper inferno.

Jay will likely be watching the price action of oil closely for cues about inflation. On that note,

(Click on image to enlarge)

A large bull wedge breakout is in play, but so is a negative H&S top pattern.

It’s possible that oil oozes back into the wedge pattern and trades near $65 before beginning a big leg higher.

(Click on image to enlarge)

The dollar index sports a huge H&S top. A break below the neckline would occur at the key number of 100. Mainstream analysts are focused on Fed rate cuts as the driver for a lower dollar, but I would suggest they need to be open to a scenario where the Eurozone and Japan become more hawkish, while the Fed stands firm.

My scenario is negative for the dollar and the stock market. It’s positive for oil since oil trades in dollars.

In the short-term, the mainstream thesis of imminent rate cuts and a lull in the war cycle has seen the stock market favored. Gold, silver, and the miners have swooned. Can the situation change?

Well,

Metals market investors need some patience. It will take a few more months for money managers to learn (the hard way) that Jay isn’t a stock market investor’s whipping boy who does all their bidding.

The inflation era is only beginning, and as the stock market rally dies, rates continue higher, oil moves back above $100, and tensions with China increase, money managers will turn to the miners with the most consistency since the 1970s. Are investors prepared?

(Click on image to enlarge)

awesome GOAU chart

The pullback has put GOAU at the outskirts of a massive support zone and a huge C&H (cup and handle) pattern may be in play.

In a nutshell: mining stock investors need to jettison concerns, put on their space helmets, wave some pom poms, and get ready for the bull era ride of a lifetime!

More By This Author:

A Triple Whammy For Gold: What Now?Gold Prices For Action $1880 And $1808

Gold Stock Race Cars On A Bull Era Track