A Gold Exposé: The 60/40 Deception

Image Source: Pixabay

Earlier this year, I wrote to you about the Ol’ faithful 60/40 portfolio.

That’s because in May, it was dead.

Markets were too volatile, too over-priced…

And ridiculously backwards.

Yet, if you were to have set yourself up with a simple 60% stocks and 40% bond portfolio near the end of 2023, you’d be making record gains right now.

|

|

Investment in AI infrastructure is pushing stocks higher.

And in the case of Nvidia (NVDA), for example, stocks were selling more than 23 times the company’s projected sales just a month ago.

Since it’s been over two years now of higher-for-longer federal fund interest rates, the long-term effect on bond yields for a portfolio are also positive. Increased bond yields are adding portfolio profit.

But, those gains can be deceiving.

Equities are in a bubble, and…

Bonds are only now contributing to higher profits.

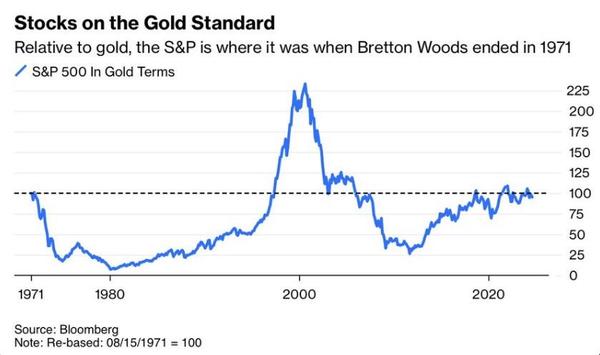

First, we can look at stocks. When you consider the S&P 500 valued in gold, you see a different story.

|

|

Since 1971, the S&P relative to gold shows not much change at all.

In fact, if you zoom in to see what the $6 Trillion in money-printing by the Federal Reserve has done to produce real value for the economy in gold terms, you see it’s not much.

$6 Trillion later, US equities are still below what they were during the Bretton-Woods era of the gold standard.

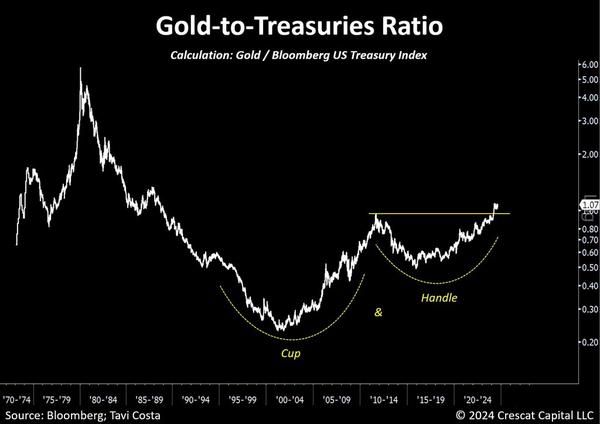

Now, if you consider Gold to US Treasuries, the ratio forms one giant cup and handle.

|

|

Since the start of Quantitative Easing(QE), gold has not made much headway…

Until recently, gold has broken out with much of the action happening in the past two years.

Seeing this, which would you rather buy?

More treasury bonds based on USD?

More passive investing with faith placed in your bank’s financial advisor (who advises you to go with the “conservative” 60/40 pie chart based on three options on the paper in front of you)?

Most likely not.

Here we see the value of gold.

More By This Author:

Gold’s Moment Of Truth: It Happened Over 13 Years Ago. It’s About To Happen Once MoreThe REPO Act: A Precursor to the Dollar’s Downfall

Buffett Indicator Nears New High