A Desire Fulfilled: 3 Factors Driving Gold Soaring Prices

Image Source: Pixabay

Gold bugs everywhere, rejoice!

Yes, a desire fulfilled is like eating from a fruitful tree.

And now, it bares the fruit…

Sudden movements for gold prices.

Bloomberg reports:

Gold Hits Successive Record Highs Ahead of Expected Fed Rate Cut

“Bullion climbed as much as 1% to $2,583.45 an ounce on Friday, putting it on track for a weekly gain of more than 3%.

Gold has surged by more than a quarter this year, supported by the Fed’s path to monetary easing.

Central-bank buying and strong haven demand due to conflicts in the Middle East and Ukraine have helped the advance, while interest from retail investors is also picking up.”‘

While Bloomberg published the above gold price before 10:47AM on Friday, gold futures on the COMEX were actually pricing over $2610.70.

These high hopes are based on a 50bps rate cut anticipated for September 18 (which is when the appointed bureaucrat will push the proper buttons on the mysterious unseen keyboard controlling to the world’s most powerful currency).

And so, in the midst of the fiat printing void, our good ol’ gold prices push higher.

By the time this message hits your inbox, prices may well be past $2650, but now I see gold is closing around $2577 – still higher, and probably higher as we move towards the 18th.

Yet, it is not just the cutting of interest rates that is driving gold prices up, it is unparalleled deficit spending in a time of unparalleled debt interest payments.

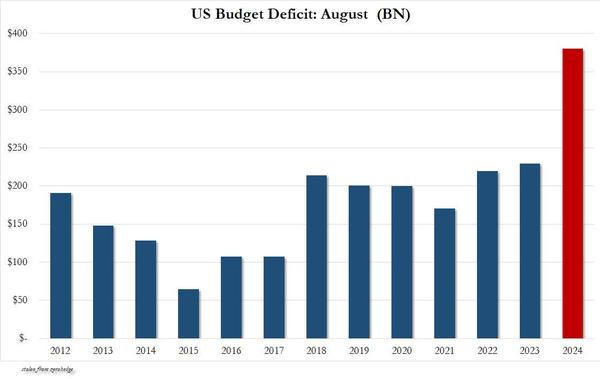

In August, the Federal government came up $380 billion short, $89 billion more than the same time last year.

Astounding!

(source: zerohedge.com)

But these are the kind of things bureaucrats decide are needed when executing policies.

As an example?

$1.3 Billion in military aid to Egypt – no strings attached…

Among other “drops in the bucket” US federal spending remains out of control.

It is so out of control that interest payments on federal debt now rival social security to become the heaviest line item on the federal budget.

CNBC reports:

Interest payments on the national debt top $1 trillion as deficit swells

“The U.S. government for the first time has spent more than $1 trillion this year on interest payments for its $35.3 trillion national debt, the Treasury Department reported Thursday.

With the Federal Reserve holding benchmark rates at their highest in 23 years, the government has laid out $1.049 trillion on debt service, up 30% from the same period a year ago and part of a projected $1.158 trillion in payments for the full year.

Subtracting the interest the government earns on its investments, net interest payments have totalled $843 billion, higher than any other category except Social Security and Medicare.

The jump in debt service costs came as the U.S. budget deficit surged in August, edging closer to $2 trillion for the full year.

With one month left in the federal government’s fiscal year, the August shortfall popped by $380 billion, a dramatic reversal from the $89 billion surplus for the same month a year prior that was due largely to accounting maneuvers involving student debt forgiveness.

That took the 2024 deficit to just shy of $1.9 trillion, or a 24% increase from the same point a year ago.”

Make no mistake.

Deficits will most likely continue.

Unfortunately, the the only way for the federal government to pay down the debt now will be to force the Fed to print more money. Then the Fed buys up the debt, placing it on their balance sheet until it runs off.

Basically, the federal government cannot meet the demands of its own budget. So they must unofficially take control of the central bank to meet the demands of their fiscal spending.

Fiscal spending, which is now almost driven by debt interest payments.

That is what commentators mean by “fiscal dominance.”

It’s all good news for gold.

So do not defer your hope…

Your desire will be fulfilled soon enough.

More By This Author:

Right On The Dollar: Devaluation Lining Up For The Fall?

A Gold Exposé: The 60/40 Deception

Gold’s Moment Of Truth: It Happened Over 13 Years Ago. It’s About To Happen Once More