A Contrarian Call For 2023: Stocks Up, Silver Up

Photo by Kanchanara on Unsplash

Every year in markets is vastly different. You might want to ‘enjoy’ the last 9 weeks of 2022 which was one of the most challenging years in history, a true rollercoaster year. Stocks were down and our favorite metals lithium and silver started the year very strongly but were hammered around the start of the summer. In our 2023 forecasts we described why we expect a good year for stocks (still volatile but less so than in 2022), a bullish 2023 for silver, and a very bullish 2023 for lithium stocks. Contrary to what pundits are trying to sell you, there will be no stock market crash in 2023. Note that all these forecasts are correlated, they are part of the same underlying trend as we’ll explain in this piece.

The market forecasts mentioned above all start by answering the question of whether there will be a market crash in 2023. Our belief is that markets won’t crash in 2023. They had plenty of opportunity to crash in 2022. While the market came down a lot, it did not crash. What happened is a rotation between sectors on a scale that was never seen before.

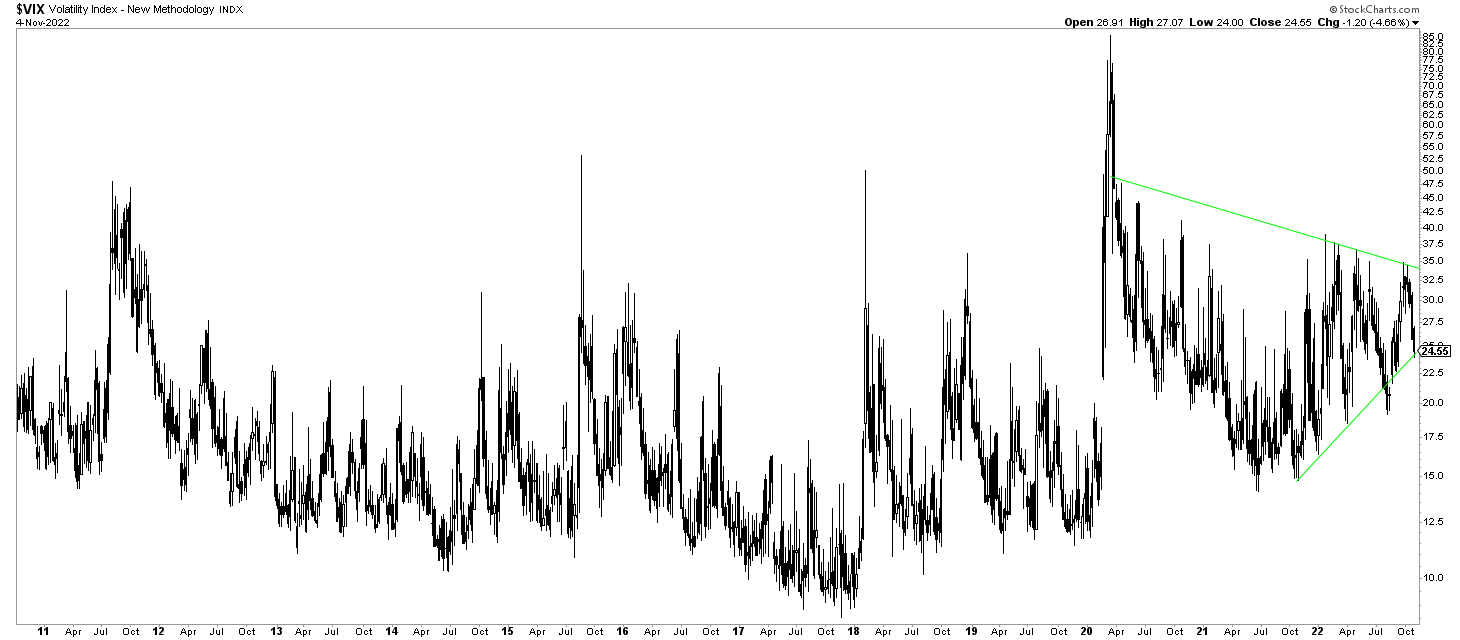

This epic rotation between markets and sectors is reflected on the long-term VIX chart.

(Click on image to enlarge)

One of the reasons we believe markets will resolve higher, not lower, is that VIX had plenty of opportunity to erupt, similar to how it went above 40 points back in 2008, 2011, 2018, or 2020. It didn’t happen in 2022. What we got, instead, was a steady and high level of volatility, which broke the morale of at least 50 to 70 pct of investors. This, in turn, broke the portfolios of many investors by over-trading, changing strategy, buying at local tops, and selling at local bottoms.

The big topic in 2022 has been inflation. It has been the driver of monetary decisions, pushing the U.S. Dollar and yields higher, metals and markets lower, since May of 2022.

This inflationary and Intermarket trend is in the process of reversing, this is why:

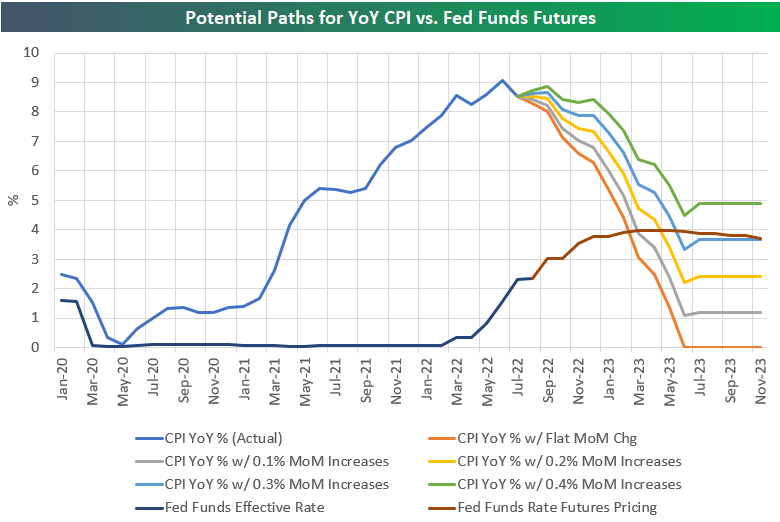

As shown on this chart, courtesy of Bespoke Invest, m-o-m CPI readings are coming down. More importantly, some 4 months from now, y-o-y CPI readings will come down a lot (compared to the headline 8% figures that are dominating headlines currently).

This is what we learn from this chart:

- Let’s think worst case scenario: m-o-m inflation readings of .4%. Even in that case, the y-o-y inflation will fall to 4.5% by May 2023.

- In the ‘base case scenario’, with m-o-m inflation readings of .2%, the y-o-y inflation will be close to 2% by May of 2023.

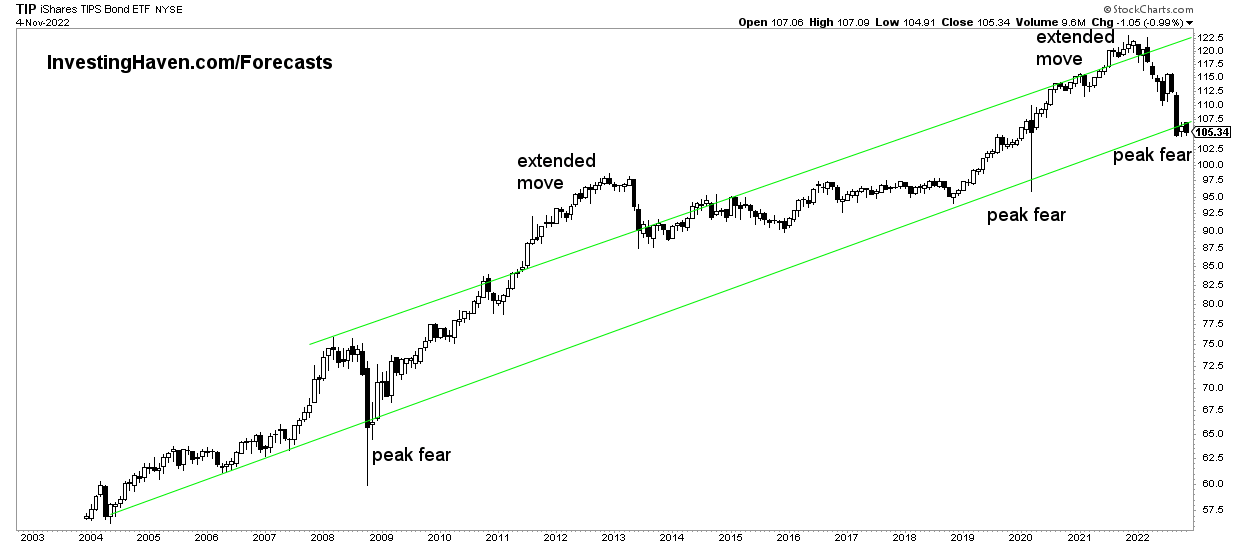

What’s more, inflation expectations (as per TIP ETF) came down a lot in 2022. That’s because of the tightening by the Fed and other monetary policymakers around the world. It is reasonable to expect that inflation expectations are in a bottoming process, one that might take a few months to complete. Similar to the TIP ETF bottoms in 2008, 2018, and 2020, this could and should coincide with a bottom in markets.

(Click on image to enlarge)

In our public post “no stock market crash in 2023” we looked at the market from several angles and came to a consistent conclusion:

- Volatility has been persistent but not explosive.

- An epic market rotation dominated markets, not a crash.

- Inflation will decelerate fast in 2023.

- Inflation expectations are in a bottoming process.

- SPX is in the process of printing a bullish reversal.

- S&P 500 forward earnings sideways, not crashing.

- Market breadth already reached crash levels in 2022.

- Contrarian readings in the bull vs. bear ratio suggest a buying opportunity (not sell).

- The consensus expectation is a hard landing, the market rarely follows the consensus.

While we believe that stocks will move higher in 2023, we also believe that 2023 will be a bi-furcated year for stocks. That’s because of the structural impact of higher interest rates. Some sectors will do well, others will barely move.

So far stocks.

What about metals?

Frankly, there are 2 metals that we like a lot: lithium and silver.

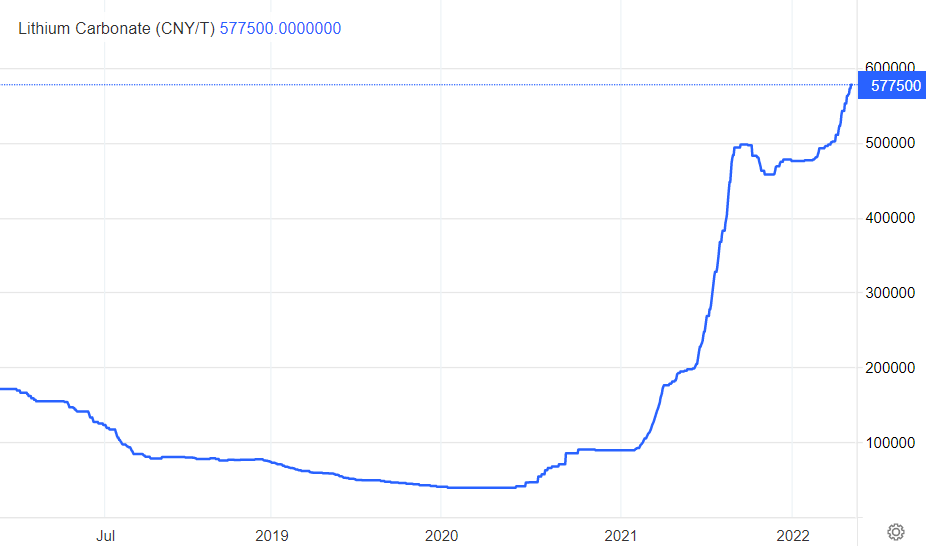

Lithium is a no-brainer. The spot chart says it all. It is the only commodity trading at all-time highs.

Lithium stocks, in the meantime, are only now starting to react. There has been a huge disconnect, though temporary, between spot lithium and quality lithium stocks. This disconnect is about to resolve higher for lithium stocks.

In a way, we are going through a short window of opportunity in the lithium market.

Our Momentum Investing team published a lithium stock selection, based on a very thorough analysis of the lithium market. We have identified the structure and logic that the lithium market is following. We explained this in detail with our premium members on October 21st in “Lithium & Graphite top stock selection” available in the restricted area of the Momentum Investing service!

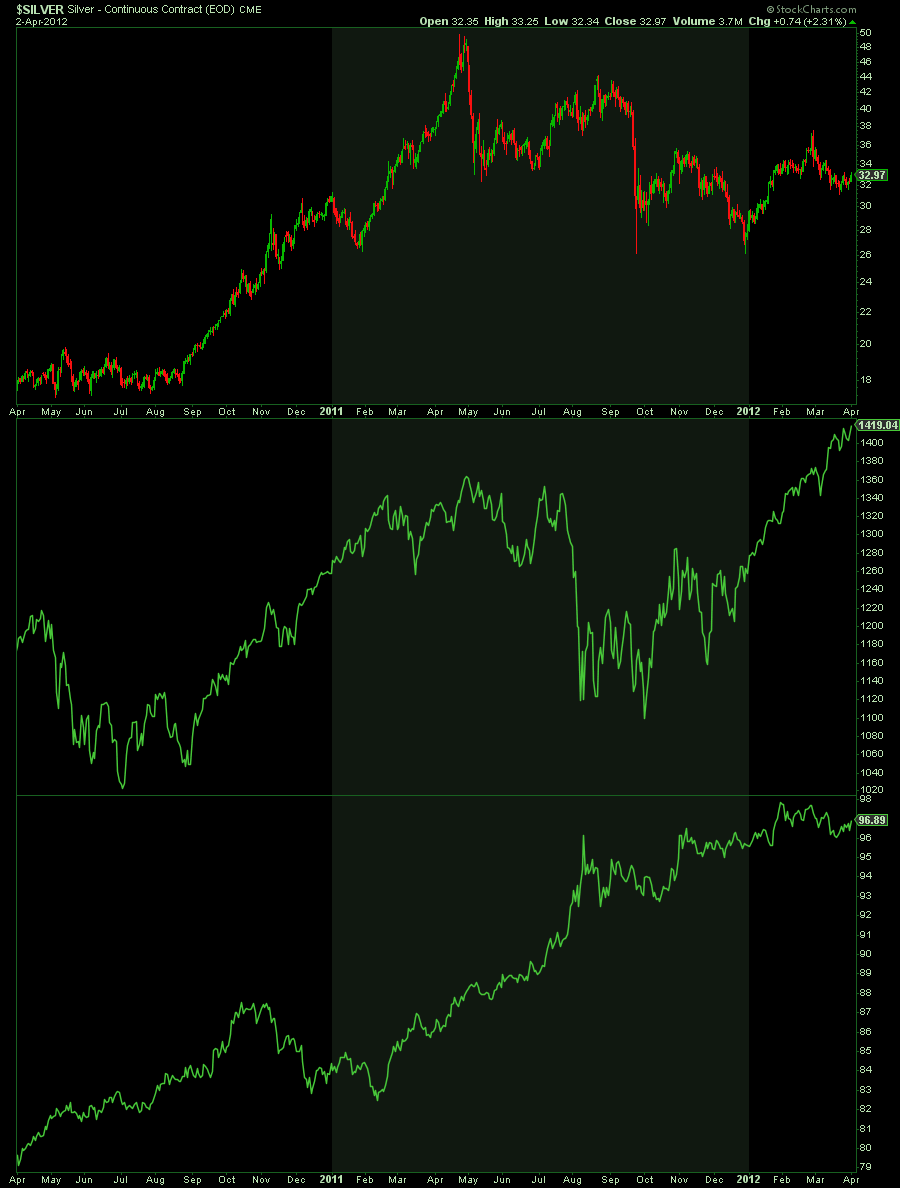

What’s interesting is that silver tends to perform well when stocks are rising. We made this point by comparing the price of silver with the S&P 500 and TIP ETF.

(Click on image to enlarge)

As seen on the above chart, rising stocks and silver prices go hand in hand, not always but certainly during the strongest bull runs in silver.

Both stocks and silver need rising inflation expectations.

Stated differently, one of the key indicators for investors going into 2023 will be TIP ETF. Once TIP ETF starts rising we will have a green light to aggressively enter beaten-down quality stocks and also initiate silver positions. By then, however, it might be too late to enter the lithium market because we believe there is a short window of opportunity in lithium which is now.

Stocks and silver will go up in 2023 provided TIP ETF move higher in 2023.

More By This Author:

Is The U.S. Dollar About To Confirm An Epic Bullish Bottom In Silver?Healthcare & Biotech Stocks: A Big Opportunity In 2023

A Bottom In Markets Feels Ugly! This Is What It Looks Like.

Disclaimer: InvestingHaven.com makes every effort to ensure that the information provided is complete, correct, accurate and ...

more