A Bull Era For The Miners

Tomorrow’s Fed decision is adding to the wild action in the metals market. The white metals (silver, palladium, and platinum) all experienced huge price swings on Monday.

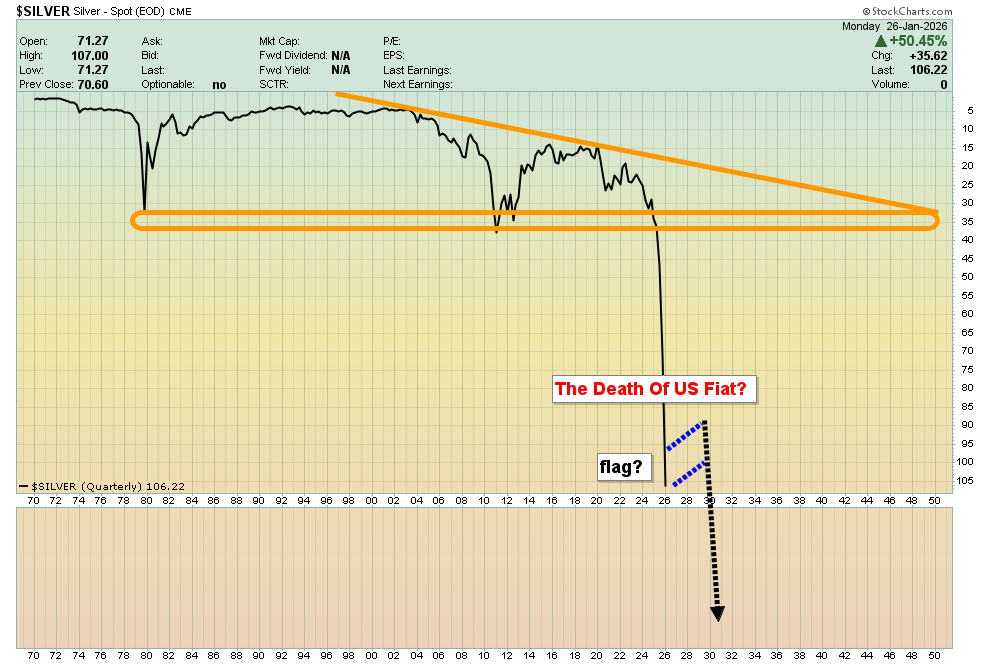

(Click on image to enlarge)

Fiat monies die over time, but there are occasional rallies and the next one against silver could take the form of a bear flag.

Amateur stock market investors like to “outperform the indexes” and “sell at the top”, rather than seeking an all-weather allocation that is stress tested.

Investor allocation needs to be tested for both upside and downside scenarios of significant personal surprise.

Western gold bugs can get caught up in a similar situation… trying to outperform the metals with their miners rather than simply investing… to win. Once an investor becomes frustrated, irrational decision making can occur.

nvestors who are worried about a significant rally for government fiat monies against their miners and metal should book partial profits now…

But only enough to be able to manage (and buy) a price dip of surprise.

What about US politics and the metals? Well, there are rumours that the government is looking at “critical” investments in US silver companies… and at stockpiling silver itself.

These rumours are likely putting a big floor under the price.

The upcoming mid-term elections could also provide more fuel for the metals markets; in Minneapolis, citizens put themselves in harm’s way of poorly trained and debt-funded ICE agents who, with the exception of their now-sidelined leader, appear too cowardly to do their jobs without masks, the same masks that armed criminals like to wear. Some of the citizens in protest mode have paid a heavy price for their adventurous actions.

In turn, this turmoil has deepened the democrat-republican rift in the congress and senate. The republicans probably should have focused much more on tax cuts for the poor and middle earners and left the round-up of the illegals until after those cuts granted them a landslide victory in the mid-terms.

Instead, in the eyes of millions of on the fence voters, the round-up went off the rails, and at the same time struggling citizens have been pounded with vile tariff taxes. Horrifically, all of this has occurred while government “pigs at the trough” have enjoyed ramping up spending on themselves and…

All the wild action is rocket fuel for gold!

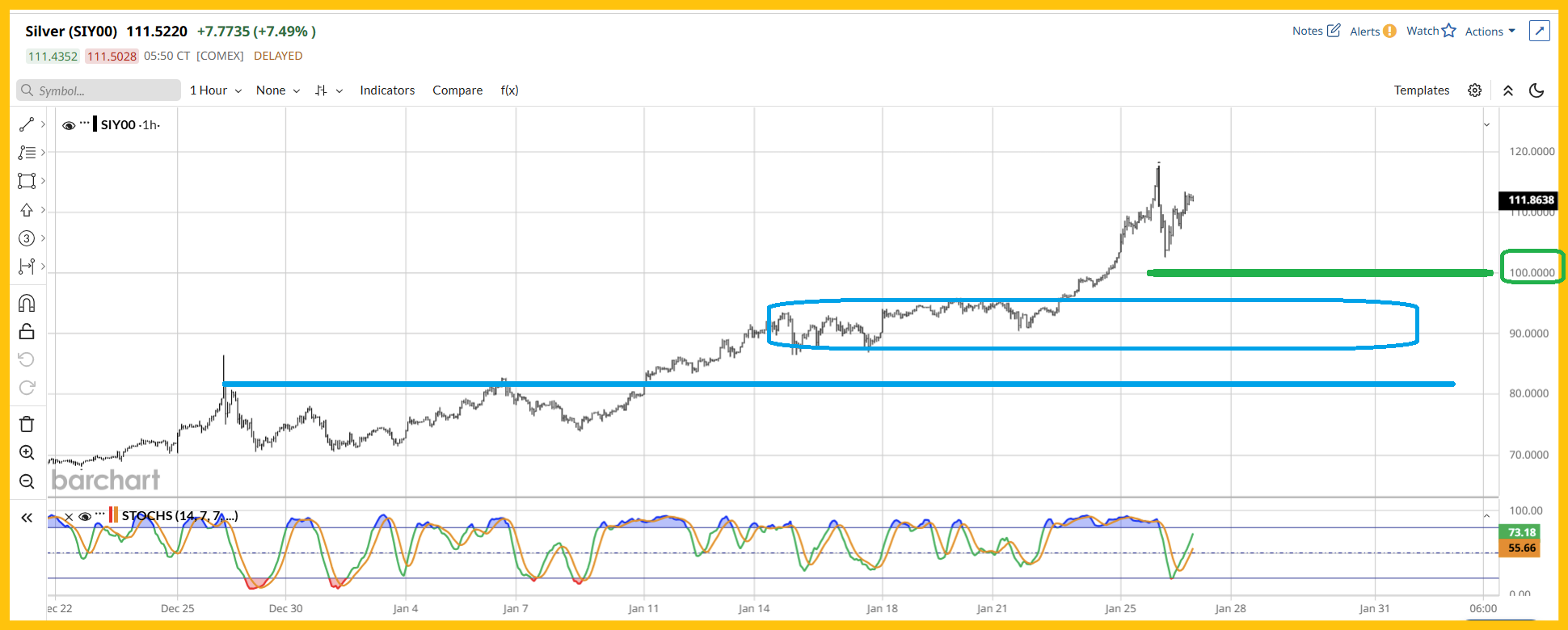

(Click on image to enlarge)

impressive short-term gold chart

The action around the big $5000 number is solid.

More than ten years ago, I forecast the demise of the silly Western “gold pays no interest” trade, but I suggested it would be a multi-decade process, rather than a one-time event. Currently, the debt-crazed US government demands lower rates for its bonds, while its creditors want higher ones… and some of these creditors no longer care what the rate is.

They believe the government has weaponized its fiat, and the fear is that other governments could do the same thing. They now want unencumbered gold, and it’s a trend that I’ll suggest is not only here to stay… but here to accelerate!

(Click on image to enlarge)

silver chart

The big round number of $100 has been cleared, and there are numerous floors of support just under that price. There is no need to call a metals market “top”, but there is a need for investors to book some profits and be prepared to buy the next significant sale in the price… a sale that may not begin until silver is above $120.

18. The miners? Gamblers can be 100% invested in the miners, but most investors should own significant amounts of metal too. At the current time, the big theme is a move from government fiat and bonds to physical metal. The “big” move to the miners won’t occur until the ridiculously overvalued US stock market incinerates… and that event may occur soon.

(Click on image to enlarge)

spectacular CDNX chart

A historic breakout occurred last week, and it likely ushers in a multi-decade “bull era” for junior miners who are tasked with finding critical minerals, silver, and supreme money gold.

While intermediate and senior miners have failed to outperform gold and silver, a myriad of CDNX and OTC-listed juniors are staging glorious ten, twenty, and even one hundred bagger action… with more to come! A pullback after this kind of breakout is expected and normal. Note that the neckline is the entire 1100-850 zone.

(Click on image to enlarge)

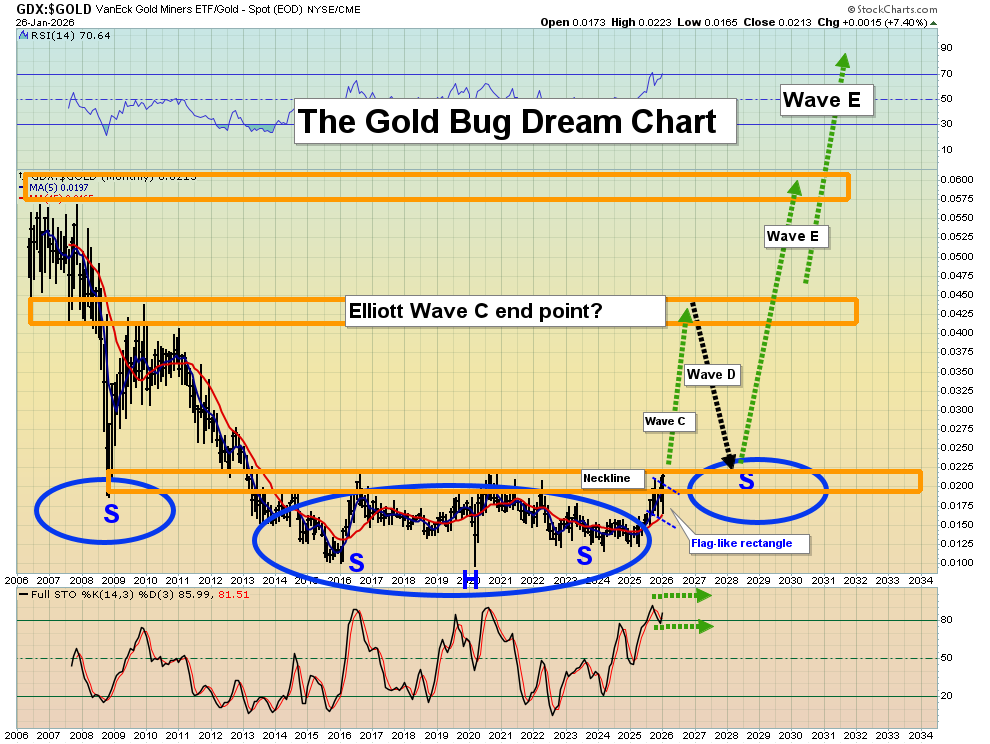

stunning GDX versus gold chart.

It’s the chart all intermediate and senior mine stock enthusiasts should focus on most.

GDX is now arriving at the neckline of the gargantuan inverse H&S pattern. Will the breakout be accompanied with an exciting crash in the US stock market?

In the 1970s, that’s exactly what happened. Gold stocks soared as stocks and bonds crashed. Money managers who are forced to stay invested in equities turned to the miners for salvation… and got it! Neckline action can be frustrating, but investors who can endure that frustration are likely on the cusp of price action that makes the 1970s look like a short-term warm up act. An awesome bull era for the miners is ready to start now!

More By This Author:

A White Hot Metals ChristmasTools To Get More Gold

The Problem Is Fiat