A Brief History Of Gold And The World Economy

The history of gold spans several millennia and the entire globe. The cornerstone of civilizations, used as a medium of exchange and then as a standard, gold as a currency helped create trust between individuals. As the heart of the global economy shifted, so did the world's gold reserves.

(Click on image to enlarge)

A few centuries before our era, exchanges were taking place in a variety of ways, the Greeks changed the course of history by making gold and silver universal currencies in the 7th century BC. The idea of adopting gold and silver coins as a means of exchange was then widely shared in the Mediterranean basin, and gradually throughout the world. Debts no longer took the form of foodstuffs, but of metallic currencies. History accelerated: ancient Greece develops at an astonishing speed, both in scientific and literary terms. Gold coins were minted and used in the region to trade spices and products of all kinds. Armies, notably that of Alexander the Great, were paid in gold.

Over the centuries, the center of the world economy shifted to Rome. Thanks to its many wars (in Africa, the East, etc.), the Roman Empire accumulated gold and built an unparalleled empire by the beginning of our era. At the same time, new mining techniques were developed to extract large quantities of gold. But this abundance led to cycles when the deposits ran out. And the rapid development of Asian countries led to major gold transfers. Between the 4th and 5th centuries in Rome, the tax burden continued to grow, civil wars followed one another, prices rose sharply, the rural exodus accelerated and demographics took a turn for the worse. The decline of the Roman Empire was inevitable. Until around the 12th century, gold was no longer minted in the West, and was held almost exclusively by the powerful.

(Click on image to enlarge)

The Sack of Rome by Karl Briullov (1836)

At the crossroads of the great trade routes, it was across the Mediterranean to Constantinople that most gold reserves moved, within the Byzantine Empire (also known as the "Eastern Roman Empire"). Trade flourished in the region, starting with a new gold coin called the bezant, which was issued until the 14th century. The products traded diversified and were exported as far as China. Thanks to a largely agricultural and artisanal economy, decentralized and interventionist, Constantinople grew and expanded. But this rapid growth slowed with the emergence of the Muslim world in the 7th century. With strategic armies, the unified Arab countries undertook numerous conquests, and Baghdad became the hub of the world economy.

Basilica of Saint Sophia, Constantinople (now Istanbul)

Dynasties were formed and schisms emerged. After Baghdad, it was in Cairo in the 10th century that international trade was concentrated, thanks to the Fatimid caliphs - who were particularly tolerant of Christians and Jews. Rich in land and watered by the Nile, Egypt developed an important agricultural sector, enabling trade with Asia, Africa and Europe. But competition soon developed in the Mediterranean basin. As a place for the transmission of knowledge, the region was transformed by historical events. In Spain, the Reconquista led to the construction of the great port of Barcelona, while Italy became a superpower thanks to the birth of the banking sector.

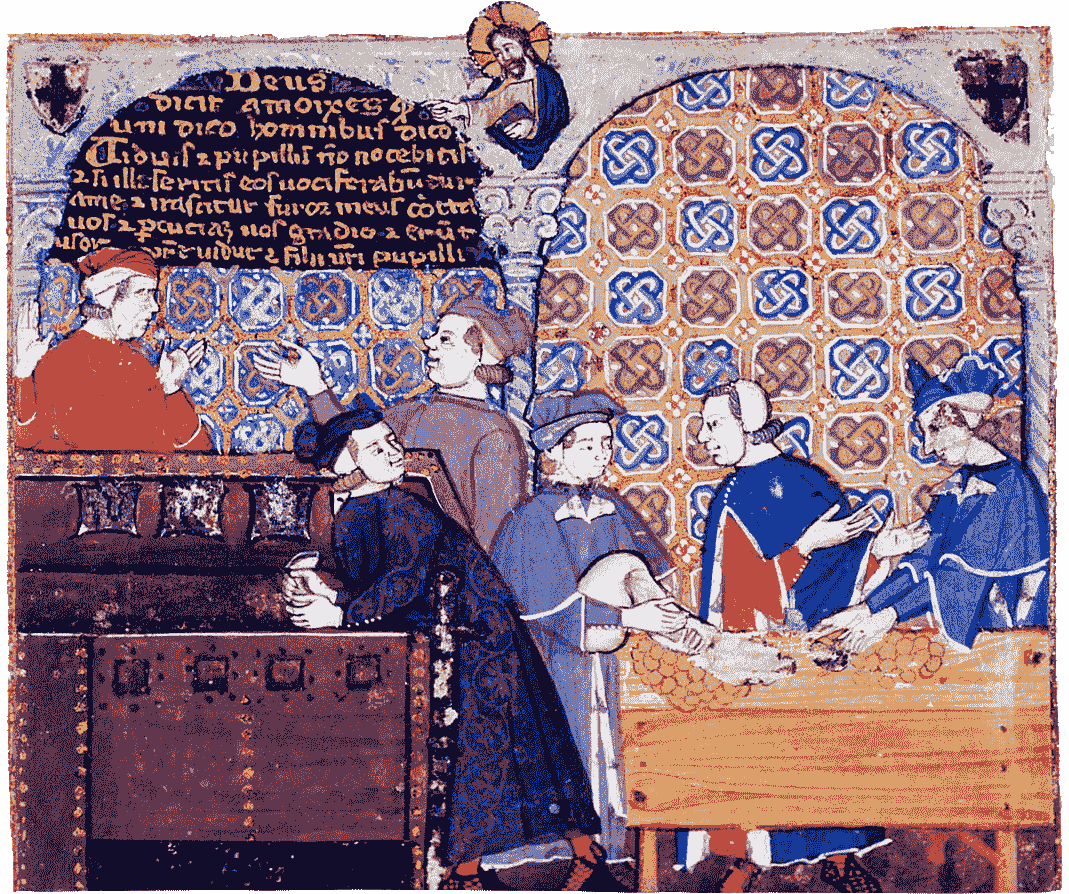

In the early 12th century, the heart of the global economy moved to Venice. The Italian city developed an incredibly efficient economic model, with gold at the heart of its financial system. With the birth of the first bank in 1151, followed by the development of many others, the Venetians accelerated history. New financial instruments were introduced, including interest-bearing loans (previously banned and condemned), bills of exchange and double-entry bookkeeping. Trade multiplied at an ever-increasing pace, with merchants from the four corners of the continent coming to trade (in unprecedented quantities) incense, silks, cotton, spices and other products. Capitalism was born, seen as a system in which exchange value rather than use value was the primary concern.

National merchants became the creditors of much of Europe, including the knights who borrowed from Venetian banks as part of their crusades to the Holy Land. Thanks to a continuous trade surplus, Venice amassed unparalleled wealth in gold, enabling it to develop a sizeable army (including a large naval fleet) with the aim of conquering foreign territories. In 1296, during the famous Venetian-Byzantine War, Venice defeated Constantinople and seized its gold reserves. The Italian city was at the height of its prosperity. Its wealth was so great that it had the power to set the price of gold on the market, while its new currency, the gold ducat, circulated on every continent.

Representation of Italian bankers

For almost three centuries, Venice dominated the world, despite competition from neighboring cities. Florence, in particular, thrived thanks to its banking sector, as did Bruges, thanks to its strategic position as a major trading center.

At the same time, at the end of the 15th century, Christopher Columbus persuaded the Spanish kings (and above all their advisors) to finance his voyage to Asia, in search of new riches. Finally arriving in the New World, Columbus and his crew brought back massive quantities of gold, which were transferred to Spain. Upon their arrival, the European countries went to war to divide up the booty that had come all the way from America. A violent inflationary crisis erupted as a result of the abundance of gold and a shortage of the old currency. The heart of the world economy shifted. According to the famous historian Fernand Braudel, after Venice, it moved to Antwerp in the 16th century, then to Genoa in the 17th, to Amsterdam in the 18th, and finally to London in the 19th.

Dioscoro Puebla, Christopher Columbus's first landing in America (1862)

In the 18th and 19th centuries, with the emergence of "rational" thinking, banknotes were developed, backed by gold of equivalent value. But banknotes, relying solely on the confidence of their users, were widely distributed by banks and not correlated with the quantity of gold they possessed. Banks fail and bankruns occur. After the creation of the first central bank in Amsterdam in 1609, new ones were created to provide liquidity to banks in the event of banking contagion. The Banque de France was created in 1800 after the great French financial crisis of the 1790s. However, the world economy continues to rely on the yellow metal.

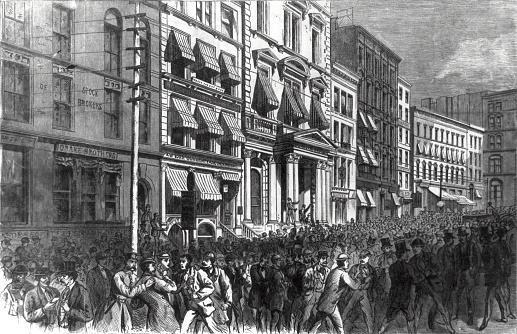

Banking crisis in 1873

To avoid further crises, most of the major powers adopted the gold standard at the end of the 19th century. The value of their currencies was set according to a fixed weight in gold, and the evolution of their money supply in circulation depended on the quantity of yellow metal reserves. In other words, the more gold a country had, the richer and more powerful it was; London was, at the time, the world's leading economic power.

The rest is history: this system showed its limits during the Great War, when military spending continued to rise and gold reserves were no longer sufficient to finance the war economy. The crisis of 1929 and the resulting loss of confidence sounded the death knell: the gold standard was abandoned, then partially continued until just after the Second World War. During the Second World War, Nazi Germany seized the gold reserves of the countries it attacked (Czechoslovakia, Poland, Austria, etc.), thus financing its development for years to come.

Far from the fighting, the Roosevelt government sold arms to the Europeans in exchange for gold, having developed its military-industrial complex and banking sector over the preceding decades. The United States gradually became the world's leading power. This enabled them, in the aftermath of the war, to decide on the broad lines of the Bretton Woods agreements, which were supposed to give rise to a fairer international financial system. In 1945, all currencies were pegged to the US dollar, which in turn was pegged to the price of gold. The reconstruction of European countries was financed by the United States: Europe went into debt in dollars against gold...its reserves were further depleted, and some were stockpiled on the other side of the Atlantic (France, under General De Gaulle, attempted to repatriate them to France).

The decades that followed forced the United States to rethink this system, due to the colossal financial needs of the American government, particularly for space research and the Vietnam War, and the unavailability of reserves. In 1971, the Nixon administration declared the abandonment of the gold standard because confidence was threatened. With a clean slate, the hegemony of the dollar flourished, thanks to American military power.

Since then, money has been created by a simple game of writing, and no longer corresponds to any tangible material value - the role previously played by gold. The yellow metal is no longer a recognized currency, but has the status of a store of value. All over the world, investors buy it to hedge against the multiplicity of risks and, more broadly, against the uncertainty of the future. Public institutions, for their part, continue to show a strong interest in gold. In particular, central banks are constantly accumulating gold in order to free themselves from American hegemony and prepare, perhaps, for a Bretton Woods 2.0.

More By This Author:

The Resurgence Of Inflation Is Bad News For The FedChina: The Deleveraging Process Has Begun

The Never-Ending Crisis Of U.S. Regional Banks

Disclosure: GoldBroker.com, all rights reserved.