$80 Silver... Achievement Unlocked

Image Source: Pixabay

I have a lot of silver…

I started loading up on silver in early 2024 after our Hedge of Tomorrow report…

At the time, physical spot silver was at $25 an ounce. The argument went that monetary inflation would fuel a return to metals… and it did…

That wasn’t a revolutionary argument… It was a reflection of what I saw and what people that I trust saw as well… The timing was clear… the actions of the Treasury Department reflected a currency on the brink… we’d weaponized the dollar against Russia… we went further on the trade side… then we tripled down…

Well… here we are - at a 200% move on Silver in about 20 months.

So… this afternoon, I made a very unusual decision.

I had some physical silver on my person… and I started to drive to my friend’s business. He is a buyer of metals. I wasn’t going to sell much… about 16 ounces… take the cash and enjoy the New Year at home… That’s a sliver of my position…

But I was thinking along the way…

Why the hell would I sell this actual metal?

The reality is that the metal is fine…

It’s the paper money that’s broken.

In the 35 minutes after that decision, silver jumped another $3 dollars…

Then it finished the day up 10%… and sits shy of $80 an ounce.

Yes, I look at it with a complete and total realization that things are really odd…

Which is why I said last night… There is no precedent for right now…

Just a variation of history.

And to understand today… We have to understand that history isn’t repeating…

It’s just rhyming…

Check this out…

Oh, That’s Right…

About 20 years ago, I was bartending behind the family bar.

A man ordered a Bud Light, which at the time cost a staggering $2.50.

He gave me $3.00.

Hey, that’s a pretty good 20% tip. No complaints.

Then I looked down…

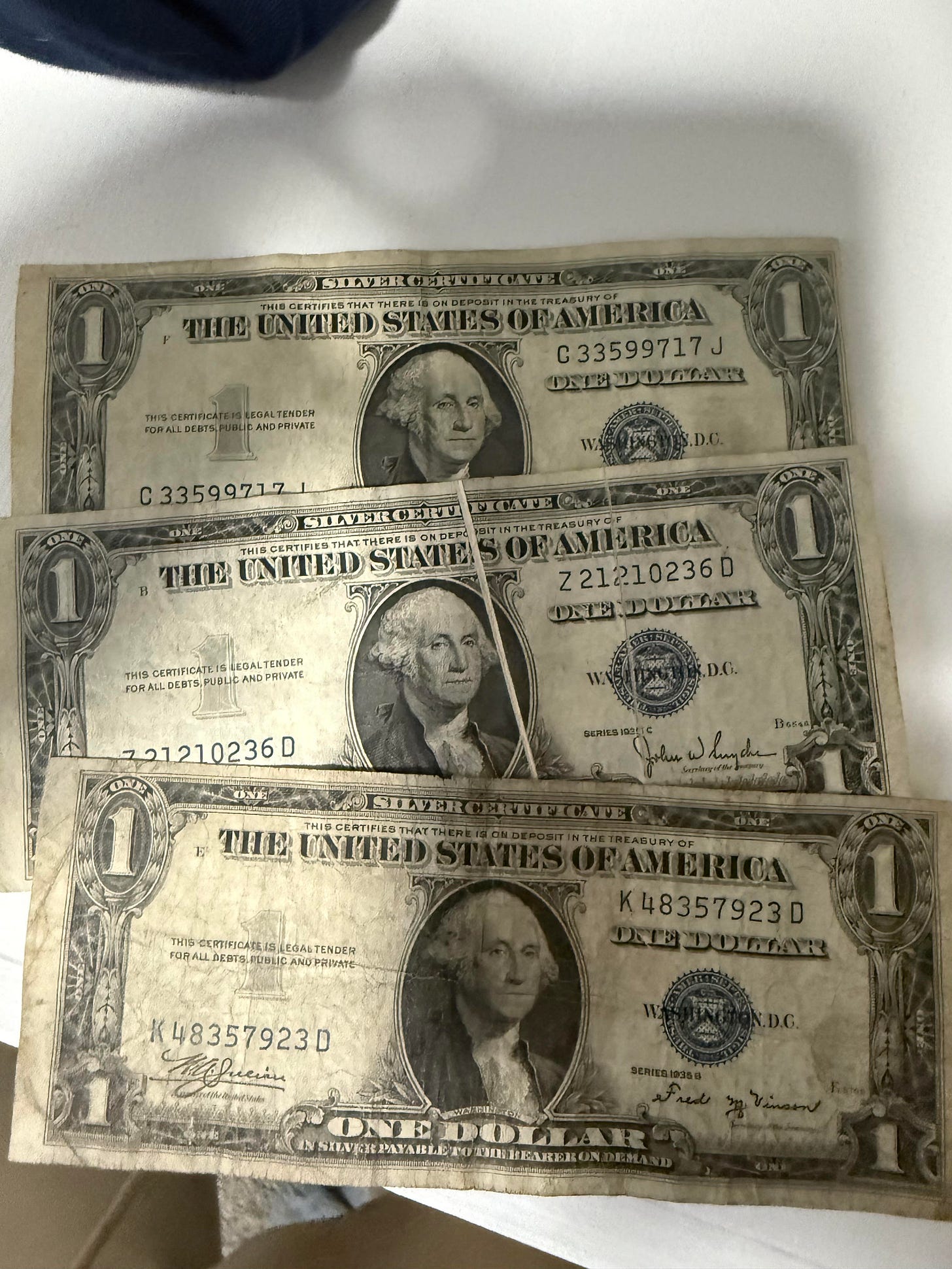

The three $1 bills he gave me were… these.

Silver certificates…

And that’s where our real story begins today…

To understand silver’s rally over the last few months, one must understand…

The death of the silver certificate…

Tell Me About This, Garrett… I’m Beyond Interested…

No problem…

Everyone knows how the gold standard ended.

It came with a date, a speech, and a villain.

Richard Nixon was on television, Bretton Woods was in flames, and there was a clean historical break you can point to and say, “That’s when the rules changed.”

They actually ANNOUNCED IT.

Silver didn’t get that courtesy back in the 1960s. And we don’t get it today.

Let me explain why what’s happening today isn’t getting the attention it deserves…

Precedent.

The gold standard collapsed so loudly that it needed real announcements…

But the silver standard?

Yeah… it was a thing… it ended the way most monetary promises actually die.

Not with drama, but with a clerk at a counter being told to stop honoring a sentence printed on a piece of paper.

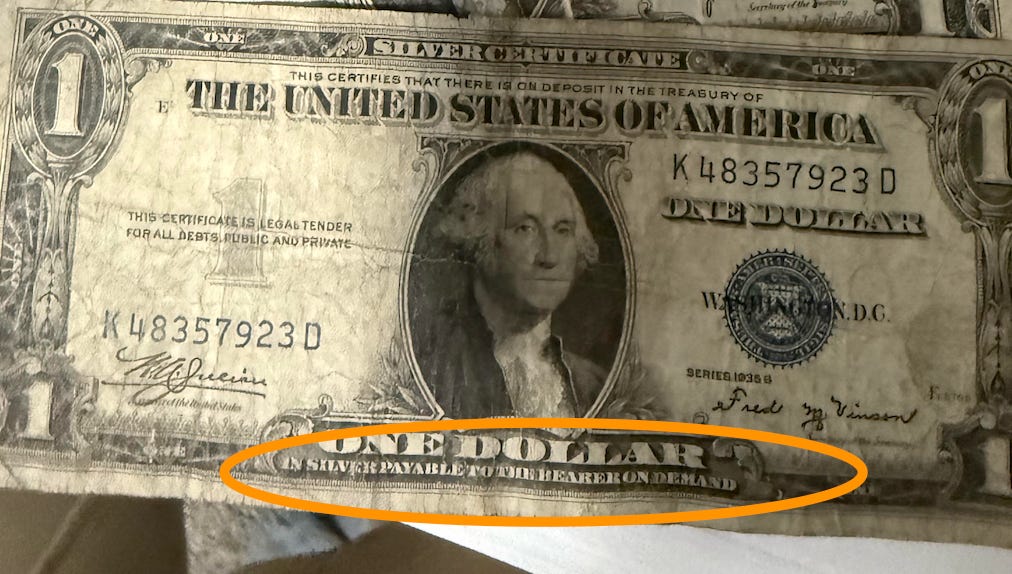

That one…

“In silver payable to bearer on demand…”

For decades, silver certificates were not symbolic.

They were explicit.

They said, in plain English, that a dollar was redeemable for silver on demand.

That’s what the certificates I own say…

For a long time, they were honored.

You could walk into a bank with paper and walk out with metal.

The promise was mechanical…

Then silver became inconvenient for many people…

Industrial demand began to rise in the middle of the twentieth century.

Electronics, photography, manufacturing, and later energy applications all began consuming silver at scale.

Unlike gold, silver does not sit politely in vaults.

It gets used, lost, scattered, and embedded into things that never come back.

Your trash dump is worth a fortune down the road…

At the same time, Americans were exercising their rights of redemption.

Paper claims were turning into physical withdrawals.

The math stopped working.

So the U.S. did not announce the end of the silver standard.

It simply narrowed the door.

Up through March 1964, you could redeem silver certificates for silver dollars.

After that, the Treasury redeemed them in silver bullion (often described as granules) until June 24, 1968, when redemption ended.

The notes stayed legal tender, but the silver promise was over.

The sentence stayed on the paper long after it had been nullified in practice.

That is the part no one remembers.

Silver was administratively suffocated.

And that template matters today.

What we are watching in the silver market right now is the collision of an old monetary role with a modern industrial reality…

We’re operating inside a financial system that has spent decades treating silver as if it were still optional.

It hasn’t been. When 2008 happened the first thing I bought…

Was silver… 60 Silver Eagles at around $10 an ounce…

That was… actually… then… a lot of money for me.

But I’ve never let go of them. And I didn’t sell any of them today…

I’m still going to be long here…

The paper is trash. The metal is solid…

I’m Still Long

I’m going to put this sentence into words… It’s something I haven’t wanted to say for a while… but I am going to say it.

I have lost “full” confidence in the dollar.

Not all of my confidence… just 100% of it… we’re starting to wane…

You may say… “What took you so long?”

That’s not my point. I don’t fully believe the U.S. dollar is the cleanest shirt in the laundry of fiat currencies, as it was for the last 17 years.

If I have to go long anything, it remains the Swiss Franc… and even then… yikes.

Gold and silver are more realistic options.

Here’s the further case for silver…

Silver sits at the intersection of three forces that rarely align at the same time.

It’s a monetary metal in a world openly debasing currency.

It’s an essential industrial input for solar panels, electrification, data centers, and advanced electronics.

And its supply is constrained in ways most people do not appreciate.

The majority of silver is mined as a byproduct of other metals.

You can’t just decide to mine more because the price is higher.

That alone would be enough to drive prices higher over time.

But the accelerant is structural.

Silver pricing is still heavily influenced by paper markets that trade multiples of annual global production every few days.

Futures, options, and derivatives were built on the assumption that physical supply would always be there when needed.

That assumption works until it doesn’t. As physical demand tightens and inventories shrink, paper promises begin to matter again.

Every dollar higher exposes leverage that was comfortable at lower levels.

Shorts become trapped not by ideology, but by physics.

This is why silver moves the way it does.

It does not climb politely. It compresses, absorbs pressure, and then releases it violently when the system can no longer pretend the metal is plentiful…

The historical parallel is not the gold standard.

It is the silver window itself.

In the 1960s, the United States did not close the silver window because silver was failing. It closed it because silver was both useful and scarce at the same time.

The system could not tolerate a monetary instrument that was also used in the real economy.

Today’s silver market carries that same tension.

Only now it’s global, financialized, and leveraged beyond anything that existed then.

Today’s rally wasn’t really just a result of supply issues in London. It was supply issues in Shanghai at the same time…

The price action we are seeing is not a surprise if you understand that silver has been underwater for decades, held down by a structure that assumed physical constraints could be managed indefinitely.

Like any object forced below equilibrium, the deeper it is pushed, the more energy is stored. Yea… now that pressure has released…

What’d we think was going to happen…

Gold went first… silver followed because it was mechanically a bigger deal…

Silver is reminding markets of something they forgot when the window closed in 1968. Promises that cannot be honored indefinitely don’t disappear, son son...

They accumulate risk.

And when the underlying reality finally asserts itself, the adjustment is never gentle.

This is not about a target price. It is about a system rediscovering limits it spent half a century pretending no longer existed.

The next step is to stop thinking in dollar terms. It’s to think that an ounce of silver is worth an ounce of silver, and reprice the world accordingly… That is going to take years, but I’m way out in front of everyone on this… and I hope you are too…

I’m not short the dollar… but I’m diversifying further away than I have in the past… It treated me well for a very long time…

More By This Author:

So... Silver Hit A New High Of $69.43... Now What?A Harley-Davidson Trade

This Chart Explains Why Markets Feel Completely Broken