5 Reasons Why This Correction Is Actually A Good Thing

Image Source: Unsplash

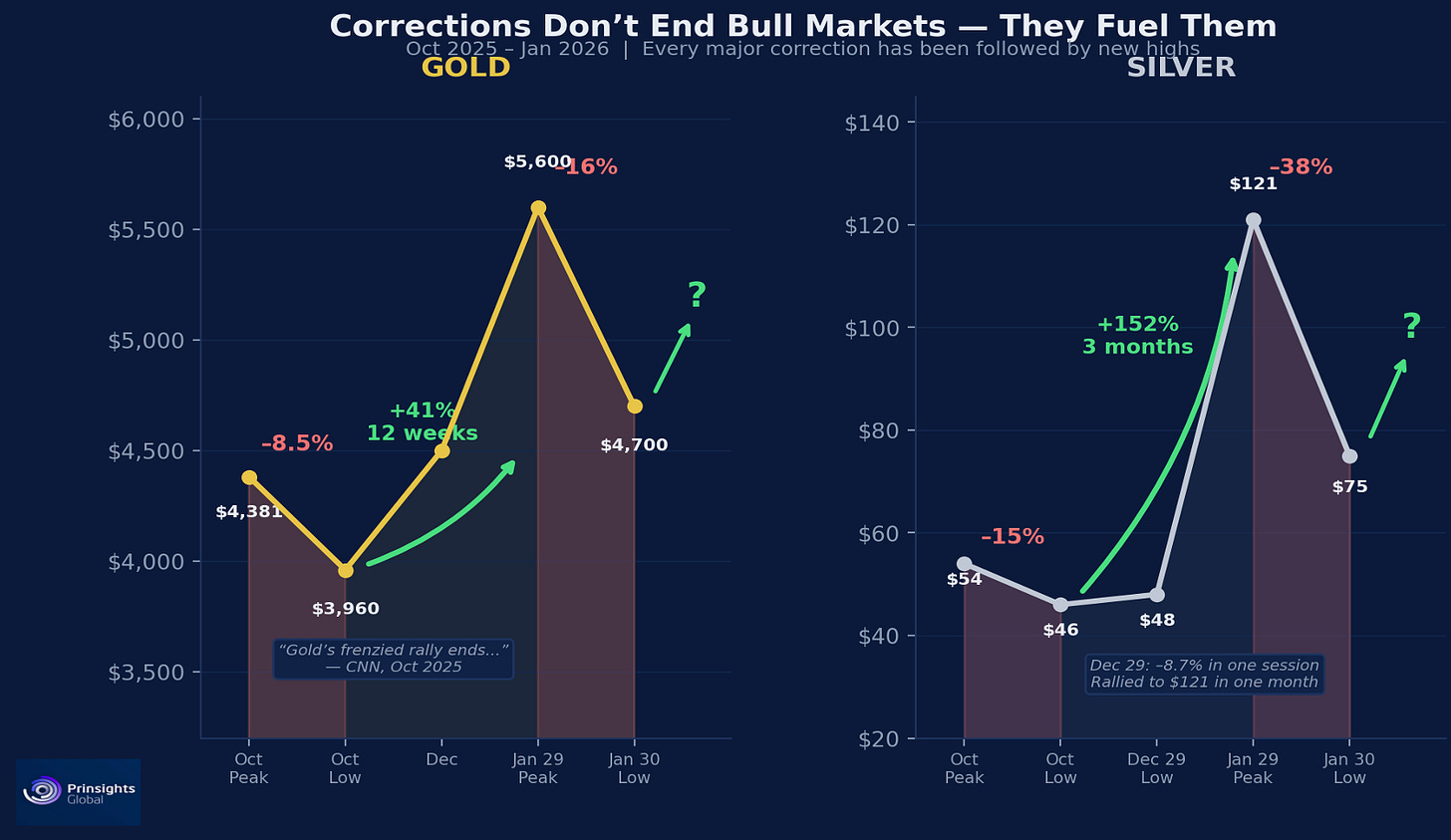

On Thursday, January 29th, gold touched $5,600 and silver briefly reached above $121. By Friday’s close, gold fell to $4,700 and silver to below $75, a 36% intraday decline, the largest since 1980.

The headlines were predictably dramatic.

As of Monday afternoon, gold is trading near $4,670 and silver has recovered to roughly $79, already bouncing from Friday’s lows. The sky did not fall.

We’ve seen this before, recently.

In October 2025, gold dropped 8.5% from its then all-time high above $4,350. CNN ran a piece titled “Gold’s frenzied rally ends with largest selloff in over a decade.” What happened next? Gold went on to rally over 40% from that correction low, running from roughly $3,960 to $5,600 in three months.

That pattern is consistent.

Violent corrections inside powerful bull markets are not the exception. They are the rule.

For investors who understand the fundamental picture, these moments are not reasons to panic. Instead, these are reasons to pay closer attention and hold even stronger convictions of growing wealth, in contrast to casino-style bets chasing Wall Street noise.

Here are five reasons why this correction is actually a good thing for investors. The list works to present and consider the long-term structural transformation-based opportunity that’s ahead.

1. The Warsh Announcement Changed Nothing Fundamental

President Trump announced that he is nominating Kevin Warsh as the next Federal Reserve Chairman on Friday morning. The media immediately framed this as a hawkish shock to the system. It wasn’t.

We suggested Warsh could be the nominee back in August. The possibility changed none of our views or recommendations that were added to our Pulse Premium and Founders+ model portfolios then. It changes none of them now.

Here’s what most headlines and pieces beneath them leave out. Warsh served as a Fed Governor from 2006 to 2011. During that period, the federal funds rate went from 5.25% to effectively zero, the most aggressive easing cycle in the Fed’s history.

He was on the Fed’s Board for all of those cuts. He rarely lodged a dissent, with the notable warning about the second QE round, through the 2008 financial crisis and the unprecedented ballooning of the Fed’s balance sheet. The idea that this man is a rigid inflation hawk (or a savant that can see the future) who will push to dramatically tighten policy doesn’t square with his actual record. Plus, he has said as recently as last summer that the Fed has room to ease.

The Warsh nomination prompted profit-taking and programmed trading. The structural drivers and motives for central bank buying, de-dollarization trade, fiscal deterioration and geopolitical tensions all remain entirely intact.

2. Leverage Got Flushed and That’s Healthy

Silver prices rallied 57% in January alone. Gold prices posted seven consecutive up sessions. Options activity hit record levels which meant unwinds were easy because they were based on paper, not turning in physical gold or silver.

As Goldman Sachs noted before the selloff, a wave of call option purchases was mechanically reinforcing upward momentum. That kind of positioning creates fragility.

When the Warsh announcement came out, the interpretation of him as an uber-hawk triggered algorithms, which forced margin calls, prompted liquidations on paper and then tanked prices. In response, the CME raised margin requirements on COMEX futures for gold to 8% from 6%, and silver to 15% from 11%, effective as of Monday, February 2.

Ultimately, the market was shaking out leveraged speculators. That’s the basis for solid foundation going forward.

3. Physical Demand Didn’t Stop

While paper prices dove, physical demand told a different story.

China is paying premiums of over 15% above Western spot prices to secure silver bars through the SGE and SHFE exchanges.

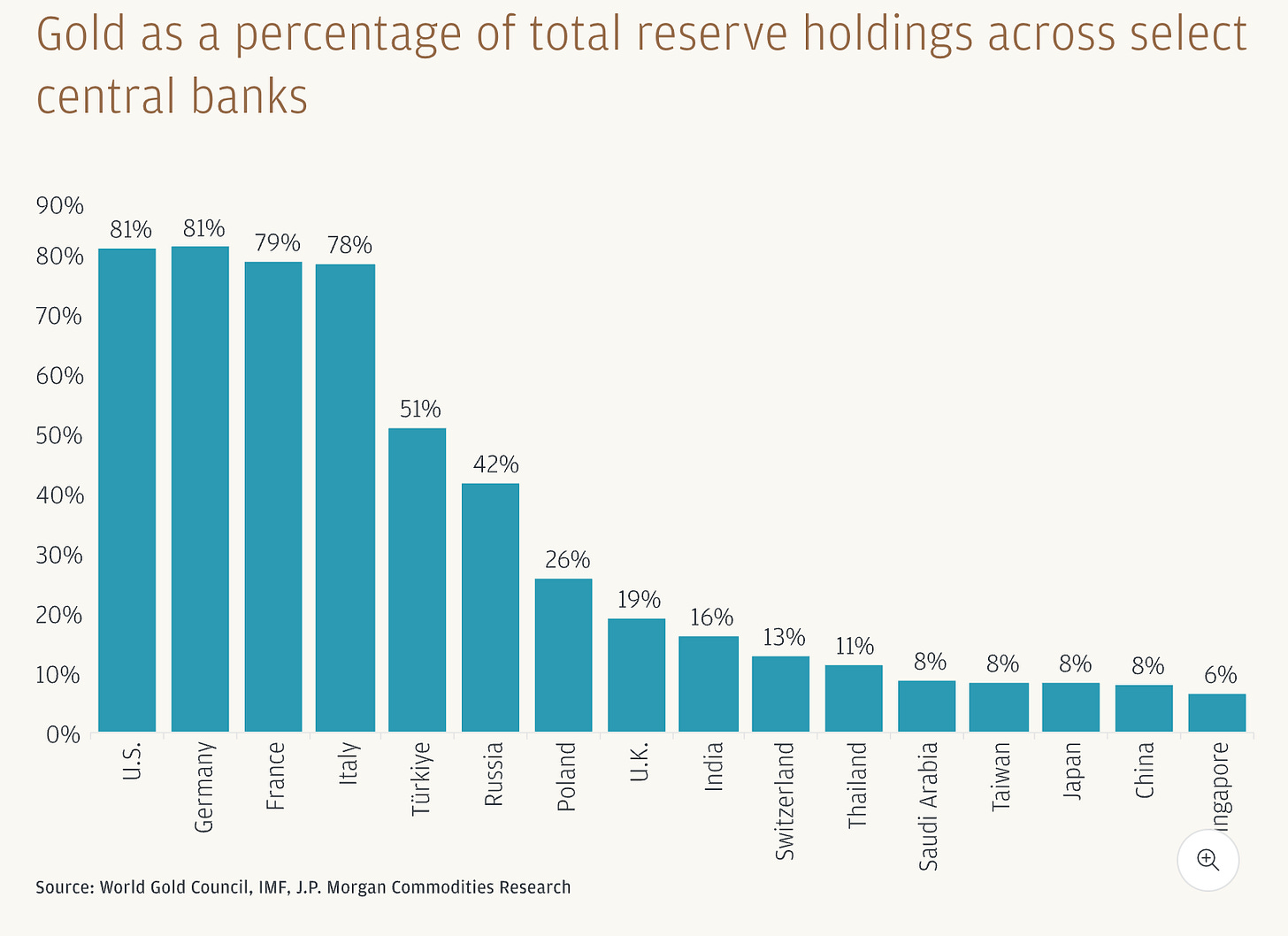

Central banks, which have purchased over 1,000 tons of gold annually for three consecutive years, have no strategic reason to stop.

JPMorgan still projects roughly 755 tons of central bank purchases in 2026 and readers here know our target is higher, and these lower prices make that more feasible. My former employer, Goldman Sachs, raised its year-end gold target to $5,400 from $4,900.

Here at Prinsights, our outlook remains at $6,000. The investors and institutions buying real metal at real prices are not selling because of headlines. That divergence between paper market panic and physical market conviction is one of the most telling signals in this entire cycle.

4. The Macro Backdrop Has Only Gotten Stronger

Zoom out. The U.S. national debt is above $38 trillion.

The dollar index has been weakening for months, despite some minor strengthening during the selloff in metals. On the same Friday as the selloff, a hotter-than-expected producer price report landed, complicating the Fed’s path on rate cuts. Deficits are escalating. Neither party has a credible plan to address them.

Gold has returned about 400% over the past decade to its recent peak through two full rate hike cycles, multiple rounds of cuts, a pandemic, wars and an inflation spike. It doesn’t matter what the Fed does. Gold needs the fiscal trajectory to keep deteriorating, geopolitical tensions to keep surfacing, and central banks to keep diversifying away from dollar-denominated reserves.

All three of those trends are accelerating, not reversing. Silver needs all these trends, plus the ongoing structural deficit to continue, which it is.

5. Corrections Create Entry Points for Accumulation

This is the practical reality that matters most. Even after Friday’s decline, gold is still up roughly 8% year-to-date and over 67% from a year ago. Silver is up about 11% on the year and over 155% from a year ago. These are assets in secular bull markets experiencing cyclical volatility because of a large associated paper market.

Investors with a long-term fundamental view understand that miners that produce real material still matter. That’s why physical metal held outside the banking system has value, why the supply-demand imbalance in silver is structural – and why this moment is an opportunity. Not for frenetic investment, but to continue to accumulate hard assets and best-jurisdiction miners slowly and deliberately.

Expect headlines to keep blaring as they always do during sharp corrections. But nothing about the long-term setup has changed. If anything, this reset has made the foundational case stronger.

So please stay patient, stay fundamental and recognize these moments for the opportunities they are.

More By This Author:

Here’s Why Gold’s Overpowering The Fed By A MileThe Fed Vs The White House: Why Gold Is The Clear Winner

The 2026 Power Play: Why The Grid Is The Trade That Matters

Disclosure: None.