2021/22 U.S. Stocks May Tighten, But 2022’s Plantings Were The Surprise

Market Analysis

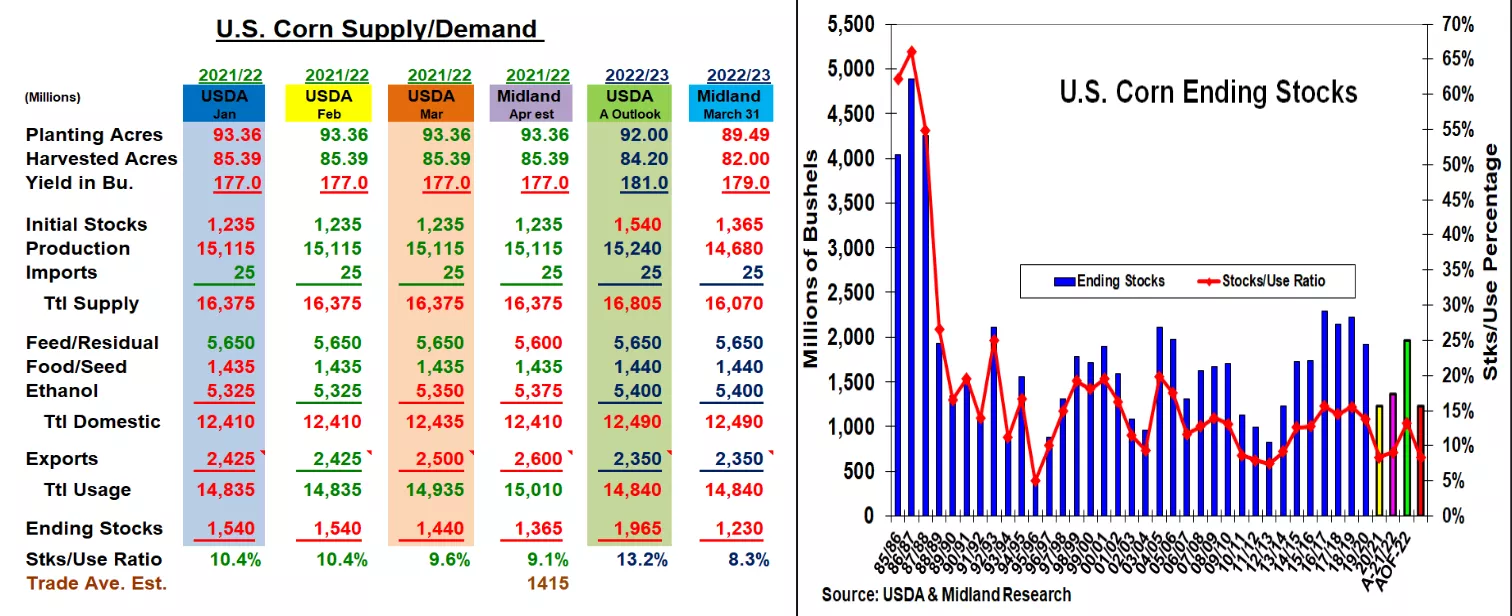

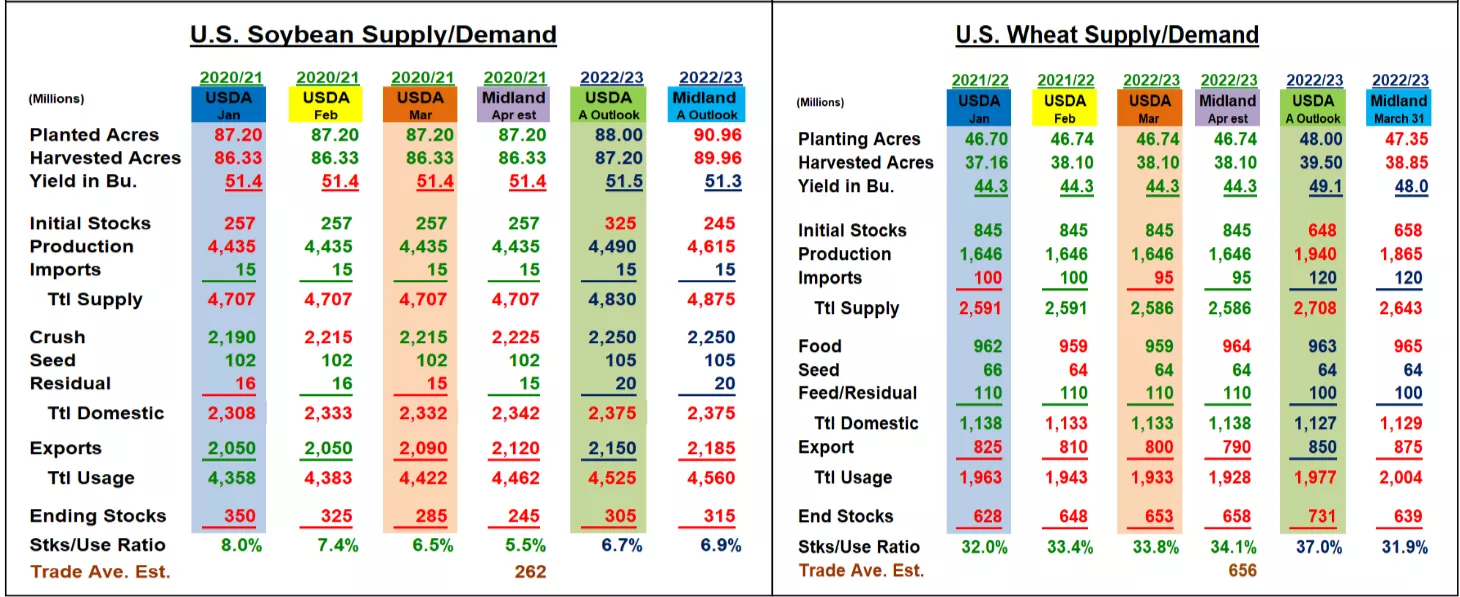

Last week’s 2022 US planting intentions provided some dramatic surprises when the USDA survey revealed sharply lower corn plantings & substantial jump in soybeans seedings than the trade expected. The Ag Department won’t utilize these planting levels until their May 12 first 2022/23 US supply/demand update. Their importance however justifies a 2022/23 balance sheet creation utilizing Ag Forum trends. The latest quarterly stocks and the ongoing impact of Black Sea war on world trade will be the major adjustment factors for the upcoming April 8 US old-crop balance sheets. Corn’s March 1 stocks were just 27 million bu. below expectations suggesting the latest winter quarter feed demand was similar to last year. However, the latest US Hogs and Pigs report revealing 1-2% lower numbers for the 2nd year in a row. This suggests this major livestock group could consume 50 million less corn in the last half of the year. The ongoing Black Sea conflict curtailing Ukraine’s corn trade (China purchased 1.1 mmt of US corn this week) suggests US exports could be upped 100 million bu reducing corn’s old crop stocks below 1.4 billion. These smaller stocks, 2022’s 3.87 million lower seedings and a reduced US yield outlook from the 2 million smaller major Midwest plantings could reduce 2022’s US corn output by 560 million bu This could cut 2022/23’s stocks below 1.3 billion bu. Soybean’s March 1’s stocks were 30 million over the trade’s estimate. Talk of an underestimate of the 2021 crop circulated, but June’s report needs to confirm.

With current US exports 150 million bu ahead of the seasonal pace to hit the current 2.09 billion forecast, this demand could be increased by 30 million reducing 2021/22 stocks to 245 million bu. Larger 22/23 US supplies are likely, but this year’s curtailed S American output opens more US export potential. Wheat’s slightly lower seedings are supportive, but US Plains and Canadian weather (lowest US winter wheat spring ratings this week since 2018) and the impact of the Black See war on Ukraine’s export trade are wheat’s major price factors this spring.

(Click on image to enlarge)

What’s Ahead

The Black Sea conflict is tightening old-crop US corn & soybean supplies. This spring’s US planting intentions showed a dramatic shift in corn and soybean seedings adding new price and output uncertainty to 2022’s 2 major US crops. Weather will be market factor in both N & S America the next 6 weeks. Hold corn & beans sales at 90%. Use $11.50 KC prices to finalize sales if 2022 crop looks promising.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more