Clovis: Evaluating The Prospects Of A Possible Acquisition

Summary

- Riding robust data, Rubraca is most likely to gain approval for resistant prostate cancer having the BRCA mutation.

- Additionally, I believe that the Rubraca/Opdivo combo can upstage Lynparza's first-line indication for ovarian cancer soon.

- I present a scientific analysis to merger and acquisition to give you more insight into Clovis.

It does mean that a company with research centered around each of these divisions, like a cluster of trees each growing additional branches from its own trunk, will usually do much better than a company working on a number of unrelated new products which, if successful, will land it in several new industries unrelated to its existing customers. - Philip Fisher

It's usually an exciting time for shareholders when a biotech company is bought out. That's because an acquirer typically pays a premium (i.e. at least 50% higher than the share price). As you recall, there were interesting discussions and speculation about a potential acquisition of Clovis Oncology (CLVS). Inside IBI, I also analyzed a potential acquisition by Bristol-Myers Squibb (BMY).

Keep in mind, the chances that a company getting bought out is slim. However, it's intellectually stimulating to analyze it to gain better insight into this subjective area of research. That being said, I'll feature a merger and acquisition of Clovis and provide my expectation of this Phillip Fisher growth equity.

Figure 1: Clovis chart (Source: StockCharts)

About The Company

As usual, I'll present a brief corporate overview for new investors. If you are familiar with the firm, you should skip to the subsequent section. Operating out of Boulder Colo., Clovis is engaged in the innovation and commercialization of medicines to serve the unmet needs in various oncology indications. Examples include ovarian, prostate, breast and bladder cancers.

April 2018 marked a key milestone for Clovis as its flagship drug rucaparib (i.e. Rubraca) gained FDA approval. As an oral, small-molecule inhibitor of poly (ADP-ribose) polymerase (“PARP”), Rubraca is marketed as second-line maintenance for recurrent ovarian cancer. Because of its second-line indication, sales ramp-up has been gradual. In my view, the most aggressive growth occurs when Rubraca goes into the first line. Thereafter, it's spaghetti to sauce that it will be crowned as a blockbuster.

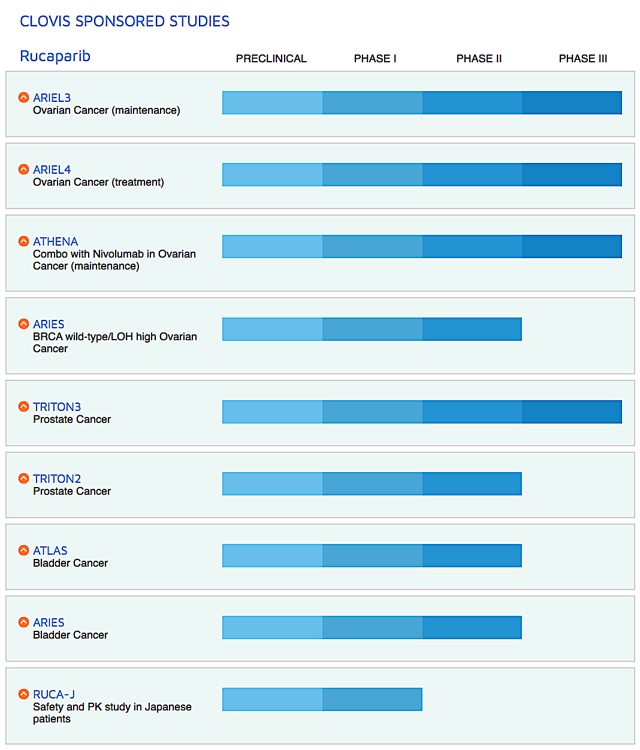

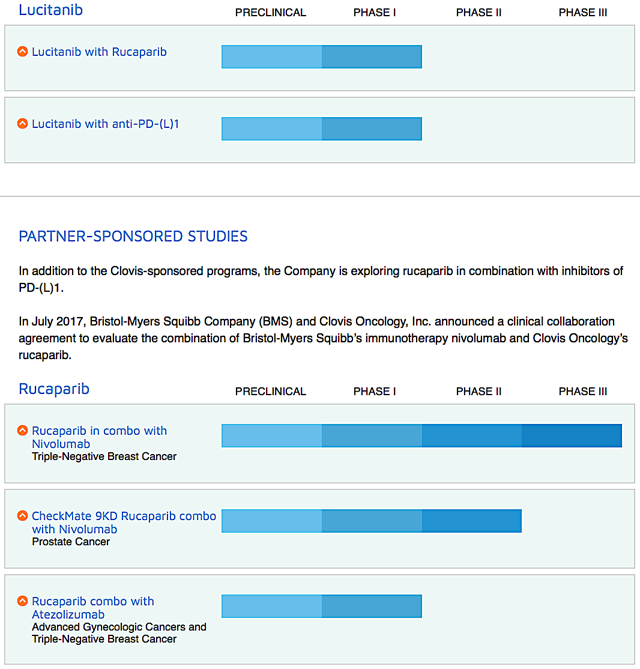

Figure 2: Therapeutic pipeline (Source: Clovis)

Of note, Clovis also is studying various combination treatments of Rubraca with either immune checkpoint inhibitors and other drugs (lucitanib and rociletinib) for different cancers. Just recently, the company in-licensed a radiopharmaceutical targeting drug known as FAP-2286. And it will file an investigational new drug ("IND") application for FAP-2286 by 2H2020.

Continue reading on Seeking Alpha.

At Integrated BioSci Investing:, members get access to model portfolios, regular updates, a chat room, and more. more